By Mark Pruner

How to Be the Winning Buyer in a Tight Greenwich Market

How to Be the Winning Buyer in a Tight Greenwich Market

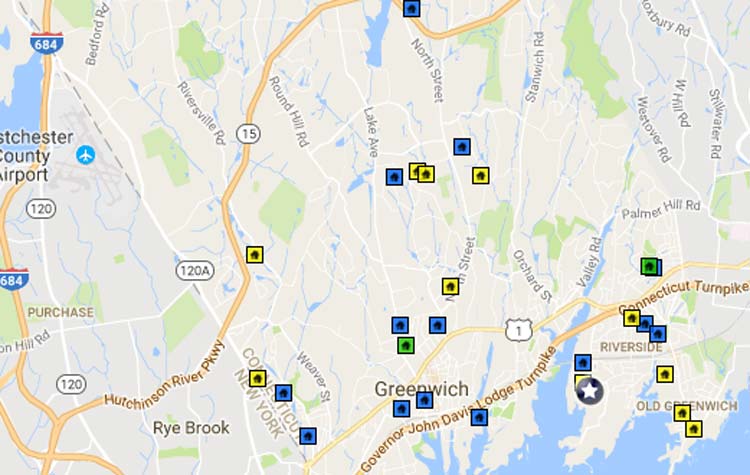

So far this year, we have had 180 single family homes go to contract or been sold. Of those 180 transactions about one-sixth have either sold for list price or more or been on the market for less than a month. Now you would think that these properties were our lower priced properties, but the price distribution matches our sales distribution fairly well. Eight of the 29 properties were priced less than $1M, 13 were from $1 – 2M and eight of the properties were priced over $2M. So a well-priced, desirable property can sell quickly at any price.

So how does a buyer get an advantage in competitive bidding situations or a tight market? The short answer is to be better prepared than your competition and then use that preparation to move quickly.

Build a Team Early

Everyone knows to get a good Realtor when they buy a house, but you will need other professionals too. If you are going to need financing talk to a mortgage broker or banker early. Meet with them and build a relationship. Very few financings are pro forma today.

Most buyers don’t think about a real estate attorney until after their offer has been accepted. Be prepared and find your attorney early. Let him or her know your level of experience and that you’ll probably need a quick turn around on the contract rider.

Building inspectors can also be a big help. Once again, speed can be crucial. In a competitive bidding situation you may only have a day or two to inspect the property. The only thing worse than coming in second in a bidding war is winning it and getting a house with problems.

The top capital gains tax has increased and there is an additional 3.8% Medicare tax on gains. The rules are complex, but if you have a significant gain in your present house, you may face a bigger tax bite this year. If you are selling your own house and you need the funds from that house to close consult a tax attorney or accountant to see just how much the taxman taketh and ways to minimize the take.

Tactics

First relax you’ve got a team of advisors if things get difficult. You’re better prepared than most of your competition.

Second, have your mortgage broker or banker pull your credit and check for any problems. Get not only pre-qualified, but pre-approved. A pre-approval letter and shorter mortgage contingency goes a long way when bidding against someone without one. Also now’s a good time to fix your credit score rather than when your loan hangs on getting a higher rating.

If there is some way you can do all cash great. An all cash offer in a competitive bid situation can move you to the top of the list and often reduce your purchase price by $10,000 to $20,000 for deals under $1,000,000 and by as much as $50,000 for deals under $2,000,000. Consult with your team before you do this. Refinancing later can be tricky and may affect your taxes.

Third, be available. If one of you can’t always take phone calls, what about email or texts? Whenever possible whoever is most available should be able to make decisions for both. Discuss various options in advance so you are both comfortable with this.

Fourth, be flexible and reasonable. Don’t let a minor deal point or few dollars become an ego issue. Work with your team to come up with other options, particularly when the other side is being unreasonable. Don’t yell and scream. The seller has lived in your house-to-be for years and knows all your new neighbors. You want to arrive in their good graces.

Fifth, be human. Let the seller know why you like their place and what it will mean to you and your family to live there. Also try to connect with each person you deal with; don’t become just another case number.

Lastly, have fun. How often will you get to do this? With a good team you’ve got people to talk with. Even if you lose out the first time around you will have gained valuable experience. You will get a house and often a better house at a better price.

Mark Pruner was the #1 Connecticut agent for Douglas Elliman in 2015; mark.pruner@elliman.com, 203-969-7900.