By Mark Pruner

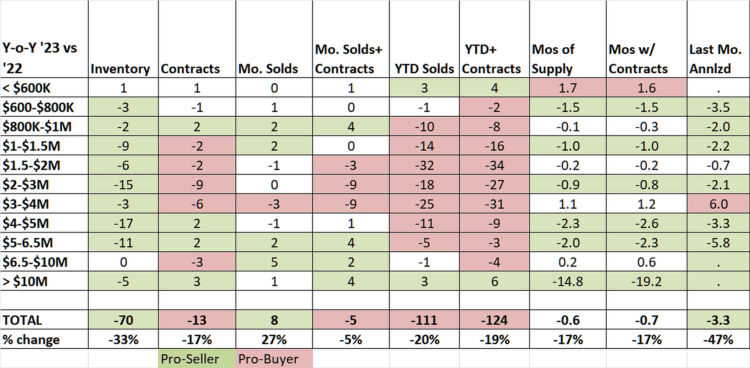

We are seeing small changes in the Greenwich real estate market, which may signal we are headed back to a normal market, but we have a long way to go. Inventory, or the lack of it, has been the main driver of our market since June of 2021. Right now, inventory is down 77% from where it was at this same week in 2019, but for once inventory is not dropping further.

This week in 2019, we had 603 single-family houses on the market. This week we have 141 SFH listings, an all-time record low for this week. Even last year, a year known for extreme shortages of inventory, we had 207 listings or 45% more than we have now. Last year’s inventory was bad, and this year is worse, so what has changed?

For the previous 7 weeks, our inventory has been flat, and last week it actually went up. In a normal year, inventory starts dropping around Halloween and it keeps dropping through the middle of January. For the last two months, that hasn’t happened; it’s been right around 138 listings.

Inventory is a derivative number. It goes up when new listings come on the market, and it goes down when listings go to contract or expire unsold. A flat inventory can, therefore, be either a lack of contract activity leaving listings to accumulare or it can be an uptick in new listings, fighting the the late fall downturn in new houses on the market.

Since our contracts are down, we must be getting more inventory to offset the drop in contracts. However, the number of contracts is itself a derivative number. It goes up when more contracts are signed and it goes down when more houses under contracts are sold and that’s what we saw in October.

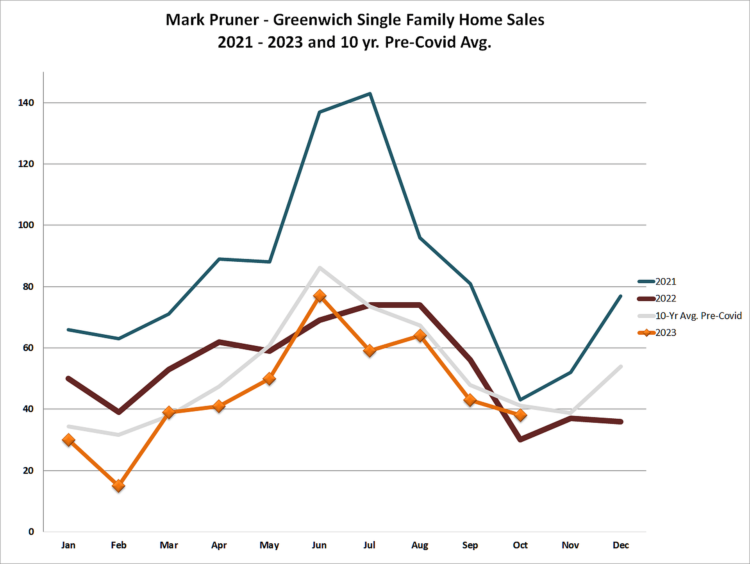

We actually saw higher sales this October than we saw in October 2022. This year we had 38 single-family home sales in October, compared to only 30 sales in October 2022. Sales went up last month even as inventory was down 33% from last year, a pretty remarkable accomplishment. We are squeezing more sales out of what was already a pretty dry orange. Still, inventory hasn’t gone down for two months, a pattern that you just don’t see in September and October. These months are the heart of the fall market, when sales and contracts happen faster than new listings with the exception of a short, post-Labor Day jump in inventory.

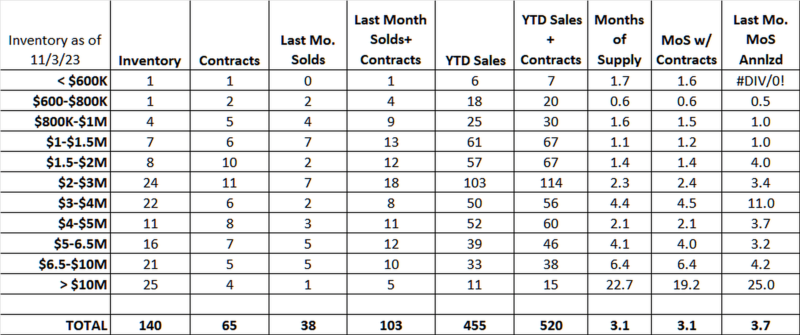

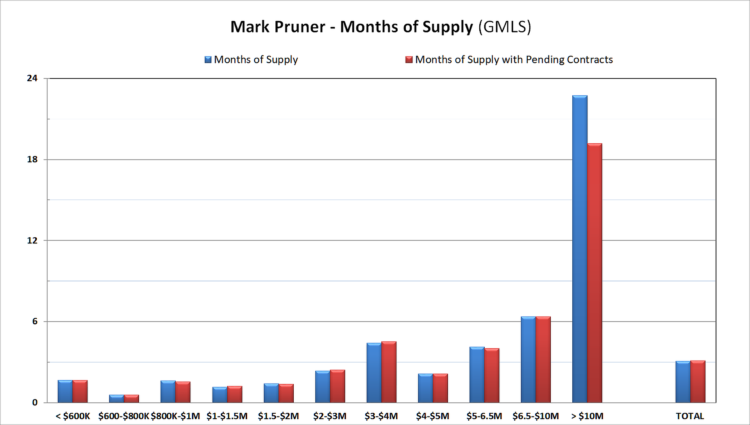

Our inventory is down, pretty much at every price range. Demand has lessened, but the demand drop is under $2 million, the price ranges most affected by higher interest rate. Under $2 million, we are looking at a months’ of supply under 1.6 months. To see really tight, take a look at our market under $800,000, where you have a choice of two listings. At the same time, year-to-date sales are up 100% from last year; from 3 sales YTD last year to 6 sales this year.

At the beginning of a market change, it takes a while for changes to accelerate enough to be noticeable. What we have now is a tick up in inventory when it should be falling and more sales for this October than we saw last October. The uptick in sales is mostly over $4 million. Within the higher price ranges, the most improved awards go to our market over $10 million. So far this year, we have sold 11 houses over $10 million, up 3 sales from last year. We also have 4 contracts for listings over $10 million, up 3 from last year.

Is this actually the beginning of a change in the market? Ask me in December, or even better in January. The Fed’s increase in interest rates acts with a long tail. It takes a while before higher mortgage rates, higher auto loan rates, and even increased credit card rates have affected a significant minority of households. This delay is further exacerbated by household savings cushion that Covid and massive stimulation creates.

Covid resulted in some of the highest savings rates that we have seen in a long time, while inflation and higher interest rates are eating into people’s savings cushions. Some people, especially downsizers, are putting their houses on the market as they look for lower carrying costs as these savings cushions start to get thin.

For many downsizers, higher mortgage rates on a new home purchase are not an issue. These downsizers are sitting on lots of equity from decades of price appreciation. In fact, many of them have so much equity, that if they sell, they will be hit with the 23.8% Medicare capital gains tax for people with over $400,000 of income. If Congress wanted to free up some inventory, they should eliminate that tax for one year. (Then again, they should eliminate the tax applying to a one time sale of a personal residence.)

These older downsizers aren’t going to be taking out a mortgage at any rate, since they have the equity build up to pay cash for that last home. The main thing that higher interest rates do for them is to give these downsizers more interest income on the bonds that they are buying now.

All of the above is derived from a few sales, in some cases, less than a handful of sales, so this could just be a minor bump, but several indicators are performing differently than they did earlier in the year and in 2022. The market continues to be tight at all levels, so the signed contracts go to those buyers that act quickly, and are fully prepared to out maneuver the competition.

To see why this is necessary take a look at our 38 sales in October. Half of them went for over-list or for full list. Of course half of those contracts were signed after 43 or more days on the market or before the beginning of our fall market.

There is a good chance that the Greenwich real estate market is changing, but we are still deep in a seller’s market. If you have a beautiful house in good condition, November might be a good time to list your house. Right now our team is seeing a really busy market on both the buyers and the seller’s side.

If you are thinking of heretical thought of listing in the holidays, It’s all a matter of looking at the micro-market for your house, its competitors, and how fast similar houses are going to contract. For each of those houses that went to contract with multiple bids, there are multiple disappointed buyers and only one satisfied successful buyer. Listing when the buyers are motivated is a good idea.

Stay tuned; the next couple of months are going to be interesting…

Mark Pruner is a realtor with Compass in its Greenwich office at 200 Greenwich Avenue. He is a principal on the Greenwich Streets team at Compass. He can be reached at 203-817-2871 or mark.pruner@compass.com.