By Mark Pruner

Dashboard Editor

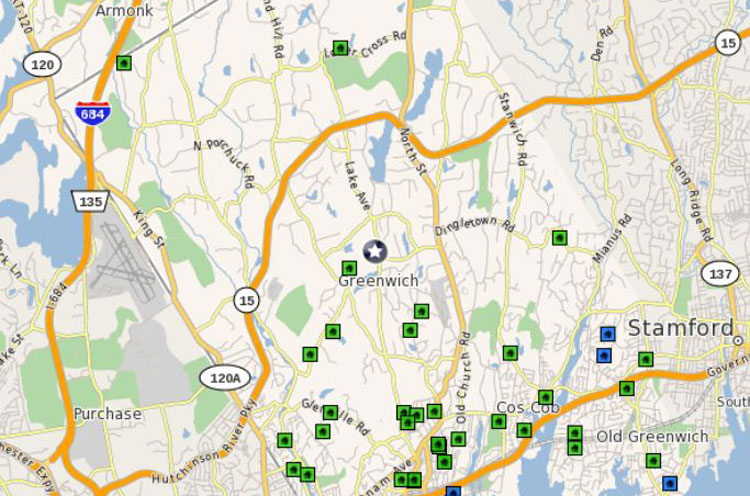

If there is one thing the market dislikes, it’s uncertainty. Regardless, all the international turmoil hasn’t seemed to have a significant impact on the Greenwich real estate market. The warm weather that we’ve had, with the exception of last week’s big storm, brought out buyers.

If there is one thing the market dislikes, it’s uncertainty. Regardless, all the international turmoil hasn’t seemed to have a significant impact on the Greenwich real estate market. The warm weather that we’ve had, with the exception of last week’s big storm, brought out buyers.

So far this month we’ve had 23 sales. In 2013 we had 27 sales for the entire month and in 2015 we had 28 total sales. Our 10 year average is 39 sales, but more recently January has not been a great sales month (with the notable exception of 2014 with 53 sales ~ an anomaly because of tax chnges).

So despite all the stock market turmoil, we’re not that far off of normal.

A better indicator of market activity is the number of outstanding contracts, of which we presently have 69. We’ve been holding at around 70 contracts for the last couple of months, which for this time of year is a good number of contracts.

I was talking to Jay Couillard at Citizens Bank and he said there are lots of requests for preapprovals so buyers are out there.

Now, were it not for the stock market and the crisis in the Chinese economy, we would likely be doing better, but the rapidly falling gasoline prices are a also big plus for the north east economy. (I was looking at listing a high-end waterfront in New London County recently and there you can find gas for $1.85 per gallon.)

Foreclosure By Market Sale

The Connecticut legislature gets its share of grief for passing a series of laws and tax increases that have not helped the Greenwich real estate market. However, one law they did pass that went into effect last year was foreclosure by market sale. This adds a third type of foreclosure method which is much better for the homeowner.

In Connecticut there have been two types of foreclosure. One was strict foreclosure where the property was significantly underwater. In that case the court sets a law date and anyone can show up and buy it on that date. Given that the property is significantly underwater the senior lien order holder usually gets it for the price of the mortgage.

The other option is foreclosure by sale where the property is auctioned off in the front yard. This process often results in a low ball sale, because the buyer has to come up with cash to pay for it in a very short period of time.

Effective last year the Connecticut legislature came up with foreclosure by market sale where the property may be offered for sale by a broker for a period of time.

The most important part of the law is that the bank does an appraisal at the beginning of the process so that the seller and bank know what the sale price should be. The result should be that the property sells much closer to fair market value.

The bank gets more money and the owner might get some equity. Overall the process should run more smoothly.

The problem is that banks are not taking advantage of this option. The bank has to consent to a foreclosure by market sale and it appears that they’re not doing that – preferring instead their own tried and true short sale process.

The law requires that the bank notify the owner that this process exists and both parties have to agree, but so far Connecticut is not getting large, or even smaller banks to go along with this inventive new law. The law was also envisioned to allow owners to go to banks and propose a FBMS, but banks, like buyers, dislike uncertainty.

If you think it’s a good idea for your situation, give let’s give it a try. There always has to be a first case.

Mark Pruner is with Douglas Elliman in Greenwich, CT.

Mark Pruner, Realtor

203-969-7900

mark@greenwichstreets.com

www.greenwichstreets.com