By Mark Pruner

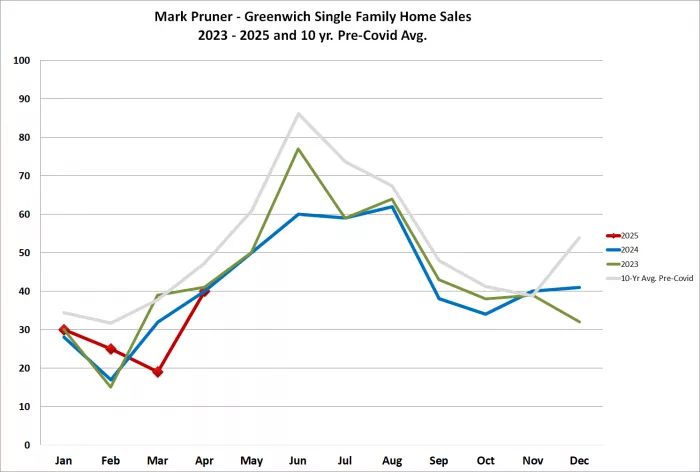

Greenwich home sales took a dramatic jump in April compared the prior month. In March 2025, we only had 19 sales of single-family homes. This was our second worst March this century only beat by March 2009 during the Great Recession. In April, sales more than doubled to 40, the same as we had last April and the highest month for sales so far this year. Part of the drop in sales in March and the jump up in April is due to the wild ride that the stock market took in March and April.

Funds for many of our purchases come from selling stock. When the Dow dropped 4,580 points from April 2nd to April 8th, buyers who were ready to close decided not to cash out their stock, since it was worth much less than when the contract was signed. The standard Fairfield County Bar Association form provides for an initial delayed closing period without penalty. This free delayed closing period is often in the range of 6 to 10 business days. If the closing is delayed beyond that period, the buyer has to pay 1/30th of 1% for each day beyond the delay period. After 30 days from the original closing date, the buyer is in default and loses their 10% deposit, i.e. they are out $300K if they don’t close.

Let’s take a look at how that might work in real life. Starting back in April of 2013, a young finance executive got a good year-end bonus and decided to buy 15,000 shares of Apple stock at $15/share for a total of $225,000. Fast forward 12 years, and this executive now has a spouse, a child, and another one on the way. The family decides to buy a nice 4BR/3BA, 3,100 s.f. house on half an acre in lower mid-country. They sign a contract to buy the house for $3,000,000 on February 25, 2025, of this year. On that date, the family’s AAPL stock, which they had bought for $225,000, has now grown to $3,705,000. As of contract signing, they have plenty of funds just in that one stock to close on April 8, 2025, a date picked so the seller would have time to pack and move out.

Unfortunately for our growing family, April 8th is the low point of the tariff stock trough, and AAPL has dropped from $247/share to $172/share. This means that they would now need 17,741 shares of Apple to buy the $3 million house. Fortunately, they have other investments and could close, but they decided to use the free delay period, hoping that AAPL would recover, and it does. By April 15th, 10 business days later, Apple stock is up to $202, and their 15,000 shares are now worth $3,030,000. But our trader didn’t get where she was by not taking risks, so she moves to push the closing even further out, even though her husband argued for closing during the free delay period.

After the contractually permitted 10 business delay period, the penalty kicks in, and the family is paying $1,000 a day, which is 1/30th of 1% of their $3,000,000 purchase price for every day that they continue to delay. They also have the 30-day default date of May 8th, at which point they are going to lose their 10% deposit of $300,000, which the husband points out daily to the wife. Finally, on May 1st, with the default date less than a week away and AAPL at $213/share, they sell all 15,000 AAPL shares for $3,195,000 and close on May 5th, two days before the default date.

As a result, instead of their closing on April 8th, the original closing date, with $2,580,000 of Apple stock contributing to the purchase price of $3,000,000, they got $3,195,000, or $615,000 more. They delayed the closing by 28 days and had to pay $20,000 in delay fees accumulated during that time. By waiting and paying the delay fees, they saved themselves $595,000. All in all, a brilliant use of the sales contract provisions, or was it just luck? It was definitely stressful.

This scenario played itself out a few dozen times in April and into May. People who can close close are closing in May. So far in the first week of May, we have had 19 sales; the same number as we had in all of March.

Having said that, our 10-year average for April is 48 sales, so we still have a ways to go to get back to where sales were in previous years. Even with today’s uncertainty, contracts, days on market and the percentage of sales over list, all indicate if we had more inventory, we would have more sales.

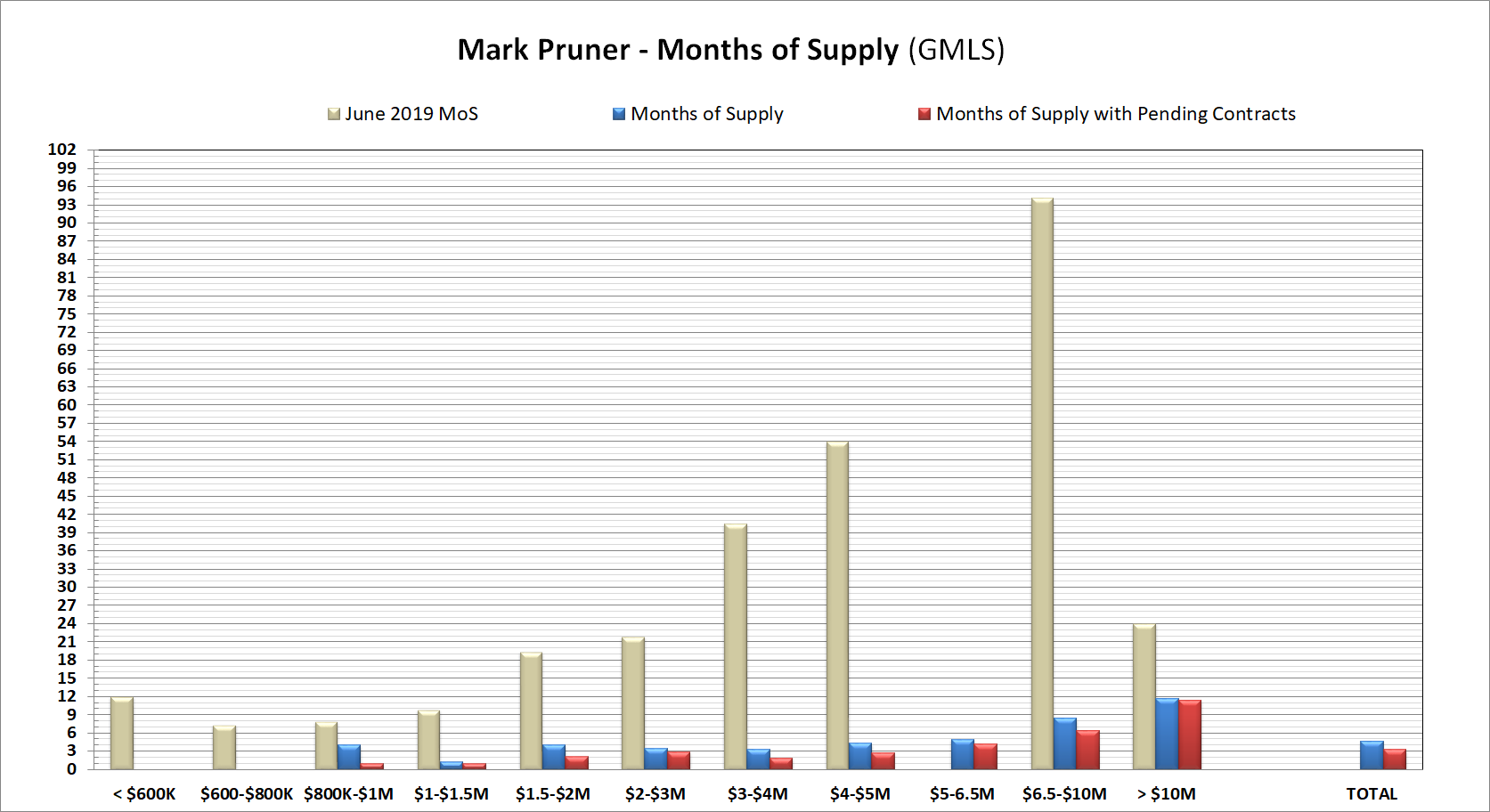

If you take a quick look back at months of supply in June 2019, our last pre-Covid year, you can see just how drastically the market has changed. Back in 2019, the months of supply bars were towering plinths, breaking through months of supply into years of supply. In 2019, from $6.5 – 10 million, we had 8 years of supply. Today that same price range has 8.4 months of supply and drops to 6.4 months when you add in contracts.

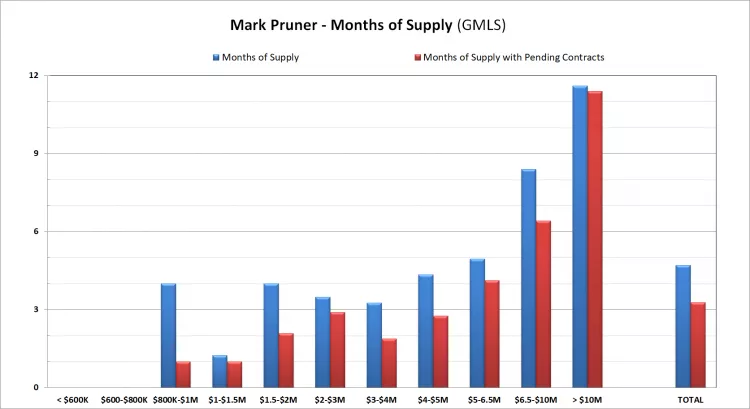

Today, our months of supply price ranges mostly hover around 3 – 4 months. For the overall, market we have 3.4 months of supply, close to a super-sellers’ market. You have to go over $6.5 million to see enough inventory to meet today’s demand. When you add in contracts, every price range shows an accelerating sales market as months of supply with contracts are lower than the months of supply with just sales.

People with no historical perspective might argue that the high-end market is weak, but it is doing much better than it was last year and way better than in 2019. This year we have 37 sales over $5 million, which is 17 more sales than we had last year, itself a pretty good year for high-end sales. Stocks, and even bonds, these days can be a very bumpy ride. Greenwich real estate looks pretty good in comparison.

Our 2025 market is very similar to the 2024 market when you look at inventory and contracts. We did have a strong jump in inventory at the end of March, then the stock market dropped. Uncertainty tends to slow both buyers and sellers; however, in 2025, contracts have continued to rise and have surpassed last year, even with lower inventory. According to my new favorite national housing statistics source, ResiClub, we have the lowest percentage of inventory in the nation today compared to April 2019 with a 78% drop. (Actually, Erie, PA has the biggest drop at 80% down from 2019. It’s a nice town on Lake Erie.)

Some price ranges have seen inventory drop all the way to zero. We have no listings under $800K. From there all the way up to $5 million, we have more contracts than inventory. Our largest number of sale is in the $2 – 4 million range. Our contracts are going up, so expect sales to go up also. This doesn’t mean that we won’t see more buyers delaying their closing when the stock market takes a precipitous drop, but the contracts are still there. It’s just a question of what month they close in.

Mark Pruner is a sales executive and part of the Greenwich Streets Team at Compass real estate. He can be reached at 203-817-2871 or mark.pruner@Compass.com or at his office at 200 Greenwich Ave.