By Mark Pruner

In March 2020, the world was thrust into a period of uncertainty and fear as the COVID-19 pandemic took hold. As governments implemented emergency orders and restrictions, the real estate market in Greenwich, Connecticut, felt the impact.

Covid Changed the Real Estate Market as the Epidemic Spread

The issuance of numerous emergency orders by Governor Lamont reflected the gravity of the situation, affecting every aspect of life, including the real estate industry. Buyers and agents quickly adapted to the new normal, implementing safety protocols during showings. Masks, gloves, and booties became standard attire, while prospective buyers had to refrain from touching anything, instead relying on agents to open doors and provide necessary access.

In response to these challenges, new ways of doing showings developed. Window peeping tours were invented, allowing potential buyers to view properties from outside. Additionally, virtual tours via FaceTime or other video platforms became popular alternatives to on-site showings. With the fear in the market, even these restrictions only held the market back for a few months. .

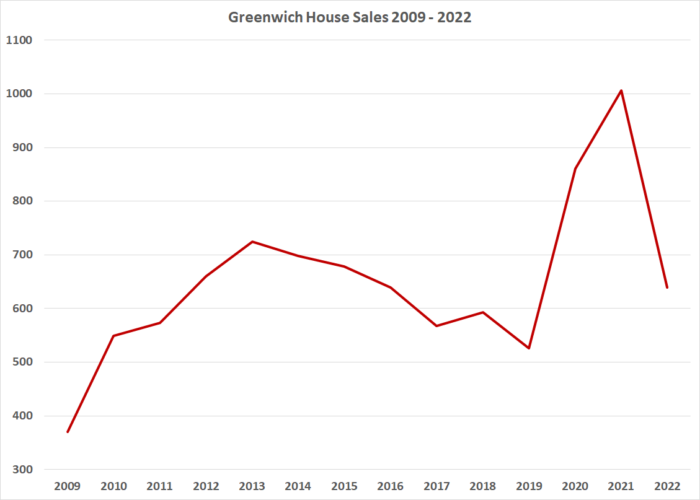

Pre-Covid Our Market had Been in a Gradual Decline

To get a better feel of just how much Covid and work from home changed the market, it’s helpful to what was happening the market pre-Covid. Starting in 2013, the market experienced a slow decline in sales. The year 2013 saw 728 sales, a number reminiscent of the boom years of the digits decade. After the Great Recession, we saw a recovery in sales from 2010 to 2013. Then we started downward trend, with 2014 recording 698 sales, 2015 had 678 sales, still above average. In 2016 we dropped to 639 sales, with a further decline to 568 sales in 2017. This steady four-year decline amounted to a 22% decrease in sales.

The Trump Tax Act and the Turnaround in 2018

The year 2018 saw our only uptick in sales in the seven year period from 2013 to 2019 and it wasn’t a big jump. Sales climbed to 593 single-family homes sales in 2018, breaking the downward trajectory of the previous years. The catalyst for this change was the Trump Tax Act which kicked in that year. One provision limited the deduction of state and local taxes to only $10,000. This change prompted many individuals to relocate from Westchester County, known for its high property tax rates, to Greenwich, with the lowest tax rates in the New York metropolitan area.

The Challenging Year of 2019

While 2018 showed promise for the market, the subsequent year proved to be challenging. The influx of individuals moving from Westchester County to Greenwich slowed down, while many Greenwich people sought low-tax jurisdictions outside Connecticut with Florida being a particular favorite. As a result, in 2019, only 526 houses were sold, marking the lowest sales figure in the past 20 years, except for the two years of the Great Recession in 2008 and 2009. Despite a slight improvement year over year in the first quarter of 2020, sales that first quarter of 2020 remained below average, just better than the poor sales of Q1 2019.

The Impact of COVID-19 and the Road to Recovery

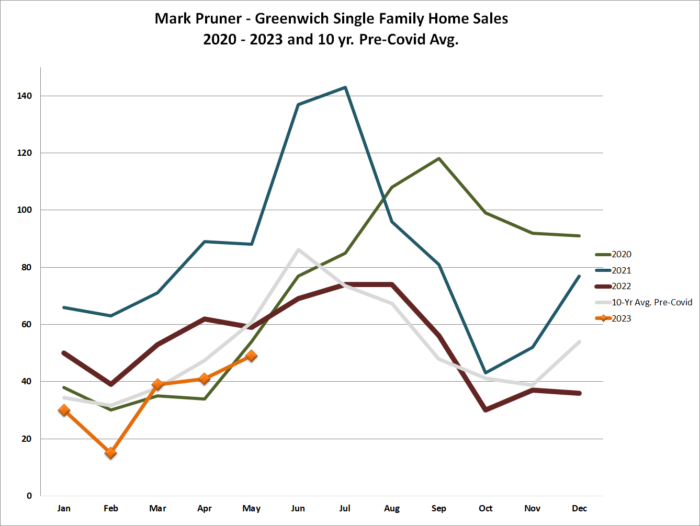

The COVID-19 pandemic posed unprecedented challenges for the Greenwich real estate market. The initial months of the pandemic brought about a decline in real estate sales in Greenwich. In April 2020, sales dropped by 20%, from the prior April with only 34 sales recorded compared to our10-year average of 47 sales. Lowers continued in the first half of the year, as home sales experienced a dip month after month compared to the prior year of 2019, which had been a bad year for sales.

The Unprecedented Boom

As the second half of 2020 unfolded, the market saw a remarkable turnaround. Sales began to surge, defying expectations and fueling a resurgence in Greenwich real estate. From July 2020 to April 2022, Greenwich saw a remarkable surge in demand. In the first half of that period, starting in September 2020, every subsequent month set a new, all-time record for monthly sales. In June 20211, we set an all-time records sales of 137 single-family home sales. The next month we broke we broke that record. The pinnacle of the boom occurred in July 2021, with a staggering 143 sales, surpassing the average of 74 sales for that month.

It wasn’t until May 2022 that the market slipped below the 10-year pre-COVID average. Overall, 2022 brought the market back to a more balanced state, with 639 sales, only slightly higher than 10-year average of 621 sales.

Sales Decline with Lack of Inventory in 2022

The drop in sales during 2022 was primarily attributed to a shortage of available houses on the market. Demand remained strong, but the limited inventory restricted the number of transactions. As remarkable as the Covid period sales were, they were actually significantly as we had a lot of uncounted off-market sales. These sales continued in 2022, as agents would mention they had a listing coming on, only to have a fellow agent, said they had a motivated buyer.

The combination of low interest rates, an increased desire for spacious homes due to remote work, and the perception of Greenwich as a safe haven during uncertain times fueled the demand. However, the lack of houses to sell hampered the market’s ability to sustain the previous levels of activity.

How Inventory Allowed for Record Sales and a Drop in Sales.

The remarkable sales figures of 2020 and 2021 would not have been possible without a significant influx of new listings. Many sellers didn’t want to listing their houses in the pro-buyers’ market of 2018 and 2019. They opted to hold off on listing their properties during that period, leading to the accumulation of a so-called shadow inventory.

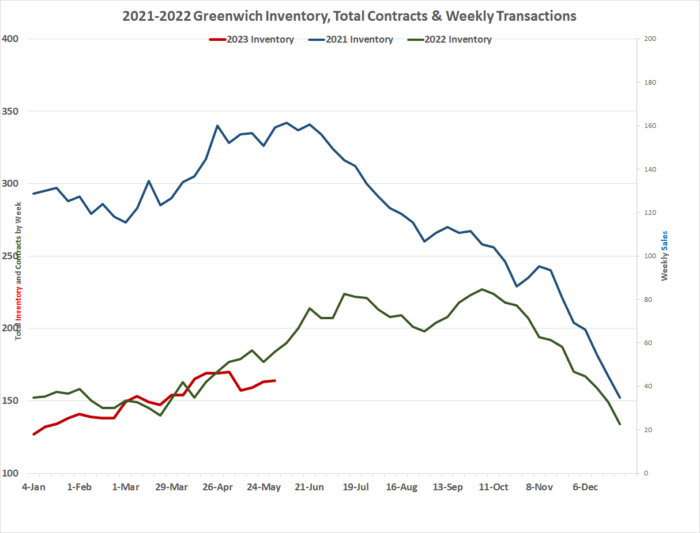

Inventory Peaks and Valley

Traditionally, inventory in Greenwich peaks in April or May, with approximately 650 listings. However, in 2019, despite reaching a peak of 738 listings on the Greenwich Multiple Listing Service (GMLS), only 526 houses were sold. During peak sales of 2021, we saw a different scenario, with a peak inventory that year of only 342 listings.

Part of this dramatic drop in inventory was because a lot listings in 2021 were never counted in the monthly inventory figures. This was due to listings quickly going under contract within the same month, they were listed. The contract and sale showed up, but that listing was never counted when the month-end inventory was prepared. Our record sales in 2020, with even higher sales in 2021, would not have happened but for the shadow inventory that had accumulated from 2017 to 2019. By the last quarter of 2021, our inventory began to decline significantly as the reservoir of shadow inventory had been used up.

Low Inventory Challenges in 2022 and Beyond

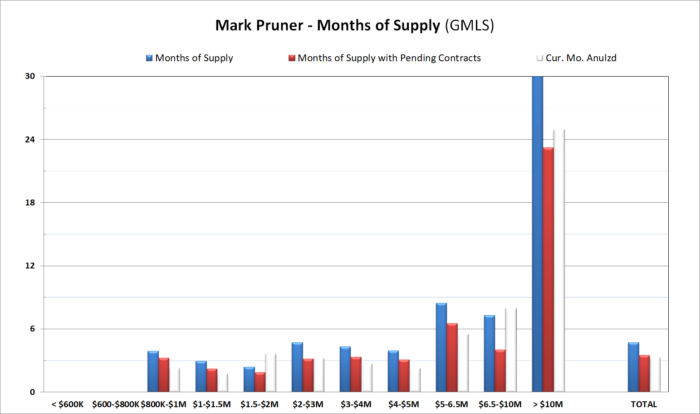

Last year our house inventory peaked at 227 listings. As of June 2023, the inventory in Greenwich stands at a mere 163 houses. While higher interest rates have contributed to some reduction in demand, the drop in listings has been far more significant. If we had more listings, we have many more sales as days on market is down and months of supply is staying very low.

Causes of Low Inventory

Several factors have contributed to the low inventory levels in Greenwich. First, higher interest rates have locked in some owners who have much lower interest. Secondly, a state of gridlock has emerged, as homeowners who would like to sell their homes can’t find a condo or a house to buy. This gridlock perpetuates the low inventory, but it also means that as more inventory comes on the market eventually, this will encourage more inventory from the buyers of that first round of inventory increase.

What’s Next

The Greenwich real estate market faces a significant challenge due to the dramatic drop in active and shadow inventory. While higher interest rates have reduced demand to some extent, the shortage of listings remains the primary constraint on sales. If you are seller, it’s a great time to list your house. If you are a buyer, you want to be prepared to move quickly on the the “good” listings that come on the market or be willing to do some work to modernize our older houses that are selling slower, than their like new competition.

We have seen repeated predictions of a looming recession, but our inventory is so low that it would take quite a shift in the economy, interest rates and the stock market, before we would see anything like a buyer’s market under $4 million in Greenwich.

Mark Pruner is a Realtor with Compass. He can be reached at 203-817-2871 or mark.pruner@compass.com