By Mark Pruner

Since the beginning of June, we’ve had 76 new listings come on the market and 28 or 37% are either already sold or under contract. That’s remarkably fast. If you want to see really fast of those 28 listings that are off market 11 of them came on, went to contract and closed in less than 42 days. As you might expect, of the fast 11 sold none of them were contingent contracts. All of these sales contract went straight to non-contingent, which means that once the buyer and seller signed the sales contract, the buyer’s 10% deposit, became non-refundable. If the buyer elected not to close, the seller got keep that 10% deposit, which in one case was over $600,000.

As you might expect, 5 of the sales were in Old Greenwich and Riverside our hottest market, however, all of the above is deceptive, in that 10 of the 11 sales were for “Reporting Purposes Only”. This means that the agent sold the property off-market without listing it. The “listing agent” is simply letting her or his fellow agents know what an off-market property was sold for. These off market/off the GMLS sales don’t count in the sales total for agents, but for most of us, they do count in the ego count.

One problem with these sales for Reporting Purposes Only is that they can screw up things like days on market. The average days on market for those 11 post-6/1/23 listings that have already sold is 1 day on market. One listing was on the market for 11 days and the other 10 listings were on for 0 days. Eleven total listings days divided by 11 equals an average of 1 day on market.

Be careful, don’t confuse days on market with time from listing to sale. DOM is the time from listing to the time the sales contract is non-contingent. The actual sales date may be months after the contract is binding, if for example a homeowner wants to stay in their house through the summer.

Overall, for sales in the first half of 2023, our days on market is 33 DOM, which is certainly not an average of 1 day on the market as we have with our post 6/1/23 listings. When the numbers get small or cover only a particular part of the market, what you get are funny numbers, that are not representative of the whole market.

As mentioned, of the 76 listings since June, we had 10 sell off market. The remarkable thing is that prior to June we only had 8 sales off-market in the first 5 months of the year. When you see the number of off-market sales go up that dramatically, it’s a clear sign that the market is heating up.

You would expect that the houses that are selling quicker are the newer houses and that’s true, but you don’t really see that in the numbers. Among our 252 sales in the first quarter, the average house was built in 1949 and hence was 74 years old. Think about it, most people are buying houses that were built before their parents were born. So of course, our inventory is being dragged down by houses that are even older. Well not really, of our 146 listing, the average age is 1944 or 79 years old, only 5 years older than our average sold house.

Well then, there must be a clear distinction between houses that have been renovated and those that haven’t been renovated when it comes to the number of sales. Once again, not so much. Of our 252 sales in the first half of the year, 144 of them had been renovated, which works out to be 57% of the sold houses are renovated. If you look at the 146 houses that we have in inventory 76 or 52% have been renovated. Having a renovated house doesn’t seem to help selling your house, which I can assure you it actually does.

Part of the reason may be that there is no definition of “renovated”. If you take a house down to the studs and redo it, that is clearly a renovation. If you put in a new kitchen is that a renovation; most agents would say yes. If you replace a toilet in a guest bedroom is that a renovation? Yes, it is, but does that mean the house is “renovated”; minds can differ.

Where we do see a clear difference between houses that have sold and houses that are inventory is in additions. Of our 252 sold houses, 22% have had additions, while of our 146 houses in inventory only 11% have had additions. It’s a lot harder to finesse an addition than it is a renovation.

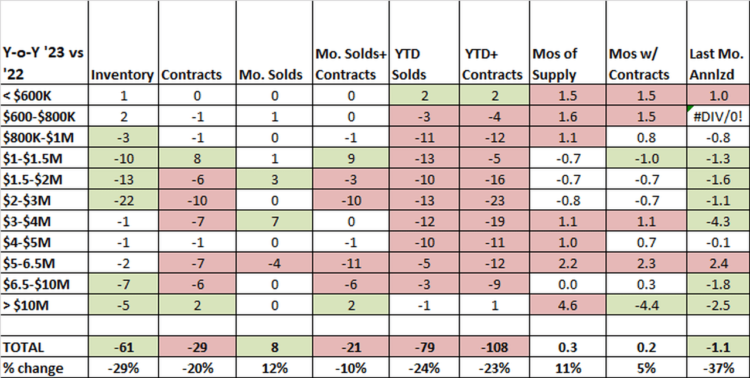

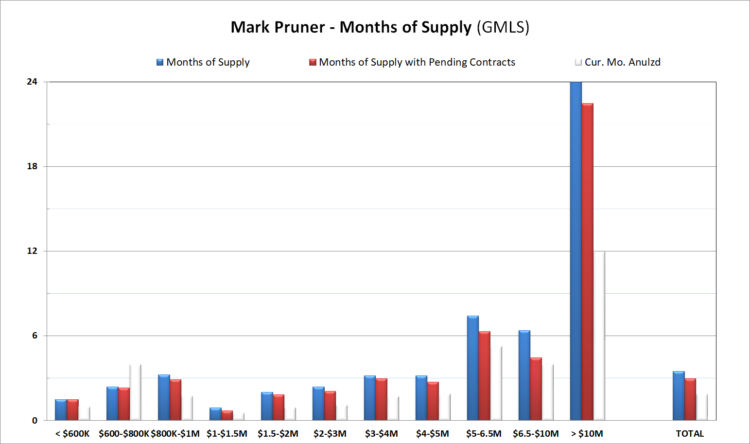

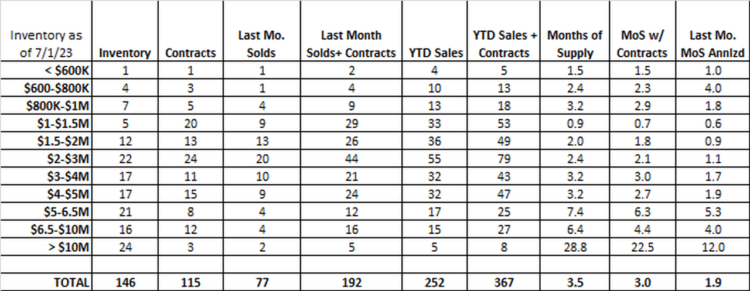

So, the price range must have a big impact on whether a house is selling. It does, but not as much as you might think. If you look at our months of supply, from $1 – 1.5 million we have a remarkable 27 days of supply. In that price range we only have 5 houses in inventory while we sold or have under contract 53 houses.

Having said that, in the last 6 weeks we’ve had 8 houses come on between $1 and 1.5 million. Only 4 of those listings are still active. One was an off-market sale, 2 have contingent contracts and one went straight to non-contingent or “pending” as our MLS software provider insists we call it. (What’s wrong with calling non-contingent contracts non-contingent?)

Under $1.5 million, the market is hot, but so is our $4 – 5 million market where we only have 3.2 months of supply. Under 3 months of supply is what I like to call a super-seller’s market. It’s only over $10 million, where we see more than a year of supply. We have 28.8 months of supply, but if you annualize our June sales over $10 million, we only have 12 months of supply.

Generally, I think that months of supply is a good measure of just how hot a market is. Over 6 months is a buyer’s market, under 6 months is a seller’s market and anything around 6 months of supply is a balanced market. The problem comes when you have very little supply. If you have very little supply, you have very few months of supply and you have a big drop off in sales.

Our sales are down 24% from last year and demand is clearly down too, but if we had more inventory, we’d have more sales, however those more sales wouldn’t be distributed evenly. With more inventory we could see where demand is weaker. Right now, we can only see that we have plenty of demand for the record low inventory that we have.

The good thing is that we are continuing to see inventory come on in July, when sellers normally back off listing as buyers start to take vacations. We have plenty of buyers, so smart sellers are listing in a traditionally slow month for new listings. I’m betting that we will even see owners listing in August, a real rarity. It doesn’t look like this level of demand is going away.

Unprecedented low inventory calls for listing in unprecedented months. So, if you are a seller don’t go to Europe or Nantucket in August, it’s going to be way too crowded, you should list your house. Or do go but list your house first; it’s always a lot easier to show houses and you get more showings, when the listing agent doesn’t have to call the homeowner in residence to show the house. July and August a great time to list house, with much less competition and what should be continuing good demand.

Mark Pruner is a Realtor with Compass. He can be reached at 203-817-2871 or mark.pruner@compass.com