By Mark Pruner

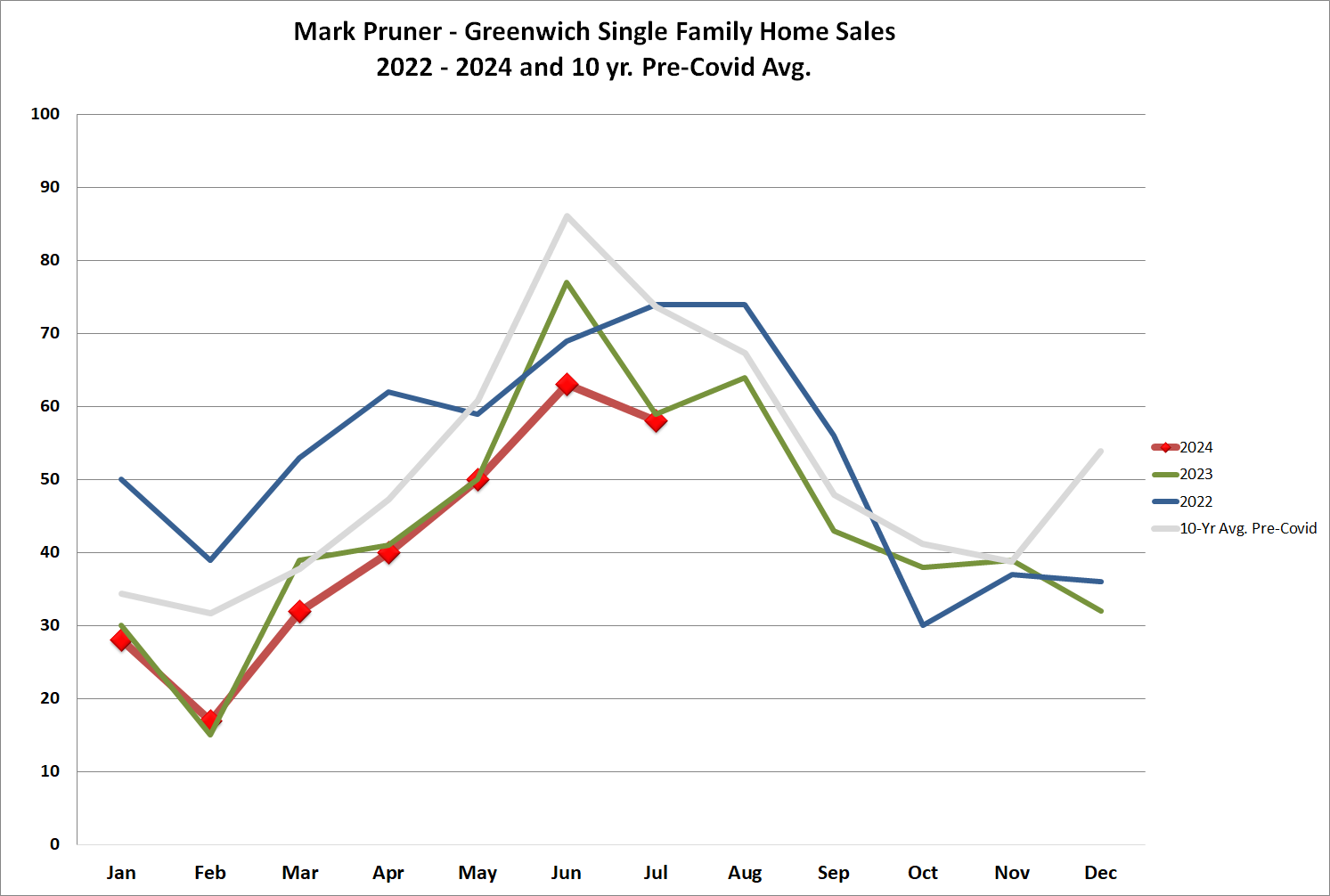

You can look at July 2024 as another in a more than year long sales slump. We had 58 single family home sales in July, when our 10-year average is 81 sales. Looked at that way, our sales are 28% below average. They have not significantly exceeded our 10-year average since September of 2022 which was the end of the Covid purchasing frenzy. We also below last year’s 59 SFH sales in July 2023. (We actually should beat last year, once all the late reported sales are reported, but not by much.)

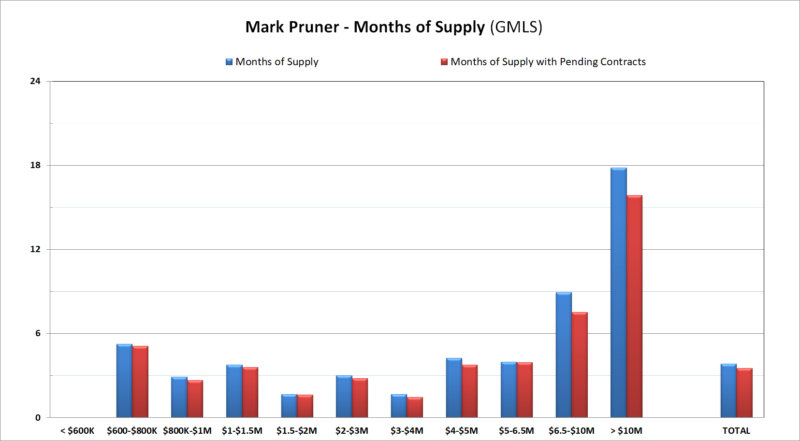

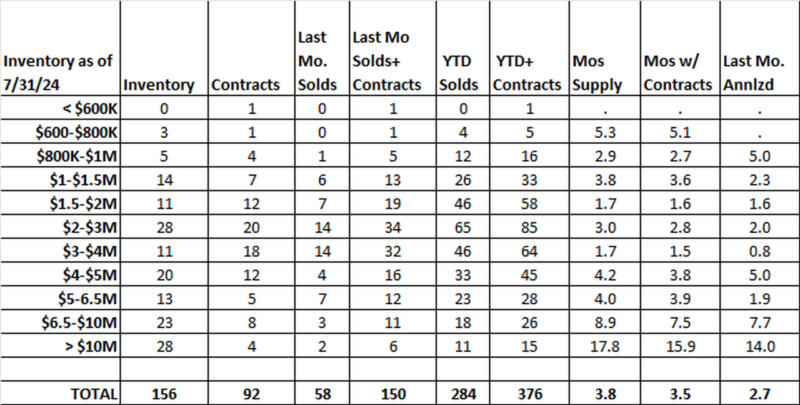

That, however, is history. If you look at today’s market our 58 sales represent 37% of all the listings that we had on the market at the beginning of the market. This means that we are looking at only 2.7 months of supply if you annualize July’s 58 sales. Think about it, if we didn’t get any more supply, we would have zero listings sometimes around October 21st.

We will get more listings on in August, but most sellers will wait until after Labor Day to put their house on the market, which for many of them will likely be a missed opportunity. The best time to put your house on the market is when there is much more demand than there is supply for your house. Many years ago, and pre-Covid, I put on a modest house in mid-country in early March, at the very beginning of the spring market. The leaves weren’t out, and the grass was still brown. The general wisdom was to wait for horticultural spring, when the property would look beautiful. However, three comparable houses that had over-wintered had just sold at very good prices and there were only 3 other comparable houses on the market.

The demand for the house meant it sold for so much over list that it held the record for a couple of years. (To show how much times have changed, two houses have exceeded that over-list percentage in just the first 6 months of this year. (One of those first half.2024 sales was my brother’s listing, that went for 38% over list. (I’d like to say, I taught him that technique, but it was the other around.)).

We are seeing good demand and low, but fortunately, not record low inventory and some fast sales. So August, when everyone is away and you can get a parking spot on Greenwich Avenue, might be a good, albeit a non-traditional time, to list a house. You just have to analyze your micro-market to see.

Of our 58 sales in July 2024, 31 of them went for over list or full list price. Also 29 houses went to non-contingent contract in under three weeks. Of those 29 houses, only 1 went for less than 96% of the original list price. So, should you list in August, our dead month? We have a lot of disappointed buyers. Of those 31 houses that went for full list or over list, many had one, two, three or more unsuccessful bidders in multiple offer situations. They are looking to buy now, and they aren’t all on vacation. It’s a good time to have a good realtor, who knows the market and knows when to break the rules.

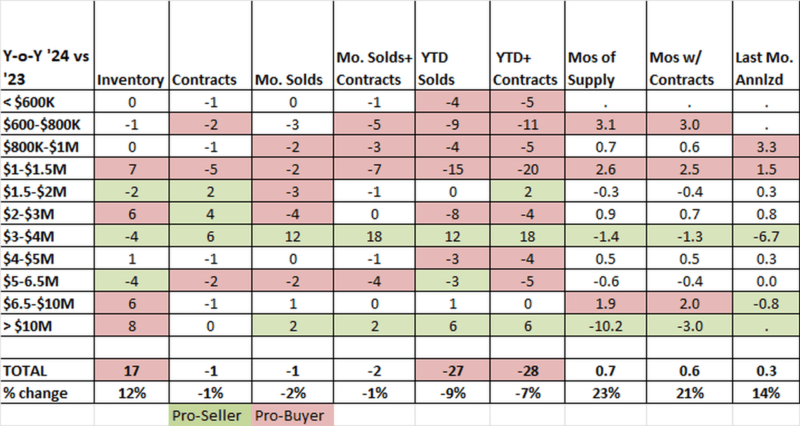

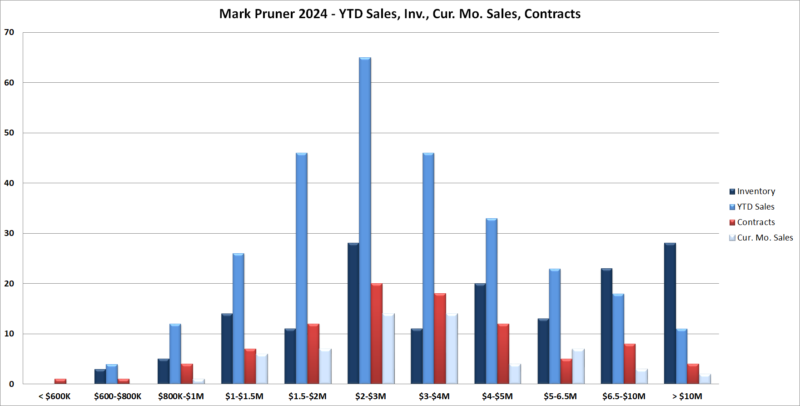

When you look at where the sales are, we have had a good year for sales between $3 and 4 million. It is the only price range where the statistics are pro-seller in every category, lower inventory, higher contracts and higher sales both in July and YTD. We’ve also seen a dramatic drop in months of supply in that price range from 3.1 months of supply in July 2023 to only 1.7 months of supply this year.

Below $1.5 million we have had a horrible year for sales. So far this year, we have only sold 42 houses under $1.5 million. This compares to 74 sales in 2023 and 174 in the first 7 months of our record setting year of 2021. The problem is that we have so little to sell. As of the end of July 2024 we have only 22 houses to sell and only 8 houses under $1 million.

The slightly good news is that last year, we only had 16 listings under $1.5, so we’ve had a dramatic 37% increase in inventory from last year, which some people would point to as a major market turnaround, but it isn’t. It’s only 6 more houses, which doesn’t’ mean that we are seeing a significant turnaround in the market, not markets in parts of Florida, Texas and NYC.

What we are seeing is a market that isn’t getting tighter, and we are even seeing a smidgen of loosening. It is, however, only a smidgen of loosening, If you need to buy a house soon, and you see what you want, go for it. We are not going to see a buyer’s market anytime soon and we will continue to see price appreciation. When houses are selling for full list and over-list, you can be sure that our median sales prices are going up.

In June 2024, our median sales price was $2,727,500. By July, that median price had gone up to $2,865,650 or an increase of 5% in one month. Every if we were to see a rapid reversal in market dynamics, we are not likely to see prices dropping by 5% per month anytime soon.

On the seller’s side the near-term calculation is a little more complicated. We have shortages in all price categories. Even our over $10 million market is seeing major improvements. Last year, we had 28 months of supply over $10 million in July; this year we are down 10 months to only 17.8 months of supply. So now is a good time to sell with limited supply and good demand.

But should a seller wait for prices to go up even more in the next few months? The market looks to have bottomed out and is getting better, so it may be that appreciation slows down even though prices continue to go up. We can also be pretty sure that sales and contracts will fall in October as the uncertainty of the presidential election causes people to wait until the uncertainty is removed. Then again, the Fed is supposed to be lowering interest rates in September. The stock market is hitting record highs and people have more money to pay more for houses.

The short answer is don’t try to time the market. It’s a hard thing to do in the stock market and it’s hard to do in Greenwich real estate. Right now, I’m talking to three families that will be selling at some point. The question is should they sell in 2024, 2025 or 2026. For each family, the better answer seems to be, do what works best for their family and not wait for some incremental price increase. Appreciation, risk, taxes, and black swans all are factors to consider, but you have little control over them, so look to what is best for your family.

Stay tuned, 2024 still has a lot of surprises to come ….

Mark Pruner is a principal in the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com or his office at 200 Greenwich Avenue in Greenwich.