By Mark Pruner

Whither the Future?

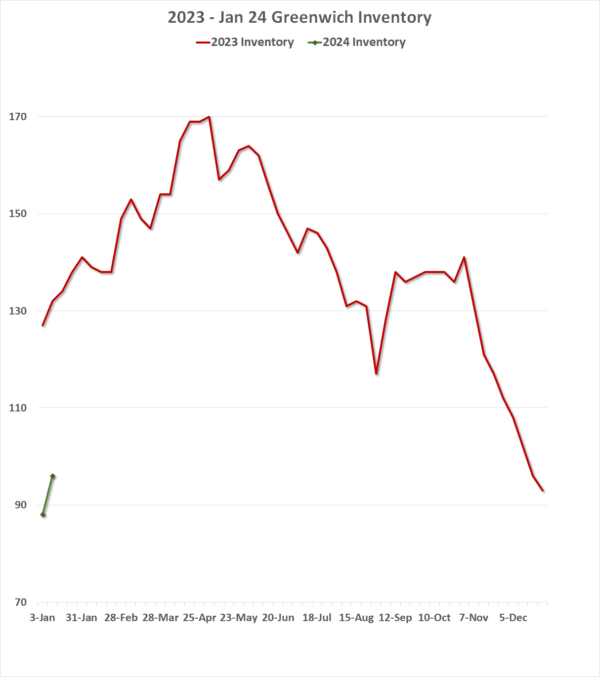

Greenwich’s real estate inventory has skyrocketed in the last week. We are up 11% in only ten days. If that rate were to continue for the whole year, we would be up over 350% for the year (which would just barely give us back to our average inventory level by the end of 2024). Of course, that is not going to happen, because we started to far down. At the end of the first week of January 2024, we got to our lowest inventory ever in Greenwich with only 88 single-family home listings. Normally at the beginning of a year we have 350 to 400 SFH listings.

The great thing about small numbers is that when you add an even smaller number to them, you get a big percentage jump. Our surprising 11% jump in inventory represented an increase of only 10 units bringing us up to 98 single-family homes from that record low of 88 listings. Rarely, however, have 10 new listings been so inspiring. Ten listings in 10 days are not a lot, but for the first time since the end of October 2023, it means that inventory is going up not down.

It also means that we have some new listings to sell which are desperately needed. Another reason that inventory went up is that contract signings are down. In the last three weeks, we have had 3, 4, and 6 new contracts signed. Those 3 weeks include Christmas and New Years, so you expect a drop-off, but in 2022, we had 29 contracts signed in the first two weeks of January. Regardless, more inventory is better than less inventory, especially when it means you are past, what is hopefully, the lowest inventory we will ever see in Greenwich.

Will more Greenwichites list their houses in 2024?

At the end of the year, there is a good chance that we will have more listings in 2024 than we had in 2023. Why? Because of the five D’s; diapers, diplomas, diamonds, divorce, and death. Babies are still being born, students are still graduating, people are still getting married and divorced, and unfortunately passing away (though it’s my mother-in-law’s 102nd birthday next week). What we saw in 2023 was the 5 D’s kept the number of buyers high throughout the year, even with increasing interest rates.

What we are likely to see in 2024 is that the 5 D’s mean that lifestyle changes have built up as potential sellers have not listed their houses over the past couple of years. For those who bought their starter home with one baby on the way and now have two children, a larger place is starting to look pretty good. For people that retired and stayed in their homes, inflation is making it more expensive to keep those big homes. This will lead to more people deciding to right size their housing and list their houses, whether they are buying bigger or smaller, they are listing their present house.

However, that additional inventory, unless it becomes a flood, will only incrementally change our market. I expect that you will see a gradual improvement in inventory and possibly not even that. About half of our sales have been for full list or over list. This means there were likely multiple bidders for those houses. For every buyer that found a house, there were at least one and often 3 and even 6 buyers who didn’t get what they wanted. As a result, even as more people list their houses, the market will stay tight until these “excess” buyers find the house they want and we get back to more of a one-to-one ratio of buyers and sellers.

Some of the first signs of this “weakening” market are when we start seeing the median days on market drift up and the sales price to original list price drifting down. Even when this happens, we are likely to see our market go from a super-seller’s market to a seller’s market.

One place where we arguably are already in a buyer’s market are older houses that need a lot of work. Today’s Greenwich buyers don’t want to buy and move into an older house and fix it up over the next couple of years. Nearly all Greenwich buyers want the house fixed up before they move in. For them, the first-year cost of the house is not only the purchase price, mortgage payments, property taxes, and insurance, but also the cost to fix up the house to today’s standard. That standard, given demand-induced inflation in building costs, is much higher than it was five years ago.

The dollar costs can be put on a spreadsheet and people can decide whether they have the money. What can’t be put on a spreadsheet is the time to educate themselves about the building process and finding and qualifying architects and builders. Most of our buyers already have very busy lives and adding this time burden on top of what they are already doing has resulted in older homes that need work being a tough sell.

One thing that a seller can do to make their house more attractive is to use the services at my brokerage, and several other brokerages, to fix up their houses and make them ready to sell. Going even further, there are companies that will buy your house, make renovations and repairs and then sell it for you and split the increased sales value with you.

Older houses do sell, even really old houses. In fact, 5 of the 540 houses that sold last year were built in the 1700s and 16 were built in the 1800s. Our median year built for a house sold in Greenwich last year was 1961. It’s not age, it’s maintenance.

One type of housing that will increase in 2024 are ADUs. The Greenwich Planning and Zoning Commission has made the process for adding another dwelling unit in your house or as a second structure much easier. You no longer have to go through a full hearing at P&Z to get approval and they have removed the restrictions limiting ADU’s to only elderly, affordable or handicapped ADU owners.

This is a good response to the constant pressure that towns are getting from Hartford to create more housing units available. If you want to know more about ADUs, (and historic overlays, and lot splits), you can check out “Zoning for Greater Property Value in Greenwich CT” on YouTube with Magarita Alban, chair of P&Z, and Tom Heagney, land use attorney, and Stacey Loh, director of the GAR. (You can also see an example of why I should silence my phone before starting a seminar.)

Where are we going in 2024? Sales will definitely go up if we get more inventory, and we are likely to get more inventory this year than we got last year. We will add a few new units to our housing stock, but the large majority of new construction will simply be a bigger, new house replacing a smaller older house with no net gain in housing units. The stock market is doing well, and lower interest rates will help both the stock market and the housing market. On the flip side, there are always the black swan events that make the future interesting. Stay tuned; it’s going to be an interesting year.

Mark Pruner is a sales executive on the Greenwich Streets Team at Compass Connecticut, he can be reached at 203-817-2871 or at mark.pruner@compass.com.