By Mark Pruner

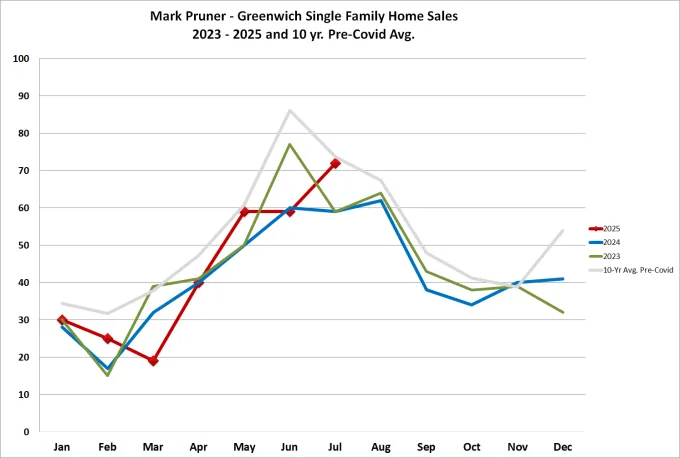

What a long, strange ride it has been. Sales over $3 million and particularly over $5 million have done extraordinarily well this year. While sales under $3 million are down pretty much across the border. But 2025 has been a bumpy ride. The first three months dropped like a rock. We went from 30 sales in January to 25 sales in February to the second worst March in this century with only 19 sales in March. Then two months of big gains with 40 sales in April and 59 sales in May. A brief pause in June only to see sales skyrocket in July to 72 sales.

Good sales even with record low inventory

Those 72 July sales were almost equal to our 10-year pre-Covid average of 74 sales. Now, slightly below average sales doesn’t sound all that remarkable. In fact, it sounds a little below average and unremarkable, until you look at the supply side of the supply/demand curve. At the end of July, we had 115 single family homes listed on the market. This is 82% below the 641 listings that we had at the end of July 2019. Think about that, we had almost an average sales month in July 2025 with only 18% of the inventory that we had in July 2019. To put it even more starkly, in July 2019, we had 72 single family home sales. In July 2025, we had the same number of sales, 72 with only 18% of the inventory.

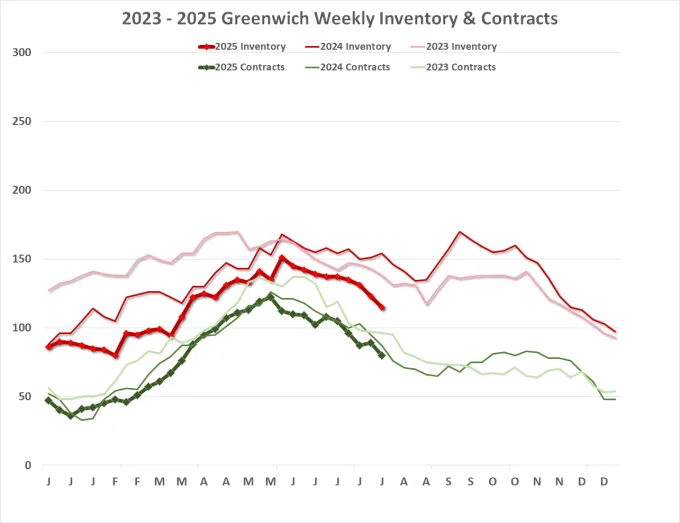

How is that possible? Two years ago in 2023, we had all-time record low inventory every week that year. We thought we’d never go that low again. Then in 2024 we went even lower for the first half of the year. In the second half of 2024, our inventory creeped a few percent about those record low 2023 inventory number. The general thinking was that we had hit bottom in the first half of 2024, and our market was in recovery on the inventory side the second half of the year. The lower inventory in the first half of 2024 resulted in only 501 single family homes in Greenwich. A number not matched in this century except for the Great Recession years of 2008 and 2009.

Of course, things would be better in 2025, with higher inventory, but it wasn’t to be. Our inventory has been at all-time record lows every week this year. At the end of July 2025, we were 26% below 2024 and even 17% below July 2023, which had been our record low until this year.

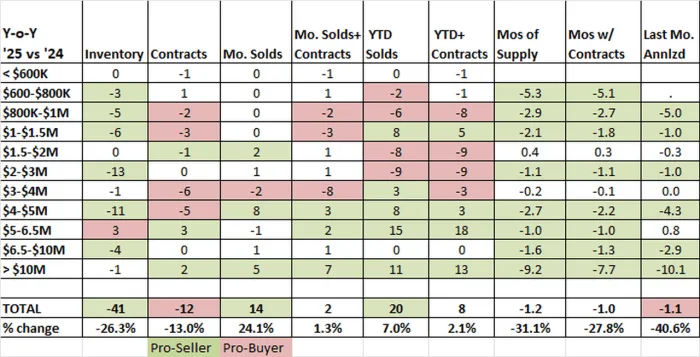

Record low inventory, down 26% over a horrible 2024, could only mean record lows sales; right? Wrong! This year our sales are up 7% over last year and we have a tale of two markets. Below $3 million our sales are down, because we have nothing to sell. Last year under $3 million, at the end of July we had sold 153 houses. This year with much lower inventory we had sold only 136 houses under $3 million or a drop in sales of 11%. Record low inventory this year led to low sales, despite high demand.

Market over $3 million doing very well

The market above $3 million is a different story. Last year at the end of July 2024, we had sold 131 houses. This year we sold 168 houses over $3 million or an increase of 28% and the higher you went the higher the increase. From $5-6.5 million, we saw an increase of 65% compared to last year. The price range that did the best compared to last year was the ultra-high-end. In 2024 by the end of July, we had sold 11 houses over $10 million. This year we have doubled that number to 22 sales or an increase of 100%.

Even more remarkable, those 11 sales of ultra-high-end properties in 2024 totaled $144 million. The highest sale in 2024 through July was $16.2 million. This year our 22 sales over $10 million total $320 million or an increase of 122% in total dollar volume. We’ve had three sales at $21 million this year and we have listings priced at $55 million and $43 million under contract. This year we actually have more sales over $10 million, than we have from $6.5 -10 million; 22 sales versus 18 sales.

What’s causing the surge in high-end sales?

So, what is causing this jump in ultra-high-end sales in Greenwich? Three factors seem to be key. Uncertainty, caused by the economic and tariff situations in Washington. The stock market took a huge plunge earlier this year and some large investor looked to a safer, and less volatile place to put their money. As we know, the stock market recovered and reached new highs, but we are seeing articles about whether the market is experiencing a bubble, as a result some people are taking their big gains and putting it into big properties. Most recently, we have been seeing the Mamdani effect. As the probability of Zohran Mamdani’s election as NYC mayor increases, some very high net worth people are looking at local alternatives for places to live or at least to establish their tax abode. We saw the same thing when it became probable that Bill de Blasio was going to be elected in 2014. High-end sales in Greenwich went up.

We also have 8.6 months of supply of listings over $10 million, which means we actually have something for people to buy over $10 million. You can see the increased demand over $10 million as our months of supply has dropped from 17.8 months of supply in July 2024 to only 8.6 months of supply this year. With 6 contracts pending, the ultra-high-end market looks to get even a little tighter. For a really dramatic change, if you take the 7 sales over $10 million, we had in July 2025 and annualize them, we get an incredible 3.9 months of supply. Is that more Mamdani or people thinking the stock market has peaked?

Super-sellers’ market below $5 million

We have less than 3 months of supply from $1 million to $5 million. We have no months of supply under $1 million, because we don’t have a single listing under $1 million as of the end of July compared to 8 listings under $1 million at the end of July last year. (It got a little better in August, as we presently have 2 listings under $1 million.) Of the 72 houses that sold in July this year, 53% sold for full list or over list price. We also only had 80 contracts at the end of July 2025 down from 92 last year. In some ways, we are eating our seed corn, as July’s high sales came from an abnormally quick closing from contract signing. People aren’t waiting around to close, just in case the stock market plunges as it did in March.

The highly competitive nature of the market also means that contracts with a mortgage contingency are becoming scarce. In the middle of August our contracts have plunged to 61 contracts from 80 at the end of July. Of those 61 contracts, only 8 are contingent contracts. If you want to buy a house under $3 million in Greenwich bring cash. If you want to buy a house over $3 million bring cash, but then that has always been the case over $3 million.

Stay tuned, the rest of the year is likely to be even more interesting.

Mark Pruner is a principal with the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-8217-2871 or mark.pruner@compass.com