By Mark Pruner

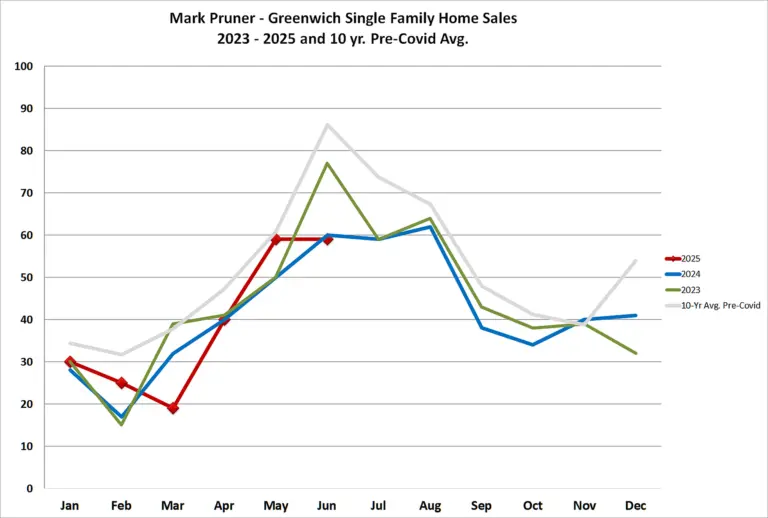

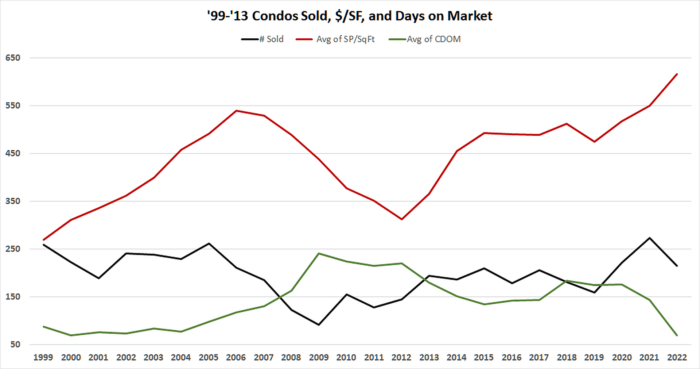

The last three years have lit a fire under the condo market. Sales are up from 159 sales in 2019 to 215 sales last year. Condo sales set an all-time high in 2021 with 274 sales. So far through May we have had 82 sales, which would be 197 sales for the year, which is exactly our average for the last 23 years.

Average sales in 2023 don’t sound that spectacular until you look at the other numbers for the market. Our price per square foot went from $475/sf in 2019 ¬to $616/sf in 2022 or an increase of 29.7% in three years. So far this year, the price per square foot is even higher at $684/sf or a further increase of 11% over last year.

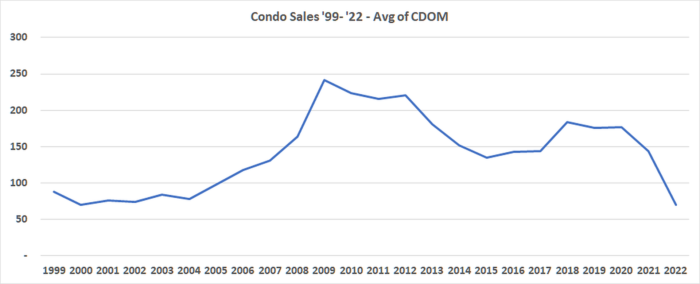

Days on market has also dropped a lot, further indicating the demand for Greenwich condos. In 2019, our last pre-Covid year, the condos sat on the market for almost half a year before selling an average of 176 days on market. The days on market number was essentially unchanged in 2020, even while sales were rising. Townhouses and garden style condos, like Lyons Farm did well that year.

By 2021, and particularly in the second half of the year, condos sell really picked up, setting the aforementioned all time high of 274 condo sales in Greenwich. As a result, days on market dropped to 144 days, but many of those sales were for condos that had been listed for over a year.

Back in 2018, we had 139 condos on the market and our DOM was 184. Even at the beginning of 2021, we still had 89 condos listed, many of them with long days on market. By last year, our inventory had shrunk drastically, and we ended the year with only 41 condos on the market and days on market dropped to only 70 days. This year we’ve dropped further with sales averaging only 66 days on market, our lowest ever.

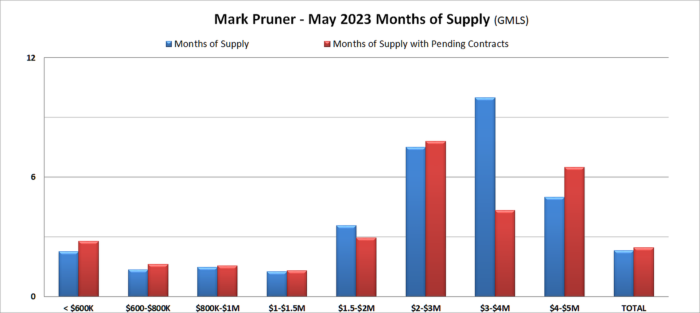

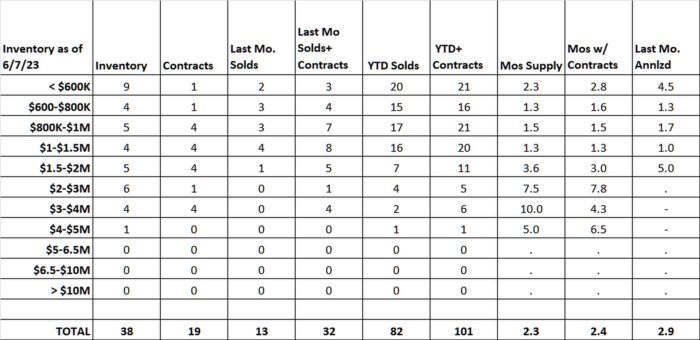

This year we didn’t really have a spring surge of listings in our condo market and our inventory is actually lower now than it was at the beginning of the year. This we only have 38 condos for sale as opposed to 41 at the beginning of the year at all prices. In 2021, we had 53 listings under $1 million, now we only have 18 listings. As with our single-family home market, if we had more inventory, we would have more sales.

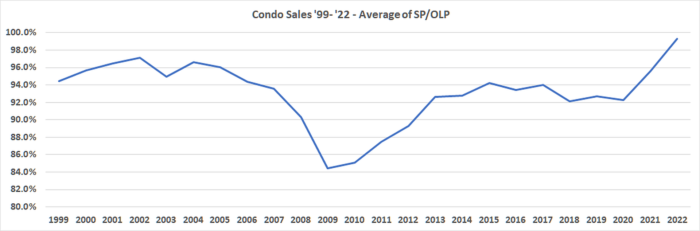

Our sales price to original list price ratio has also taken off in that same period. For the years from 2013 to 2020 our average sales price to original list price was right around 93%. Then in 2021 it ticked up to 95.6% and went almost to full list price in 2022 at 99.3%. This year has dropped back a smidgen to 97.5%, but don’t let that drop fool you. That is still the second highest SP/OLP ratio that we have ever had.

Curiously, our average condo size has dropped over the last the last three years. Average condo size peaked at 2,025 s.f. in 2017. It then slowly drifted down, with the exception of 2020, when people wanted bigger units as Covid got underway. The last two years we’ve seen significant drops in the average condo size. We were down 52 s.f. in 2022 and so far this year the average condo sold is 196 s.f. smaller than last year at only 1,687 s.f. This is down 338 s.f. from that 2017 peak.

It’s possible that developers are making condos smaller, but the number of new condos each year is small and doesn’t influence condo size much. What’s most likely happening is that people with larger, luxury condos are hanging on to them longer and people who are priced out of the single-family home market are buying condos. In 2018, we had 36 condos over $2 million dollars and right now we only have 11 condos, and that’s even with the significant appreciation we have had in the last five years pushing more condos over $2 million.

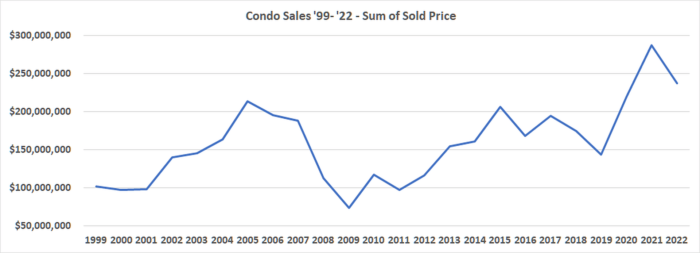

Our present increase in sales, though less so at the high-end, pushed total condo and co-op sales volume to $288 million dollars in 2021. In 2022, we dropped back to $237 million, which is still the second highest on record at a time when sales were constrained by low inventory. So far this year, we have had. $98 million of condos sales, which annualized would come out to be essentially the same as last year. If trends continue, this year will be the third highest total condos sales volume and you’d only need $4 million more to displace last year as the second highest year.

Much like our housing market, everything below $2 million sells quickly, if it is in good shape. Below $1.5 million we have had 68 sales, while we now have only 22 listings. This results in an average months of supply of only 1.7 months, which is the same months of supply as we have single family homes under $1.5 million. In our single-family home market, however, we have no listings under $800,000, while in our condo market we have 13 condos for sale.

Condos provide a great place for people that really want to live in Greenwich at more reasonable prices.

Mark Pruner is a Realtor with Compass. He can be reached at 203-817-2871 or mark.pruner@compass.com