By Mark Pruner

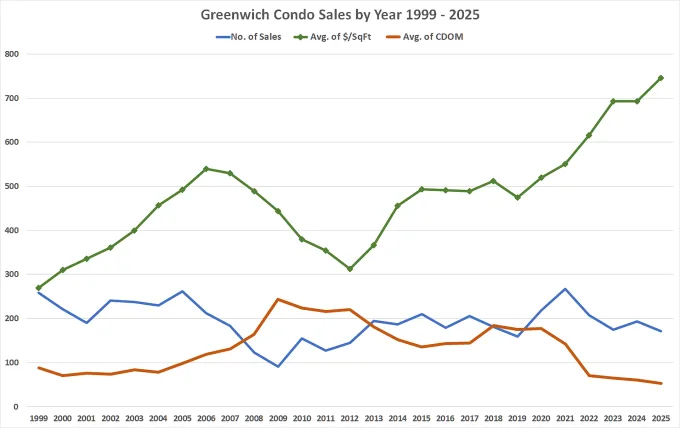

In 2024, we saw the highest dollar volume of condo and coop sales with $256 million in total sales. In 2025, total sales volume dropped back a little bit with only $226 million in sales, but that was because our total sales number dropped from 193 sales in 2024 to 171 sales in 2025 or a drop of 11.4%.

This sales drop was not for lack of demand. Our average months of supply was an amazing low 1.2 months of supply, i.e. if we got no more inventory, our present supply would be under contract in only 5 weeks. In 2024, we had 1.4 months of supply. Bottomline for the last two years, you needed to move fast if you wanted a condo or co-op in Greenwich.

In 2025, we had the second highest sales price to original list price at 100.3%. We also had the highest sales price per square foot and the second highest average sales price at $1.32 million. Arguably, last year was the second most competitive market we had after 2024. So, let’s take a look at some of the key features of this market.

In 2025, we set an all-time record for condo sales price/sf at $746/sf. In 2024, our average condo and co-op sales price was $693/sf, so we are up 10.3% in price/sf. This increase is almost identical to what we saw in our single-family home appreciation, which was up 9.9%.

Our cumulative days on market dropped to an all-time low of 53 days on the market, which is even lower than 2024’s all-time record of only 61 days on market. The reason it was even this high was two condos sold after more than 290 days on market, bringing the average up.

If you look at the median days on market for condos, you’ll find a very low 31 days from listing to non-contingent contract. The reality for buyers was that it is even lower than this, because the GMLS counts days under a contingent contract as still being on the market. An agent could have a very poor year, if all he showed were condos with a mortgage contingency contract. Only a handful of contingent contracts every return to the market.

Of our 27 contracts waiting to close, more than half had a contingent contract. This is much lower than we see for single family homes. The main reason for this is that the median price for houses sold in 2025 is over $3.0 million, while the median price for condo sales was $955,000.

Buyers in this price range are more likely to be younger, who need a mortgage to help pay for their condo. Also, mortgage interest is only deductible up to $750,000, so there is less financial incentive to take out a multi-million dollar mortgage when Uncle Sam is not letting the buyer deduct all the interest.

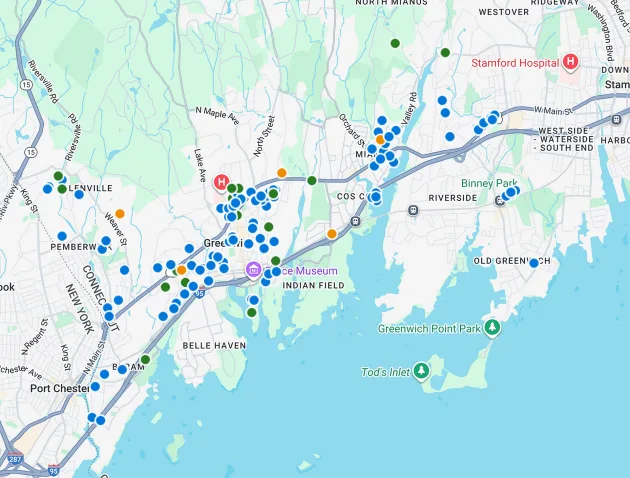

Our 171 condo sales were spread out all over front-country, where properties are zoned for multi-family. Most condo sales are in central Greenwich, Pemberwick, Glenville, and Byram on the west side of town and also in Cos Cob, with a smattering in Old Greenwich, on the east side of Greenwich. If you look at a GMLS map of condo sales and inventory, it’s hard to find the green dots that represent today’s inventory as those 22 dots are swamped by the 171 blue dots showing 2025 sales.

This week, we have 16 pending contracts and 11 contingent contracts. These 27 contracts bode well for sales in January 2026, as they close in what is usually a good month for sales. In condo sales, we generally see a slight uptick in December and bigger uptick in January as buyers and sellers try to move tax benefits to one year or another. Conversely, February is normally our month with the lowest sales.

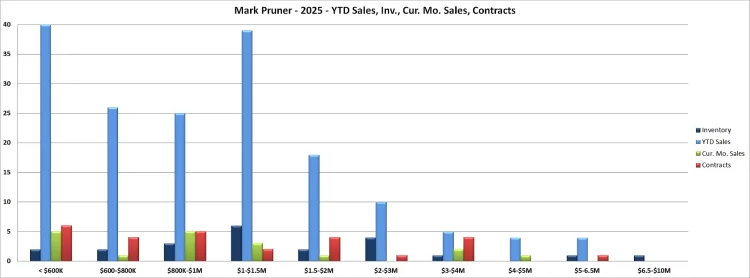

The condo market is tight at every price range. We have less than 2 months of supply from $600,000 to $4 million with the exception of $2 – 3 million where we have 4.8 months of supply. We have no MoS over $4 million since we either have no inventory or no sales. Having said that we did see a nice bump in sales from $5 – 6.5 million range where we had 5 sales. We had a record year for house sales over $10 million and it looks like many of those sellers are staying in town in high-end condos downtown.

Our highest condo sale last year was $6.2 million at The Moderne, those condo next to Town Hall. It was listed for $5.5 million and went to contract in 4 day. It sold for 13% over list price.

Today, these high-end buyers are going to find only 3 options over $3 million. Of course, today’s buyer only has 7 options under $1 million, which equates to a 1 months of supply. It’s a tough time to be a buyer.

The large majority of condo sales are under $1.5 million. The price range from $1.0 – 1.5 million has our highest inventory with 6 listings. Buyers shouldn’t be severely discouraged however, as we did have 39 sales last year in that price range.

These monthly inventory numbers are deceptive as many listings are blue moons. They come on and go to contract in the same month; hence they are never counted in the end of month inventories. Last year, 86 of our 171 sales went to contract in less than a month. If we assume that half of these 86 sales didn’t overlap the end of the month, that means 43 condos were never counted in monthly inventory numbers.

Building condos in Greenwich is tough. Of the 171 condo sold in 2025, only 8 got their C.O. in 2025. Before then, we only had 3 condos sold that were built from 2017 to 2024. If you are a masochist, you can wait to buy a 2020’s condo.

What should we expect in 2026? At this point it looks like more low inventory. We do have some large projects that will break ground this year, but none of them will be seeing any buyers moving in this year. We also should have plenty of demand to meet the supply that we do have. If you are going to buy, do your preparation and get a good agent and a good attorney who can move fast.

Mark Pruner, with his brother Russ, and Dena Zara were co-founders of the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com.