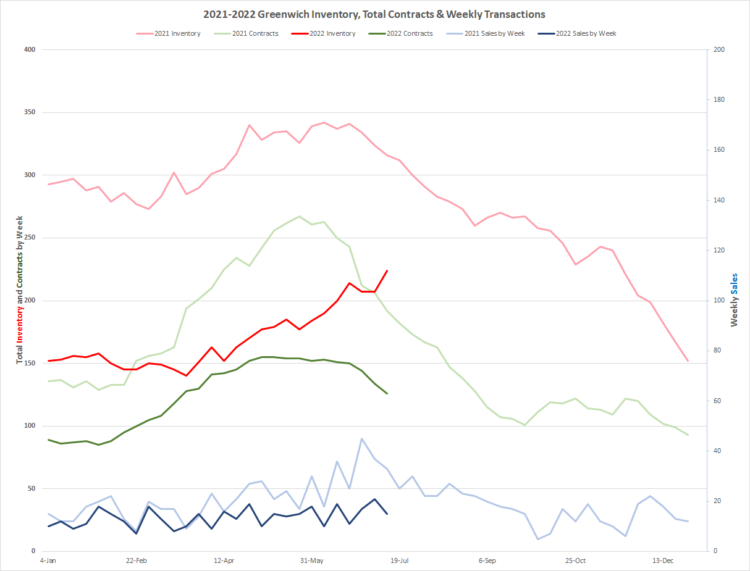

The market is much tighter than in 2021 due to our extraordinarily low inventory and very good demand. The low inventory means that sales are down, but not because of lack of demand.

We have seen a fall off in demand shifting the market from a super-seller’s market to a strong seller’s market. Inventory is up from an all time low of 140 single family homes earlier this year to 224 houses or an increase of 60% in 3 months, but it stills leaves us down 65% from normal inventory at this time of year.

If you ignore all that we we have seen in the last couple of years, what we have right now is more demand than we have supply. Without lots more inventory, I expect that prices will continue to go up, just not in the big jumps that we have seen in the last two years.

I also expect that work from home will continue to drive demand. The uncertainty from the market fluctuations, gas prices, and interest rates has had significant impact on demand, but more in causing buyers to pause their plans, while they see how things are likely to sort out.. For much of the Greenwich market increased interest rates have not been a significant factor. People can get jumbo loans under 5% and only about a quarter of the deals have mortgage contingencies down from 50% pre-Covid.

If we’d had this amount of demand in 2019, we would have been happy campers; it’s Y-o-Y comparisons that makes this market look weak.

We have seen a slight drop in contracts, which bears watching, but this is a seasonal thing that happens every year as people head out for vacations in July and August. This will give some relief to buyers who aren’t vacationing, but also could be a sign that we are headed more for a buyer’s market. It’s all a matter of degree and we aren’t close to a buyer’s market in Greenwich now except for the over $10 million segment.

Mark Pruner is sales executive with Compass in their Greenwich at 200 Greenwich Ave. He can be reached at 203-817-2871 or mark.pruner@compass.com.