By Mark Pruner

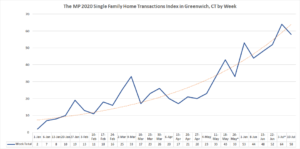

As of the middle of July, we have had 287 single family home sales in Greenwich. Of those sales, 44 or 15.3 percent went for list or over list price. Many of these, and others that sold for under list price were multiple bid situations. Many of these transactions were pre-Covid and you can expect that the percent of list and over list deals will go up (I’m working on one now).

Our contracts only really started to accelerate in the second week in May with slow 23 transactions, sales and contracts, to 33 contracts in a week. Last week we had 58 transactions, down slightly from 64 transactions the previous week, when the Gold Coast conveyance tax increase kicked in on July 1. The large percentage of those 58 transactions were contracts being signed.

The other interesting thing is where these lists and over-list contracts are. If you read my neighborhood report last week, you can predict where the competitive sales are. They are in the hot neighborhoods. Old Greenwich, Riverside, and Glenville are seeing their fair share of over- list activity. Mid-country and Cos Cob are seeing hot sales and the” backcountry is back” area is also seeing over-list activity, while we’ve yet to see this in Byram and Pemberwick.

What’s really remarkable is the number of outstanding contracts we have. As of 7/14/20 we have 198 contracts which is an amazing number when you consider that last year that number was around 99 contracts. This is a 100 percent Covid-driven increase. You can be sure that many of those 198 contracts went for list or over list. The market is hot and so far is only getting hotter with each passing week.

On the inventory side, we are getting new inventory, but it is going off fast also. We presently have 566 listings; this is down from 640 listings as of the end of July 2019 for a drop of 12 percent. We had been done down about 20 percent in inventory, so only 12 percent down is an improvement, but some price ranges in some neighborhoods are very much combat buying.

I have spoken to several of our longest serving agents – in some cases their tenure goes back 40 years – and they say they’ve never seen a market like this. Not after 9/11, not in the go-go years of the 80s, nor in the bubble years of the digits decade. This really is an unprecedented time.

Being the Winning Bidder in a Multiple Bid Situation

So, how does a buyer get an advantage in a competitive bidding situation in a tight market? The short answer is to be better prepared than your competition and move faster than they do.

Build a Team Early

Everyone knows to get a good Realtor when they buy a house, but you will need other professionals too. If you are going to need financing, talk to a mortgage broker or banker early, even before you start looking. Meet with them and build a relationship. Very few financings are pro forma today and you’ll want a banker who will go to bat for you to move the process along.

Most buyers don’t think about a real estate attorney until after their offer has been accepted. Be prepared and find your attorney early. Let him or her know your level of experience and that you’ll probably need a quick turn around on the contract rider.

Building inspectors can also be a big help. Once again, speed can be crucial. In a competitive bidding situation, you may only have a day or two to inspect the property. The only thing worse than coming in second in a bidding war is winning war only to get a house with problems. The top capital gains tax has increased and there is an additional 3.8 percent Medicare tax on gains. The rules are complex, but if you have a significant gain in your present house, you may face a bigger tax bite than you thought. If you are selling your own house and you need the funds from that house to close, consult a tax attorney or accountant now to see just how much the taxman taketh and ways to minimize that take.

Tactics

First, relax. You’ve got a team of advisors if things get difficult. You’re better prepared than most of your competition. Second, have your mortgage broker or banker pull your credit and check for any problems. Get not only pre-qualified, but pre-approved and not just pre-approved, but under written pre-approved. What this means is that the bank has done everything necessary to approve your loan for a house except the appraisal on the house. A pre-approval letter and shorter mortgage contingency goes a long way when bidding against someone who only has a pre-qual letter. Also, the beginning of the process is the time to fix your credit score rather than when your entire loan hangs on getting your credit score a few points higher.

If there is some way you can do an all cash purchase great. An all cash offer in a competitive bid situation can move you to the top of the list and often reduce your purchase price by $10,000 to $20,000 for deals under $1,000,000 and by as much as $50,000 or more for deals under $2,000,000. Consult with your team before you do this.

You may want to make an all cash offer even if you are going to finance the house later, to free up cash after the purchase. Post-purchase refinancing can be tricky and may affect your taxes, so check with your accountant or tax attorney before you pursue this path. And, the time to do that is before you saddle up and go looking for your dream house.

Also, a high price is good, but if you want to be in your new house in two weeks and the sellers can’t find a new place and arrange a move for two months, your higher, all cash offer may be DOA. You want to match your other terms to your seller’s needs

Third, be available. If you are a couple and one of you can’t always take phone calls, what about email or texts? Whenever possible, whoever is most available should be able to make decisions for both. Discuss various options in advance so you are both comfortable with this. Also, putting in a bid and going on vacation or a trip is a not optimal. Often, an hour or two or even minutes can make the difference in whether you get the house. Making decisions and responding in minutes gives you a big advantage over the competition that can’t get back to the seller until tomorrow.

Fourth, be flexible and reasonable. Don’t let a minor deal point or an item worth a few hundred dollars become an ego issue. Work with your team to come up with other options, particularly when the other side is being unreasonable. Don’t yell and scream. The seller has lived in your house-to-be for years and knows all your new neighbors. You want to arrive in their good graces.

Fifth, be human. Let the seller know why you like their place and what it will mean to you and your family to live there. Also try to connect with each person you deal with; don’t become just another case number.

Lastly, have fun. How often will you get to do this? With a good team you’ve got people to talk with. Even if you lose out the first time around you will have gained valuable experience. You will get a house and often a better house at a better price.

A call for a welcoming Greenwich

I’ve been dealing with a lot of Covid refugees who are going through the ups and downs of buying a house in a tight market. Many of them are scared of moving to Greenwich. Often, they have lived in New York City for decades and really don’t know what to expect. What will it be like for their kids? Will they be able to go to a school here? Will people from Greenwich look down on them? Where do they shop for those specialty items they love? Will there be dangerous wildlife in their backyard? We are all in this together and if you see someone that looks a little unsure of themselves you might ask if you can help. If you get a new neighbor introduce yourself or just drop a welcoming note in their mailbox.

Let’s make it as pleasant as possible for everyone and having a little fun along the way would be nice too.

Mark Pruner is the Editor of the Real Estate page of the Greenwich Sentinel. He is a sales executive at Berkshire Hathaway in their Greenwich office. He can be reached at 203-969-7900 or at mark@bhhsne.com.