By Mark Pruner

High-End Market Continues to Soar

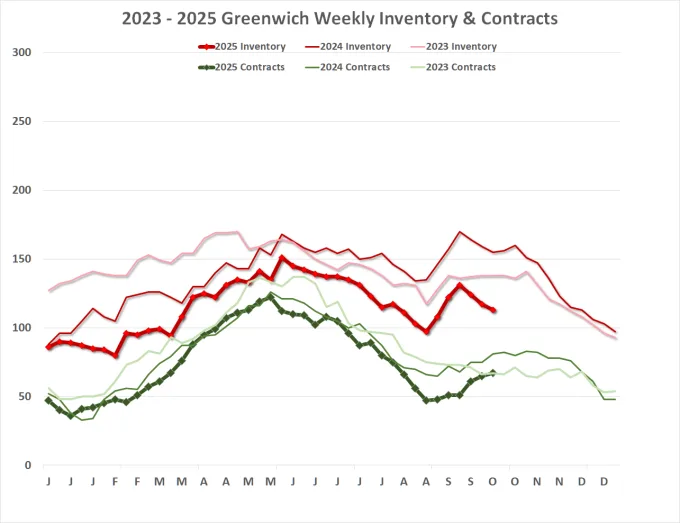

Our market is doing something remarkable and it is told by a couple of bumpy lines. Our inventory is falling rapidly, but new fall market inventory is coming on. What is causing this drop in inventory is that we are getting more sales and more contracts than in previous years. To have contracts continue to go up for the last 5 weeks, while inventory has been dropping from is remarkable.

What is even more remarkable is how many of those contracts are at the high-end of our market. We have 105 properties that were listed for over $5 million that are sold and we have another 30 that are under contract. These highend sales are up 43% from last year.

Where it really gets amazing is over $10 million where sales are up 100% this year. Not only that, but highend sales are accelerating. In the first 2 weeks of October, we have had 6 properties over $10M go to contract and 3 more have closed. Last year at the end of September 2024 we had one contract over $10 million. This year we have 13 contracts over $10 million. Last year we had one sale over $17 million. This year we have 13 sales and contracts including 3 contracts on listings at $25, $33 and $43 million. Whether is a record high stock market, Mamdani or debasement is not clear yet.

Our inventory for listings over $10 million is down to 23 listings compared 31 listings last year or a drop of 25%. It’s a heretical thought, but if you have high-end house, this isn’t a bad time to list or at least explore a sale. It’s our best market for high-end houses ever. Our previous record for sales over $10 million was set back in 2007 with 19 sales. If all the contracts close before yearend we will more than double our previous best year.

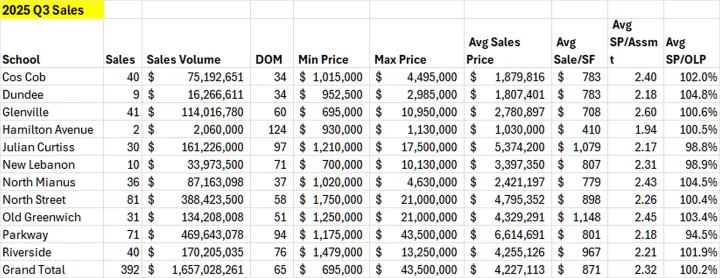

Greenwich Real Estate Sales by School District

Let’s take a look at what neighborhoods hot. The short answer is all of them. Every neighborhood is seeing higher average sales prices, higher prices/sf and higher sales price to assessment ratios.

But, this is Greenwich, so inquiring homeowners what to know if they are in the hottest neighborhoods. If you want to do it by the biggest percentage gains in sales then the clear winner is Hamilton Avenue, where sales are up 100% from last year. Unfortunately, this is an example of the law of small numbers. In 2024, we only had 1 sale in the Hamilton Avenue School District (think Chickahominy). This year sales are up 100% to 2 house sales. While Chickahominy is one our densest populated areas, it is mostly condos, apartments and multi-family housing with only a few single family homes. (That and people in Chickahominy hardly ever sale their homes they just pass them down to their children.)

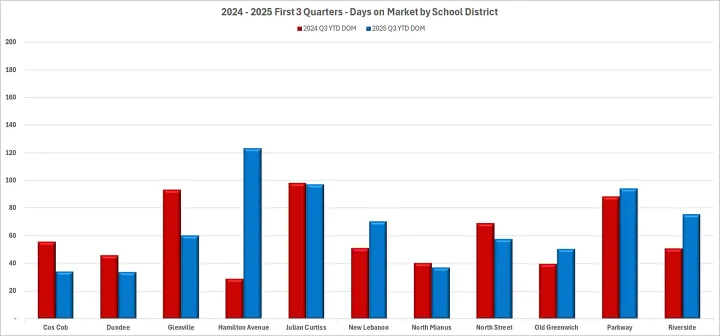

The largest jump in the number of houses sold is in Cos Cob. In 2024, we had 27 hose sales in Cos Cob. In 2025, we have already had 40 sales or an increase of 48% in sales. Every other neighborhood has actually seen a drop in sales, due to limited inventory. The biggest drop in sales are in Glenville and Julian Curtiss, each down 9 sales, followed by North Street and Old Greenwich, each down 8 sales.

If however, your definition is where we are seeing the biggest jump in the average sales price, then you want to the head to the Parkway School District. The average sales price is up 46% from $4.5 million to what is possibly the highest average sales price for a neighborhood ever at $6.6 million.

Part of that is truly a rise in prices, but remember all those high-end sales we talked about at the beginning of this column, most ot them are located in the Parkway area, i.e. backcountry and the 2 acre zone of mid-country. Probably 60% of this price appreciation is due to more high-end sales, but not all. If you look at the price/sf, then prices have gone up 17.4% the second highest in Greenwich.

But, hot is not just about price appreciation, it’s also about days on market. For lowest average days on the market, you have to look at the Old Greenwich and North Mianus school districts where the average DOM is only 40 and 41 days, respectively. Note this is the average DOM, the median days on market for OG is 12 DOM. (That number is from the listing date to the date that there is a non-contingent contract.)

Outside of the northeast and midwest inventory is rising, and in many states is higher than it was pre-Covid. Many of the previously hot states are now seeing falling prices. That is not the case here. If you want to see some really good analyses of the US market google “Mike Simonsen”. He does a remarkable job of showing what’s going on nationally

Mark Pruner, Russ Pruner and Dena Zarra are the founders of the Greenwich Streets Team at Compass. Mark can be reached at 203-817-2871 or mark. pruner@compass.com