By Mark Pruner

Here’s a heretical thought: You should list your house in the December when everyone else is out shopping for holiday presents. Very few people do that, but this year might not be a bad time to do just that. If you are a seller you always want to list your property at a time when there is high demand and low supply. Traditionally, our lowest inventory is in January, but December is not far behind.

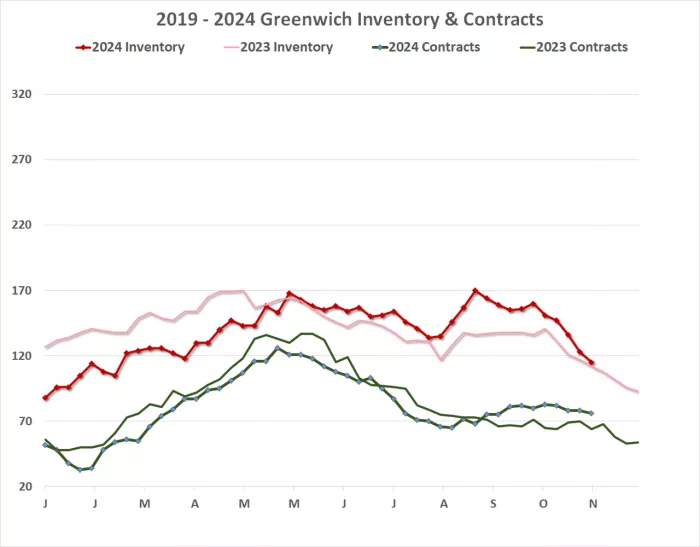

At the end of October 2024, we had 150 listings. Right now, we have 116 single family homes listed on the Greenwich MLS and our inventory is dropping rapidly. If you take a look at Tim Agro’s list of new listings and sales on the adjacent page. You can see that in the past two weeks, we have sold 29 houses and condos, while we have had only 10 new listings.

The result is that we are almost back to the record low inventory that we saw in 2023, where nearly every week, set an all-time record low for that week. Last year in the first week of December, we had 112 listings. Next week may set a new all time low inventory. All we have to do is to have less than 108 listings and with sales depleting inventory, 3 times faster than we are adding inventory, we just might do it.

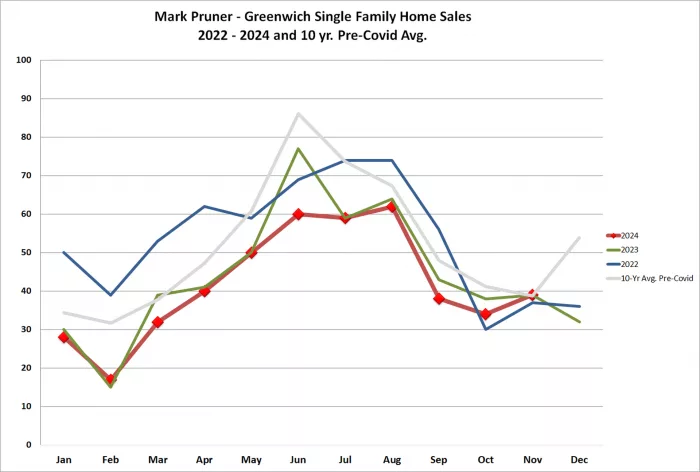

The bottomline, is that in late 2024 we have very few new listings coming on. Astoundingly, even with very little inventory, we have actually had a normal sales month in November 2024 with 39 sales. This compares to our 10-year pre-Covid average of 38.8 sales in November, when we had a normal inventory of around 450 listings. We are right at what constituted “normal” for the post Great Recession sales with 75% less inventory.

When you look at our November sales you see that our days on market varied from 3 days on market to 390 days on market. Curiously in a hot market, new listing that are at all decent sell very quickly, as you would expect, but listing queens that have been sitting on the market for months also find buyers. The definition of buyable expands in a hot market.

Where this messes up the numbers is when you look at the average days on market. The long tail DOM of the listing queens skews the average higher, and sometimes much higher, than the median. (The number where half the sales are above the median and half the sales are below the median price.)

In November 2024, the average days on market for sales is 65 DOM, while the median days on market is 43 or about a third less. Our two highest days on market at 390 days and 162 DOM, which are pulling the average DOM much higher. Because of this, days on market can be a fickle factor as to just how hot the market is. Let’s look at another stat that can indicate how hot the market is.

If you look at the average sales price to original list price ratio for November sales, you get 97.8%. In “normal” times, when we actually have normal inventory, the OLP/SP is usually around 93%. Our OLP/LP average is thus well above normal. How does this 98.7% average compare to our median. When you do that our median OLP/SP, turns out to be 100%. That means that half of our inventory sold for full list price or over list price. Sales at or over list usually indicates multiple offers.

It can also indicate a smart buyer who bids over list price and froze out all of the other buyers that were thinking about making an offer. Earlier this year, my client was the first one to see a house via a Facetime tour on a Thursday. The house had only been on the market for a few hours and was listed at $1.77 million. She agreed to make an offer of $1.81 million after virtually touring the house. We tried to get the seller to accept that offer and take the house off the market. The seller understandably refused, as they wanted to see just how high the other buyers would go in case, they had grossly underpriced the house.

After multiple showings and a well-attended Sunday open house, the seller accepted my client’s offer of 4 days before. Did we overpay? It’s hard to say. What we do know is that for a nice house, in a nice neighborhood in a hot market, we prevented anyone else from making an offer and my client got the house she wanted.

The December market is not supposed to be super-hot like that. December is a month where we get a few new listings and also few listings that have been on for many months reduce their prices, but most wait for January to make major price reductions. So far, December is looking busier. In the first 4 days of December, we have had 12 closing and 12 contracts signed. Of those 12 contracts, only one was a contingent contract, i.e. the other 11 were all cash deals: another sign of a hot market.

Should you do the heretical and list your house in December between Thanksgiving and Christmas/ Hanukkah? We know that multiple people who are ready to buy a house and made offers lost out to other successful bidders in November. These buyers want to buy, they have the money, they have the need and they do not want to lose out on another house, but should you list your house?

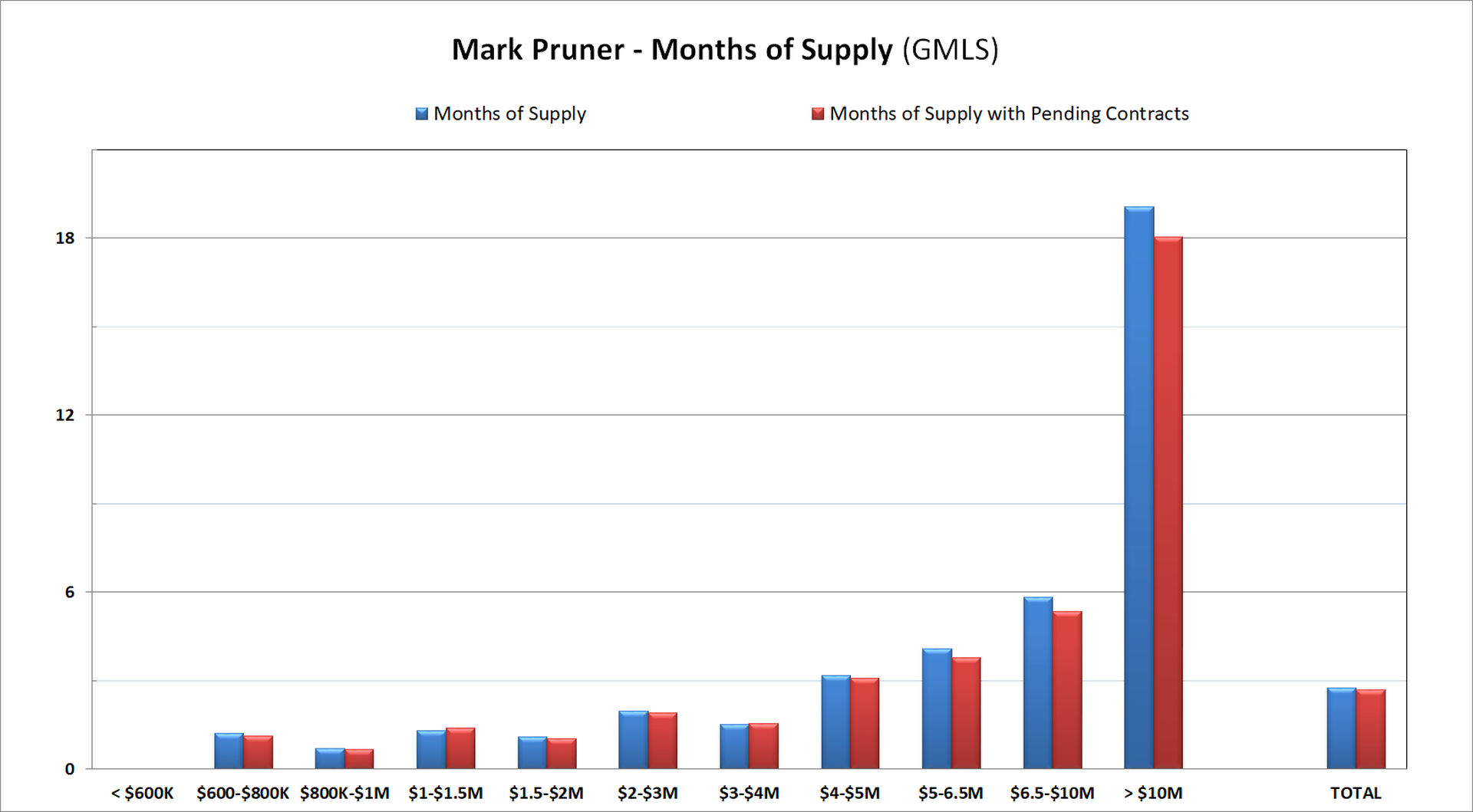

If you are thinking about listing your house for sale in December 2024, then now is the time to look at your micro-markets. What is going on in your neighborhood and your price range. If we go back and look at the November sales and contracts, one thing stands out. Most of the hot houses were priced under our 2024 YTD median sales price of $2.87 million. Of our 39 sales in November, 25 of them were listed for under that price. Of those 25 houses, 15 sold for full list or over list price, while only 4 houses over the median sold for over list price.

When you look at those houses, all but one were in front-country, i.e. within a mile north or south of the Post Road. This is as you would expect, since there is also where houses under $2.8 million are mostly located in Greenwich. Interestingly, the average year built for these “hot” houses is 1943, so new construction or recently renovated doesn’t appear to be outcome determinative in this market.

On the flipside, If you have a $10 million house in mid-country or backcountry, you should hope we don’t get a lot snow as the NWS predicts in this La Nina year. You can wait till January, but talk to your agent now. If, however, you have a house under $2.8 million in front country, you might think about taking a flyer and listing your house before Christmas. Yes, many buyers will be distracted by the holiday, but there are a bunch of buyers that want to make another offer.

What you don’t want to do is to over price your house. You want to under price your house. By underpricing your house, you will get more buyers who see a bargain and are willing to make an offer. Let the buyers compete against each other to push your house price higher.

Then again, you could just wait, but the next few months are going to a period of uncertainty as the country adjusts to the new administration and new cabinet officers are approved, or not. At the same time, inflation for the moment appears to to be going the wrong way, not by a lot, but there is much less pressure on the Fed to lower interest rates. The lower the house price, the more mortgage interest rates play a factor. Once again, a reason not to price your house above the expected sales price.

Your competition is partying, now might be a good time to take advantage of them. 🙂

Mark Pruner is a founder of the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com.