By Mark Pruner

August is always a tough month to try to figure out what is going on in the market because not much is going on in the market. We don’t see a lot of new inventory come on as most people are waiting for the fall market in September. Also, most of the sales are from contracts signed in prior months.

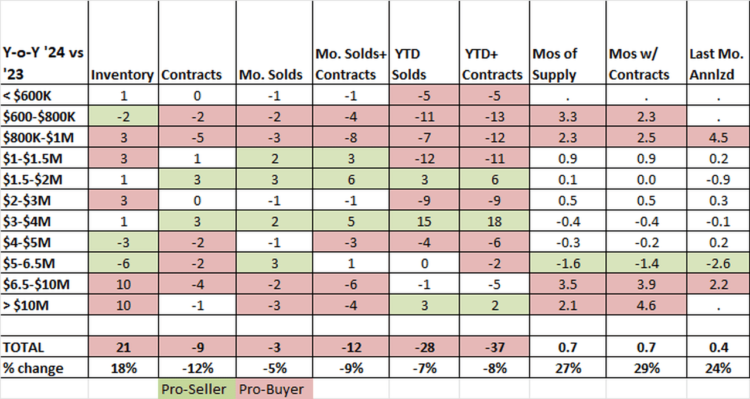

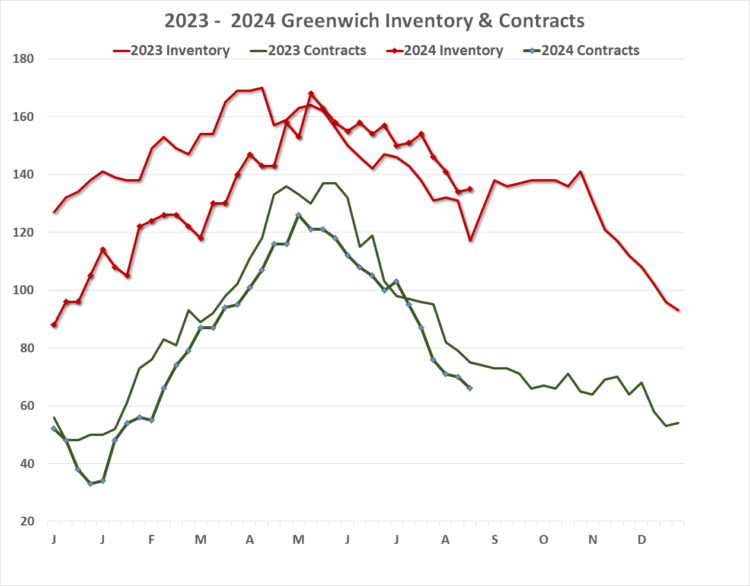

We are seeing some clear trends that have developed over the last couple of months and have continued in August. These trends may bode well for a little more balanced market. Since June our inventory has exceeded the inventory that we had in 2023, However, we still are not close to the inventory that we saw in 2022 and more than 75% below the inventory that we saw in 2019.

Our June, July inventory while up slightly still means we are in a very tight market with our weekly inventory up only in the single digits over where it was each week in 2023.

Having said that our actual number of active listings has continued to trend down as it always does in the second-half of the year. As of the first week in September which included Labor Day, we haven’t seen a lot of new pent-up inventory that was just waiting to come on the market. What we have seen is that as has happened all year the record setting low inventory levels each weekly prior to June and fractional higher inventory since then have led to a below average number of contracts, which lead to lower sales.

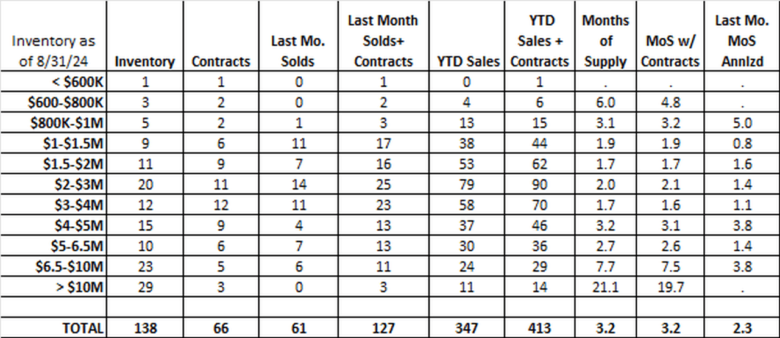

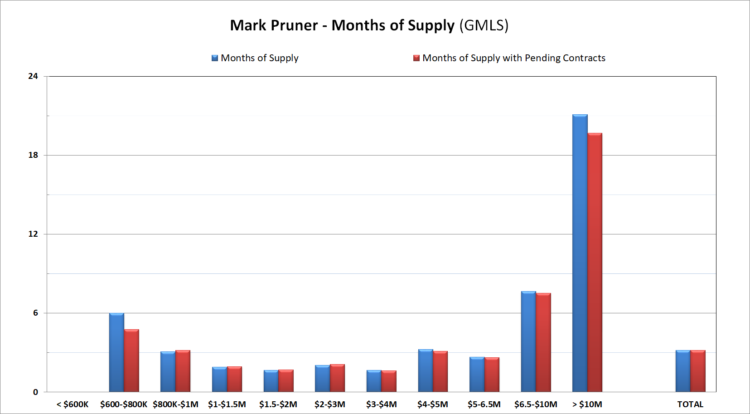

The good thing is with inventory up a little bit and contracts down a little bit we’re seeing slightly better months of supply overall. Our overall months of supply for the entire market is 3.2 months, i.e. if not more listings came on, we would sell out our present inventory in just over 3 months. This is up 0.7 months of supply from what was an astounding low of only 2.5 months of supply in August 2023.

The market has seen increased months of supply though though only slightly from $1,000,000 to $3 million which is the heart of our market where we see the most inventory with 40 single family homes in inventory and year to date sales of 170 homes.

Interestingly, our highest increase in months of supply are under $1,000,000 and over $6.5 million. Under $1,000,000 the houses have been on for an above average days on market. Anything in that price range that’s in good shapes and price to market goes in days to a couple of weeks. At the present time we only have nine listings under $1 million. Their median time on market is 40 days compared to a median of 19 days for sold properties in August.

At the high end, we’re looking at 7.7 months of supply from $6.5 to $10,000,000 and 21.1 months of supply over $10 million. Having said that, our year to date sales over $10 million are up 3 sales from 8 to 11 sales and our sales from $6.5 to $10 million are about the same at 23 sales YTD.

The really remarkable thing about our very high-end market is that we’re up 20 listings over $6.5 million which gives us 52 listed properties. Compare this to the 49 listings that we have under $3,000,000. Under $3 million 49 listings, over $6.5 million 52 listings. Overall our high-end sale are doing well with 35 sales over $6.5 million and an additional 30 sales from $5 million to $6.5 million.

We do have significantly lower inventory from from $4 -$6.5 million with nine fewer single family homes in this price range. It all depends on how you slice and dice your price ranges as to what story you want to tell.

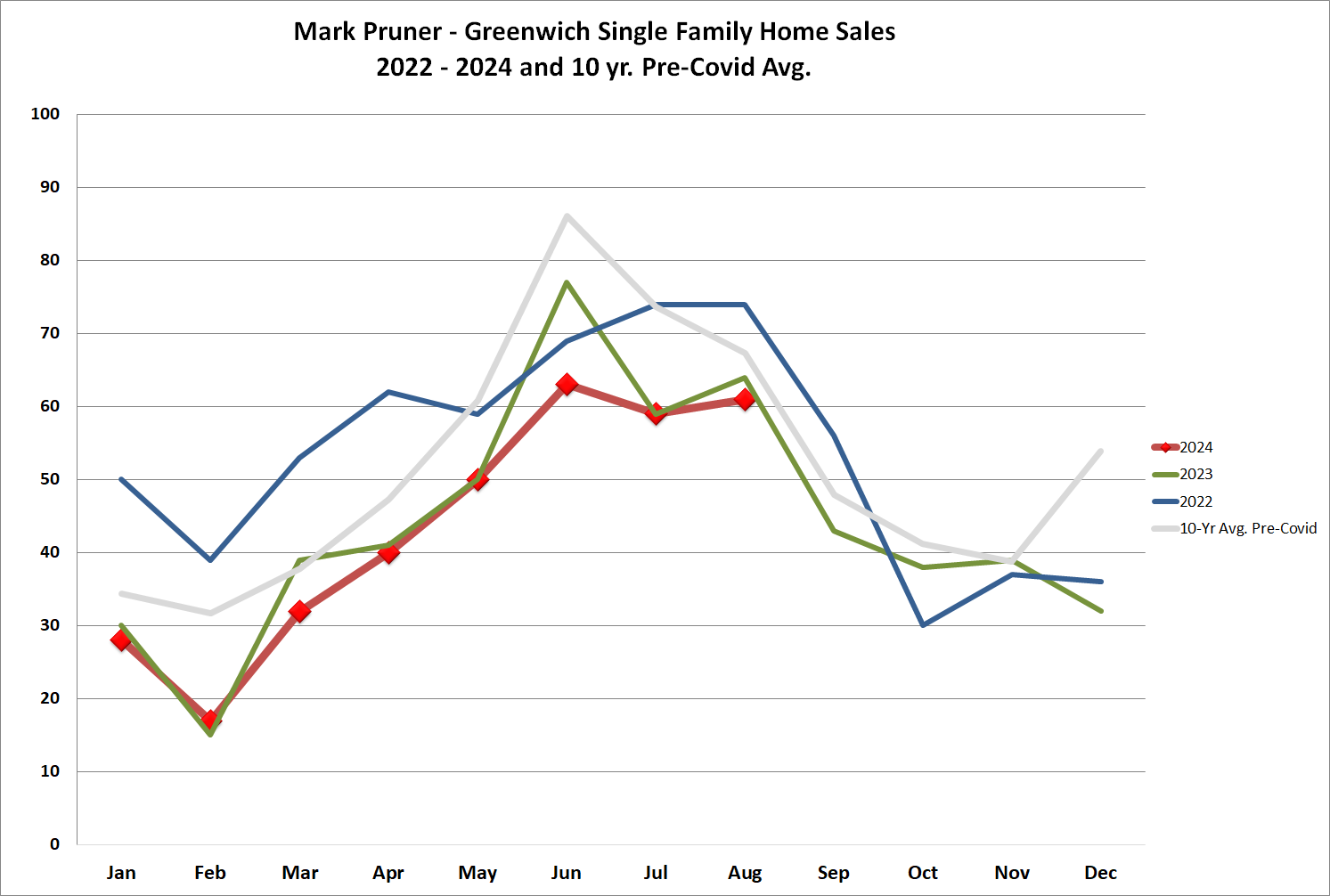

For the overall market sales rose strongly from February, traditionally our lowest inventory and sales month, to June and have essentially leveled off for July and August. Each month sales have been below our 10-year pre-COVID average, but sales have been constrained all year by the lack of inventory. One thing to note is because our days on market is so short we get a lot of blue moons where things come on and go to contract in the same month, so those listings never show up in the end of the month inventories. They do show up in YTD sales, it’s just that our inventory numbers are not quite as bad as they might seem.

All the way from $800,000 to $6.5 million, we are at right around three months of supply and even under that for some of these price categories. The three months of supply level is what I call a super sellers market since under6 months of supply is considered the dividing line between a buyers and sellers market. Our market is also stable. When you add in contracts and assume they’ll close in 45 days, our months of supply with sales and contracts is almost identical in every price category also around or under three months of supply. That indicates a relatively constant level of demand.

Of course we’re now in the spring market and September will be an important month to see whether this slight loosening of the market will become a greater loosening. Even if the loosening continues it will be months before we get back to anything like a normal market of 500 or so listings in September.

The one thing that the contracts do indicate is that the high-end is actually an improving market. This is not that unusual post the Great Recession as very high-income earners aren’t getting their big bonuses at the beginning of the year like the large majority of them did back in the digits. Post Great Recession, we are now seeing good activity in the third and fourth quarter for very high end sales.

Our contracts are down slightly from last year, as we only have 66 total contracts compared to 75 in August 203. These contracts are mainly concentrated between a $1.0 and 4.0 million.

The Fed announced a rate cut for September and this may change the vibe of the market but given that most sales in Greenwich are not using mortgage contingencies the changing interest rate may not help that much. In fact arguably it might hurt a little bit because people with large bond holdings were finally getting decent bond payments and these will drop slightly. Of course, at the same time the higher interest rates push down bond prices, but that change for people who hold their bonds for years is not that significant.

So expect to see more inventory come on in September and greater numbers of new listings then we see sales. We will almost certainly see that more so in October with the presidential elections in early November. Curiously it doesn’t seem to matter who wins the election it’s the uncertainty that freezes people from moving forward.

The main reason for more inventory from this very low base is that we are getting to the point where people who have been keeping their house off the market are starting to feel biological pressure. More children have been born and are having to stay in the same smaller house. This will eventually lead to a push for larger houses. At the other end of the age range, older folks may decide to downsize to smaller houses and condos. Many of these people have been holding out for the last several years. Having to take care of large houses and having more trouble dealing with stairs, moving to a condo a condo a smaller house, particularly with an elevator starts looking pretty attractive.

We normally see a drop in sales in the month of October in presidential election years as everybody holds their breath to see what will happen. In Greenwich the stock market plays a big role, it has hit record highs this year and we are seeing some people moving some of that stock market money into Greenwich real estate as the stock market is looking a little frothy. Also real estate is an excellent hedge against inflation. If anything close to the amount of money that each presidential candidate is talking about pouring into the economy either through reduced taxes or more government grants you can expect to see a revival of inflation

Stay tuned…

Mark Pruner is a member of the Greenwich Streets Team at Compass Connecticut located at 200 Greenwich Ave. He can be reached at mark.pruner@compass.com or 203-817-2871.