Summer vacations are here with a vengeance, well actually more likely a new puppy that just found that there is a whole new world to explore outdoors. After 2+ years of Covid, people really want to get away and our market has noticeably slowed down as lots of Greenwich residents have headed out of town for some well-earned time away.

Certainly some of this slowing is the Fed’s jacking up the fed funds rate at a vertiginous rate. This second big jump was imposed even as markets across the economy show signs of slowing, e.g. lumber is back down to under $600/1,000 bd ft from its all time high of $1,700 in May of 2020 and copper prices are down. We still have the war in Ukraine and some continuing bottlenecks restricting supplies of wheat and white goods.

At the same time sanctions and Russia’s actions have driven up prices, though they also have fallen recently. The Fed has promised additional rate increases even as the economy softens and many of the shortages are driven by factors causing inflation are driven by factors changing the fed funds rate can’t fix. The big problem is that the Fed’s increase in rates have much of their impact many months in the future.

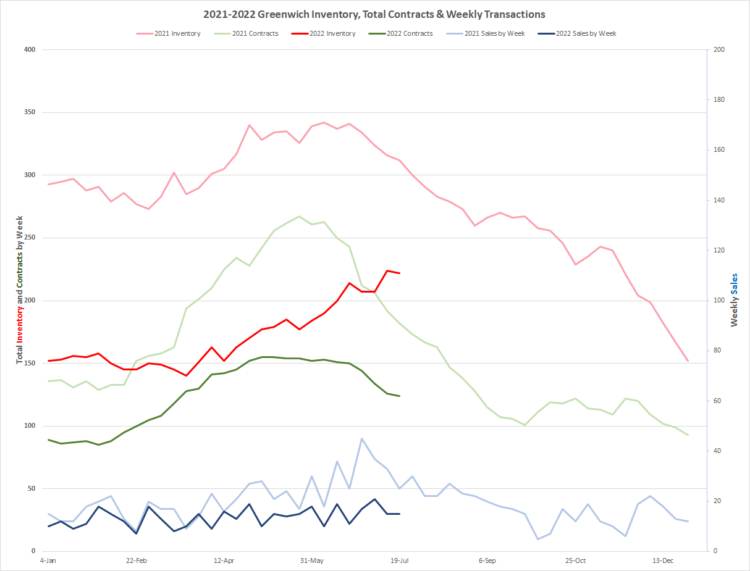

Here in Greenwich, we’ve seen a continuing turn away from contracts with mortgage contingencies. This week we had 16 contracts and only 3 of them had contingencies. These 3 contracts were between $1.1 and 2.5 million as you might expect. At the same time we had 8 new contracts in pending status (i.e. non-contingent last week) in that same price range. While total contracts did drop this week; this is a seasonal occurrence. Interestingly, contracts are not dropping as fast as they did last year when we had substantially more inventory.

This year inventory jumped right after the 4th of July holiday going up 24 listing compared to 4 listing on the holiday week. This week we added 13 new listings, a more normal jump and almost the average of the two prior weeks. So, contracts are declining somewhat and inventory is going up somewhat, but we still have more demand than supply.

This doesn’t mean that all this talk of recession and rapidly climbing interest rates hasn’t effected our market; it has. Curiously the most obvious place to see it is in the drop in sales. Right now we have 60 sales and if we add 10 more sales before the end of the month, those 70 sales will be below our 10-year average of 81 sales in July. This drop is curious, because 42 of the contracts for those 60 July sales were signed prior to June 1, before the Fed started tightening the screws. Then again, if any place as foresighted financial people it’s Greenwich.

I’m hoping that the Fed is playing a bit of chicken with consumers, to get people to reduce their demand for goods, save more and let the supply side catch up. If they do persist in these frequent big jumps, they won’t be seeing their soft landing. At the same time, people who own, or have bought in the last two years have seen their real estate investment beat the CPI.

Stay tuned, it’s going to be an interesting 3rd quarter.

Mark Pruner is sales executive with Compass in their Greenwich at 200 Greenwich Ave. He can be reached at 203-817-2871 or mark.pruner@compass.com.