By Mark Pruner

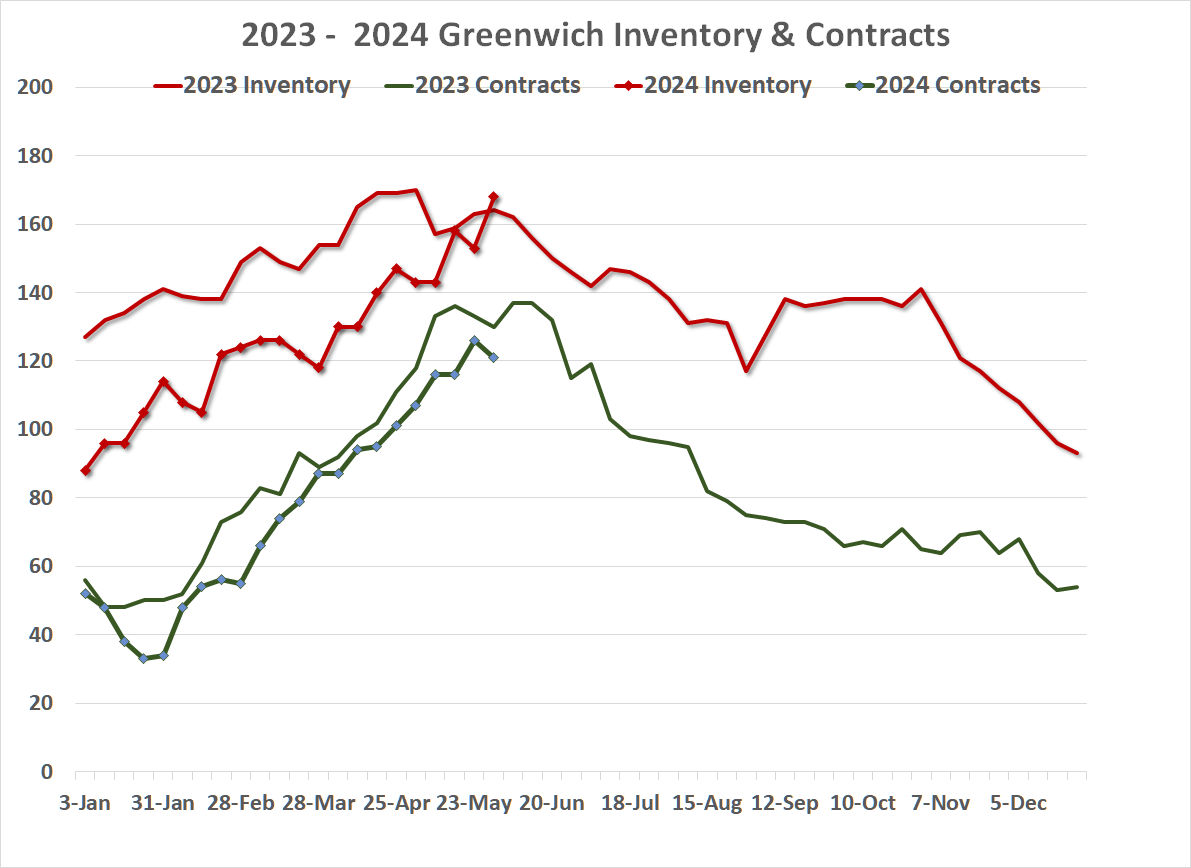

Something really good happened the last week in May and is continuing in June. For the first time in a couple of years, the inventory of single family homes exceeded the inventory for that week in the prior year. At the end of May 2023, we had 164 listings. This year we had 168 listings. I hear you saying, “What’s four more listings out of 168 listings? You are right it’s a measly 2.4%, not the sort of thing that we generally get excited about, but that 168 listings is the cutting edge of rapid acceleration in then number of home listings that we have seen since the all-time record low of 88 listings at the beginning of 2024.

The other remarkable thing is that we don’t normally see inventory reach YTD highs in June. Inventory generally comes on in March and April, goes to contract in April and May and the sales close in June and July. That’s not likely to happen this year. I, and the rest of the Greenwich Streets Team have put on several listing recently and seen them go to multiple offer in days.

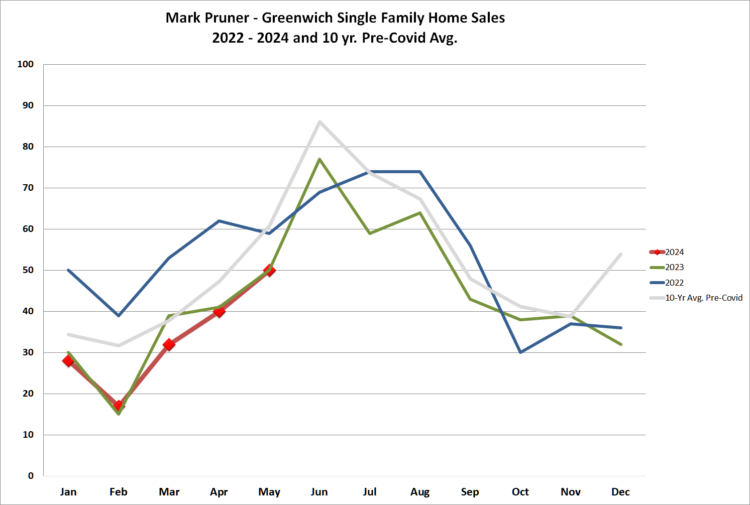

And we are certainly not the only Realtors seeing things go quickly. Of the 50 sales that we had in May 2024, the median days on market was 21 days. This means either a contingent contract went pending (non-contingent) in less than three weeks or the contract was an all-cash deal from when it was signed. Of the 25 sales that went non-contingent in 21 days or less only 7 of the contracts had a contingency.

Of those 7 contracts, only 4 actually probably had mortgage contingencies, as the other 3 went from contingent to pending in less than 6 days. Our mortgage bankers have gotten much better at shortening the time from application to approval and our borrowers are learning to get underwritten pre-approved, so all they need is the contract and an appraisal to get approved, However, I’ve never seen a bank do it in 7 days. Which means that of the 25 sales that went for over list, the seller only agreed to a mortgage contingency in 4 contracts out of 25. If you want to buy a move-in ready house in Greenwich, bring cash.

Another thing we are seeing is the return of the inspection contingency in contracts, when the seller will allow it. Back when I was a full-time real estate attorney in ‘90s, most contracts had a mortgage contingency and an inspection contingency. Now the inspection is done before the contract is signed, so it is not legally a contingency, just the next step in pre-contract negotiations. By eliminating the inspection contingency, the seller keeps control of the deal and can accept a second offer from another buyer willing to pay more even as the first buyer is doing an inspection.

Nothing good every happens for a buyer between the time there is an accepted offer and a signed contract. I’ve heard of buyers with accepted offers taking a vacation and putting off the inspection for two weeks only to find that when they get back another buyer has not only done the inspection but has a signed contract. The rule in Greenwich is that there is no deal until the contract is signed. Most of the buyers who gazump, as the British say, the prior buyer with a second higher accepted offer do pay for the cost of the first buyer’s inspection. (The interesting question is whether the disgruntled and dilatory first buyer will give their inspection to the gazumper who has reimbursed the first buyer.)

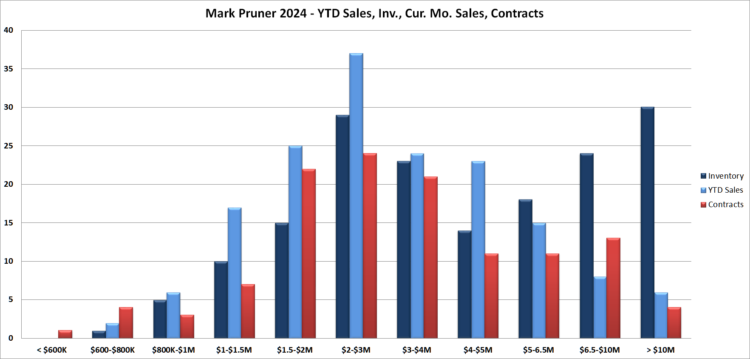

With more inventory comes more deals and our May 2024 sales matched our 50 sales in May 2023. This year’s sales matched last year’s sales with less inventory, so it was a remarkable month. It will be interesting to see what happens with sales in June and July. Our contracts give some indication of that with those also being on a steady upward rise. (OK, they fell last week, but it was Memorial Day week and even buyers and lawyers like to get away, once they have non-contingent contract. 🙂

So, more inventory, more contracts and higher prices too, which looks promising. But that’s what happens when you only have last year’s calendar. Go back to pre-Covid times and our inventory is still down over 77%. At this time in 2019, we had 738 listings and buyers were the ones driving hard bargains. Also, while our inventory is over last year’s inventory, our contracts have yet to exceed last year’s numbers, but then that’s what happens when you have less to sell.

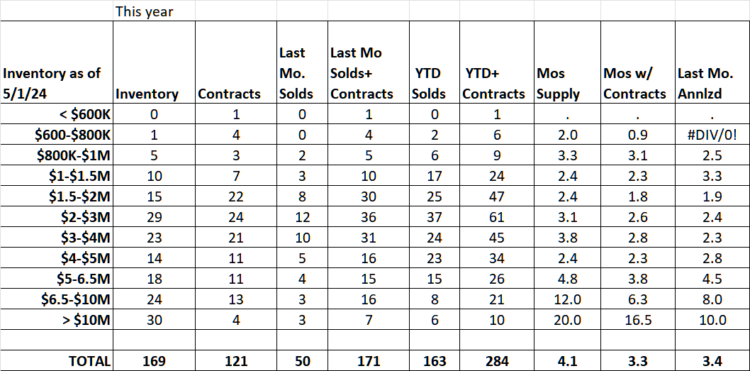

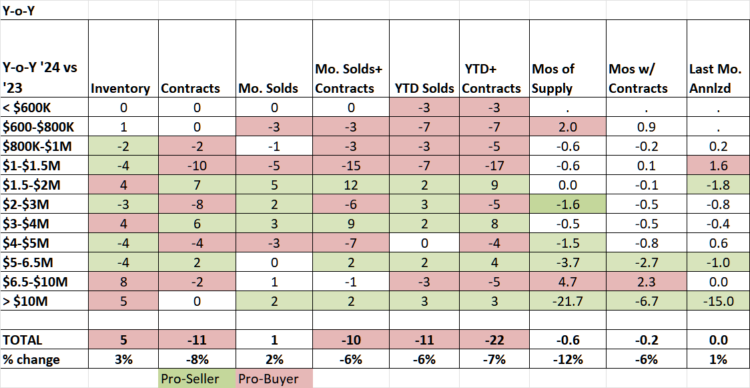

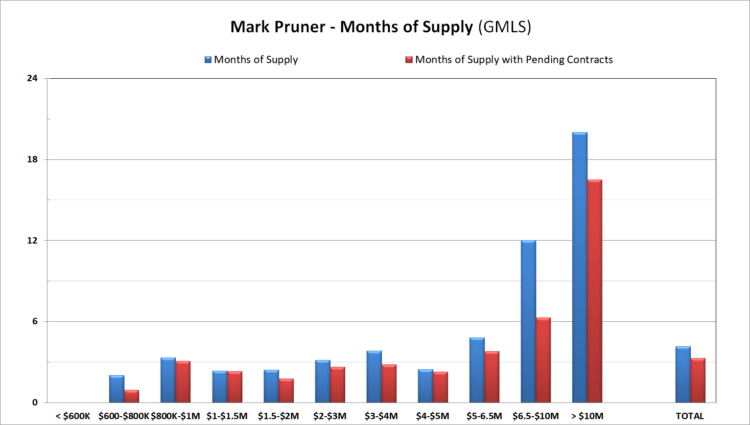

We only have 4.1 months of supply and that is below last year’s 4.7 months of supply. That number is actually not that high for most of the market. Only over $6.5 million, do we see more than 6 months of supply. Over $10 million, we have a 20 months of supply, but throw in our 4 contracts over $10 million and months of supply drops by 3.5 months.

Under $5 million, our market averages a measly 2.8 months of supply, which is a super-seller’s market. Some buyers may see inventory going up and say, I can wait as we will have more inventory coming on and this can only lead to lower prices. It looks like we may get more inventory, but it’s a small fraction of a normal market. We may need a couple of years to get back to any semblance of a normal market. You are not going to see prices drop this year.

Where we do have inventory, our sales are up slightly from last year. Sales over $1.5 million are slightly up from last year, as we have more inventory in 4 of the 7 price ranges over $1.5 million. At the same time, it’s still combat buying below $1.5 million. Sales below $1.5 million are down sharply as limited inventory has limited sales. You can tell the lower inventory is what is leading to lower sales if you look at the even lower months of supply. We’ve got plenty of demand under $1.5 million, we just don’t have much to sell. Under $1 million, you have a choice of 6 houses, with only one under $800K.

Another way to tell we have a tight market, that it will be staying tight is that our months of supply when you add in contracts (and assume they will close in an average of 45 days) are lower than months of supply based just on closed sale. In every price category, our MoS with contracts is lower, which is typical for this time of year, when contracts are increasing while inventory is falling, but this is not a typical year. Our June market has a very good chance of looking much more like an April market, as being the month when we get the most of our new inventory.

Another way to see how tight the market is is that in every price category, we have had more sales year-to-date than we presently have inventory. We are only 5 months into the year and sales are sucking up inventory, but as we saw, inventory is continuing to grow.

What we may be seeing is that we are past the bottom of the inventory drought and that people are once again starting to list their houses, as they move up to bigger houses and downsize to smaller houses and condos as they get older. That “normal” market won’t be happening this year, but it’s nice that seasonally adjusted inventory is finally rising.

In Greenwich, higher interest rates don’t play major role in our market. You can see this by the fact that houses under $1.5 million, where interest rates normally have the most impact, are in high demand. Also, a large segment of our market is downsizers, who have plenty of equity to spend on a new smaller house or condo. Most of these downsizers are not interested in taking on another mortgage payment regardless of how high or low the interest rates are. When the amount of a retiree’s future annual income is uncertain, they are not looking for another monthly payment, especially when they have the equity to pay cash.

Stay tuned and we will see whether we are actually seeing movement back to a more normal real estate market…

Mark Pruner is a principal on the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com.