By Mark Pruner

An “Average” Year of Major Ups and Downs

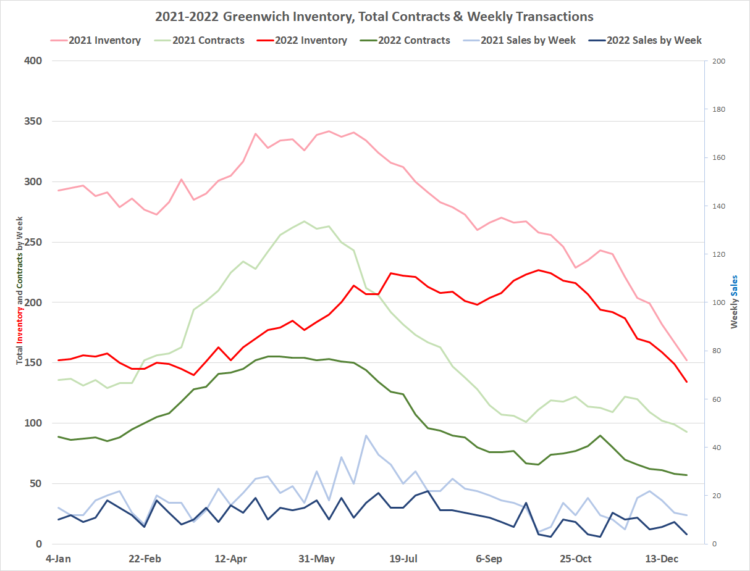

The Greenwich real estate market had an “average” year in 2022. That’s if you consider a wild roller coaster ride of big ups and downs with surprising twists and turns a normal year, because at the end of the ride you end up back where you started. In 2022, started the year with 152 single family home listings and ended the year with 145 listings. At the end there was a only a small drop in inventory from the beginning to December 31, 2022.

Whither inventory?

Of course, by the following day, January 1, 2023, another 11 listings had gone went poof many listings expired at year-end. We started 2023 with the lowest number of listings ever on the Greenwich MLS. Pre-Covid you have to go back to December 1991 for our previous low of 291. (This according to my brother Russ, who was there. Statistics are a family tradition. :).

The average the number of listings at year end over the last 10 years according to my brother, Russ, who has statistics back to 1986 is 480 listings. Inventory is the lifeblood of our market, and we were very anemic all year. The highest our inventory ever got in 2022 was 227 listing in the middle of October. If you go back to our last pre-Covid year, 2019, that year we peaked at 795 listings, i.e., our high number of listings for 2022 was a quarter of the inventory that we had in 2019. Our high for the year, was also 64 listings below our previous low. We are far from average.

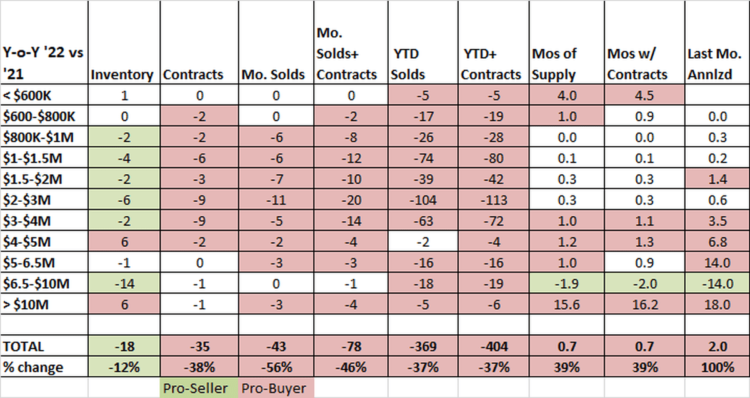

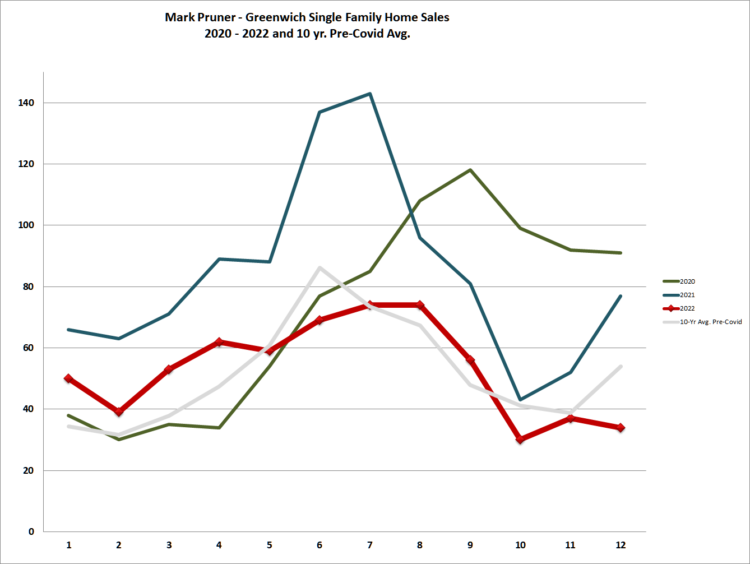

Given our record low inventory for every week last year, for us to get to 637 single family home sales in 2022 was remarkable. When you look at our sales quarter by quarter you can see what happened. We had a good first quarter with 142 sales compared to our 10-year average of 104 sales. The second and third quarters were almost exactly equal to our 10-year averages and then came the higher interest rates and lower stock prices of the fourth quarter. We had 103 sales in our fourth quarter down from our 10-year average of 150 fourth quarter sales.

Of course, if you are really into self-flagellation, which a surprising number of pundits seem to be, you can compare our 2022 sales to our all-time record sales of 2021. If you do that every quarter this year was a dramatic drop from 2021’s 1,006 sales. Or course this is kind like comparing the 1969 Mets, with then Greenwich resident Tom Seaver who won the World Series to the 1962 Mets with Craig Anderson who only won 40 games. Year over year comparisons can be deceptive, when you are dealing with records.

Prices rising

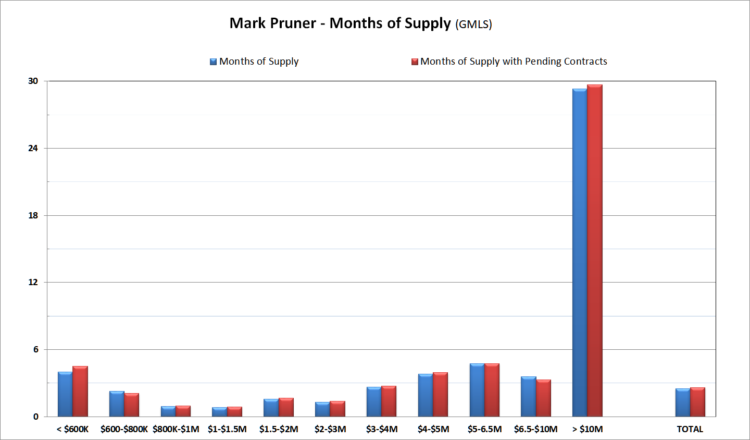

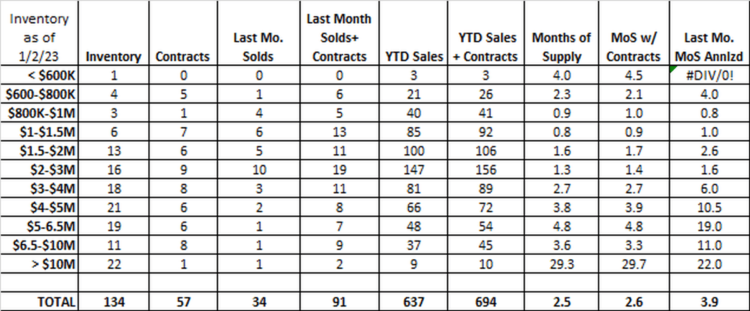

In 2021 our median price was $2.45 million up from $1.87 million at the end of 2019 or a 31% increase. This median sales price was up 6.5% from 2021’s median price of $2.30 million. Our market overall was very tight most of the year with months of supply below the 6 month dividing line between a buyers’ and a sellers’ market. The only weak part of the market was over $10 million where we have a 29.3 months of supply at last year’s sales rate.

The over $10 million market

Our ultra-high-end were down from 14 sales in 2021 to only 9 sales in 2022. What was even more remarkable was how much lower the sales price distribution was in 2022. Of our 9 sales, 8 of them were under $13 million. Our highest reported sale was 435 Round Hill Road that sold for $17.6 million. Our next highest sale was for $12.8 million at 32 Grahampton Lane. What was really dramatic was that so many of our ultra-high-end sales last year were for big numbers; with one sale at $50 million in Belle Haven and another for $45 million in backcountry. In total sales volume over $10 million was down from $272 million in 2021 to $109 million meant a loss of $174 million in sales volume.

Now the ultra-high-end actually did better than that as we did have two off market sales at the high-end. Both sales were in backcountry with one selling for $25.0 million and the other selling for $21.9 million. Interestingly, they were both within a half-mile of each other.

$1 billion less in sales vs. $1.25 billion more

Overall, the town went from total sales of $3.02 billion in 2021 to $1.94 billion in 2022 or a drop of $1.08 billion in sales. Once again, our 637 sales for $1.94 billion in 2022 sales looks pretty good when compared to the 2019, when we had 527 sales totaling $1.25 billion. It all depends on whether you are a glass half-full or half-empty homeowner.

What is clear, is the significant drop in sales in the fourth quarter, as interest rates increased. The greatest effect of the increase in mortgage interest rates was on those sales they don’t use mortgages.

This increase in interest rates attracted billions of dollars from the stock market, sending both markets down and cratering the crypto market. CNBC calculates that the U.S. investor lost $9.5 trillion in wealth. If your $100 million in wealth went to down to $80 million you aren’t likely to buy a $10 million house. However, it looks like 85 families decided to buy a house in the $5 – 10 million price range. For those people, they are probably quite happy with their new asset allocation. Imagine taking $5.6 million out of crypto or Facebook or Tesla and putting it into Greenwich real estate.

Our 85 sales from $5 -10 million with only 30 houses in inventory makes for 4.1 months of supply, still a buyer’s market if you look only at the annual sales rate. Based on December’s sales, we have 14 months of supply from $5 – 10 million. The high-end buyers look like they are being even a little more conservative, if you drop down to the next price range, our 66 sales from $4 – 5 million is only 2 less than we had in the stellar year of 2021.

The other thing that is clear is that the demand above $3 million has dropped significantly. If you take our 34 sales in December and annualize them by price range, you see a very bifurcated market. Above $3 million the annualized months of supply jumped. If you are in the higher price ranges, now is a good time to consider a price reduction.

The increased interest rates hurt investors and hence our high-end market, but why didn’t it crater our sub-$3 million price range. In fact, you would think that the increase in interest rates would have had their greatest impact on our under $1.5 million market, but it didn’t. Properties under $1.5 million continue to sell like hotcakes. At the present time we have a total of 14 listings on the market under $1.5 million. At the same time, we have almost as many contracts for listings under $1.5 million. Of the 13 contracts for listing under $1.5 million, many of them are probably selling for over list.

So why didn’t these sales drop. The monthly mortgage payments are definitely up a lot. The short answer is that unlike in prior years, most of our under $1.5 million buyers are not using mortgages, or expressed more precisely, they are not using mortgage contingencies in their contracts. These buyers either have the cash or were willing to waive the mortgage contingency protection in their purchase agreement in order to get a negotiating advantage over other bidders.

Half the 2022 sales were over list or over list

The first part of the year was arguably, the most competitive market we had ever seen with “months” of supply measured in weeks. Of our 637 sales last year, 224 sales or 35.2% went for over list with 56 going for 10% more than list. Another 101 went for full list price, meaning more than half of all sales in 2022 went for full list price or over list price.

And, it wasn’t just the percent over list price, some of the dollar amounts over list were stunning. Russ and I sold 113 Woodside Drive in Milbrook for $638,000 over list price after 8 days on market in April. We thought we’d done pretty well. It only took 3 more weeks before 432 Field Point Road went for $765K over list. The record for the year was 34 Beechcroft, which was listed for $10,175,000 and went to contract 18 days later and closed at $11,900,000. Our sale ended up coming in sixth for most over list.

December 2022 sales

Of our 34 sales in December, 10 of them or 29.2% went for list or over list. Of those 10, all were between $950K and $4.0 million. Under $1 million we have very little to sell. Above $4 million our market is pretty balanced or becomes more pro-buyer as you get higher in price. What is not balanced is our inventory. Our median price for the listings presently on the market is $4.4 million. Think about that, half of our inventory is over $4.4 million, while only 10% is on for less than $1.5 million. We actually have more listing over $10 million than we have under $1.8 million.

So, what about 2023?

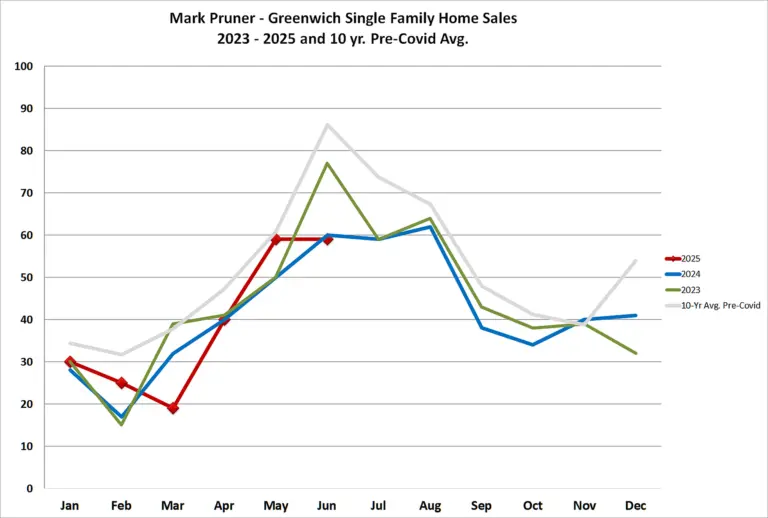

If anyone tells you they know what is going to happen in Greenwich real estate in 2023, there is a good chance that they’ve been smoking some of our newly legalized cannabis. Between, inflation, the Fed, interest rates, the Russian war, and Covid in China, the future is highly variable. I’d be shocked however if inventory get’s back to anything like normal this year. While demand is down, our inventory has been down even more.

I do expect that we will see more inventory than we saw in 2022. If we get more inventory under $3 million, we are very likely to have more sales in that price range. Also, if we get more inventory, we may get even more inventory as gridlock lessens. Right now, we have a bunch of owners that would like to sell, but they don’t have anywhere to go. If we get more inventory, these potential sellers will have something to buy and can put their house on the market. As a result, it’s possible that inventory could rise quickly, but we still have a long way to go to get to anything like our traditional inventory levels.

As a result of our record low inventory, prices may well continue to rise, particularly under $3 million, as we are supply constrained. At the same time, many sellers, particularly, at higher prices need to look at today’s market to see if they are competitively priced.

Stay tuned ….

Mark Pruner is a Realtor with Compass. He can be reached at 203-817-2871 or mark.pruner@compass.com