By Mark Pruner

Sentinel Columnist

2016 was a pretty good year for Greenwich real estate. In most price ranges in most areas of town sales of properly priced properties moved along nicely. The total volume when all is said and done looks to be pretty close to what we had in 2014 which was a very good year for Greenwich real estate. We had 700 sales of single family homes in 2014 and we should be close to that number this year.

2016 was a pretty good year for Greenwich real estate. In most price ranges in most areas of town sales of properly priced properties moved along nicely. The total volume when all is said and done looks to be pretty close to what we had in 2014 which was a very good year for Greenwich real estate. We had 700 sales of single family homes in 2014 and we should be close to that number this year.

Our condo sales were up significantly so when you look at the total market we should be up slightly. This is the new normal of a market moving steadily ahead with the occasional speed bump here and there.

OG, Riverside et al

Oh Greenwich, Riverside, Cos Cob, Glennville and central Greenwich did particularly well this year. Sales of properties from $800,000-$2 million also did well starting early in the year and continuing throughout the year.

The High End

When you look at the income pyramid of potential buyers for a property at narrows sharply at the higher incomes and we have seen that reflected in sales the last couple of years in Greenwich. The high income people did change this year from last year in real estate investment in the area north of New York City. Both in Westchester and in Greenwich we saw distinctly slower sales at the high end. In Greenwich the high end started above $6.5 million for much of the year. The high-end buyers didn’t go away they just shifted to the $5 – 6.5M range which did distinctly better this year. The nice thing is that based on some contracts and private sales the high-end market is doing better in the last six weeks.

This is is a trend that we also saw last year with high end sales shifting to year end. This bump up in sales at the end of the year however was not enough to make up for a significant drop off in high-end sales.

The Misunderstood Backcountry

This drop off in the high-end price range was also related to the weakness in sales in the backcountry where about half of our high end inventory is located. The demise of the back country however is greatly exaggerated. Sales of properties under $3 million continue to do about as well in the back country as they do in other parts of town. Unit sales in the backcountry have been about the same while sales volume is down significantly due to slow sales of the ultra-high end.

Downsizers Love Greenwich

One trend we did see in 2015 was a big jump up in down sizers moving to Greenwich. Most of these downsizers are coming from Westchester County. As has happened for decades they are moving to Greenwich for the lower property taxes. In many towns in Westchester property taxes are triple what they are in Greenwich.

When you are getting very good compensation every year much higher taxes don’t seem to be a bad trade-off for a significantly larger house for the same price as a Greenwich house. However, once you retire and have to pay for those huge taxes out of your retirement savings they get old pretty quickly. With more equity build up allowing for bigger down payments here in Greenwich moving for many Westchesterites has never looked so good.

Rollercoaster Sales that Weren’t so Bad in Retrospect

When you look back from the end of the years things seemed smoother than they actually were. Months to months sales were a roller coaster and when things start heading in one direction you are never sure when they will return to the new normal.

We had two record months, February where we had 41 sales and September where we had 63 sales compared to a nine-year average of 29 sales and 45 sales for those months. The jump up in sales in February was related to fears of higher interest-rates. We saw surprisingly decent activity given some of the worst winter weather we’ve had in decades in the first quarter of this year. Once it became apparent that interest rates weren’t going to jump up sales slowed down for the next couple of months.

The other big factor moving sales around from month-to-month was the implementation of the new mortgage rules. We had a near record June followed by a poor July and August as buyers, attorneys and bankers moved sales into June to avoid the new TRID mortgage regulations that were to go into effect on July 1. That date was changed to October 4 and as a result we saw a repeat of the up then down roller coaster with record monthly sales in September as people tried again avoid these cumbersome regulations and significant uncertainties as too procedures.

As with the rest of the nation sales in November were noticeably slower but by December they had recovered to our nine your average though still below the two big year end jump ups that we saw in December 2013 and 2014.

Contracts at Year End Looking Good

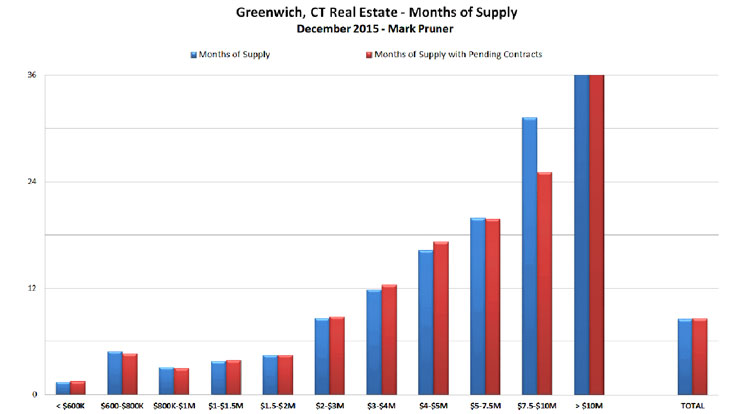

Our pending sale contracts looked good by the end of 2015 with 70 contracts outstanding. Our month of supply looked a little poor at the beginning of the year of 2016 compared to January 2015 primarily because we had 27 more listings on the market this year than we had last year at the beginning of the year.

Early Listings and Early Sales?

When you look at the raw numbers $1 million-$3 million continues to be the heart of our sales market. We have particularly good sales between $1 million and $2 million and low inventory throughout the year. This price range in the first quarter of 2016 is due close attention as I and several agents I know will be putting on listings early given the mild weather from El Niño. The question is what will demand be like given the increase in the fed funds rate by the Federal Reserve. While this is only a small amount increase, and curiously mortgage rates actually fell a tiny bit since, it’s clear that the bottom has been passed and interest rate are going to be going up. I expect an early and busy spring market.

When you look at the raw numbers $1 million-$3 million continues to be the heart of our sales market. We have particularly good sales between $1 million and $2 million and low inventory throughout the year. This price range in the first quarter of 2016 is due close attention as I and several agents I know will be putting on listings early given the mild weather from El Niño. The question is what will demand be like given the increase in the fed funds rate by the Federal Reserve. While this is only a small amount increase, and curiously mortgage rates actually fell a tiny bit since, it’s clear that the bottom has been passed and interest rate are going to be going up. I expect an early and busy spring market.

Private Sales Down Between the Bookends

The other thing that we saw in 2015 were fewer private sales. Private sales play a significant factor at the lower end and the very upper end. About a quarter of our sales are done privately under $800,000 and about and about 40% of our sales over $10 million are done privately. Between these two bookends only about 7% of the properties were sold privately in Greenwich. Overall we were down about 4% in private sales for 2015.

The 1st Quarter of 2016

Going forward into 2016 we should see more inventory coming on and more sales as many buyers that have been somewhat diffident get booted into action by the likelihood of higher interest rate. We also have an election year coming up so you can never count out Washington. Election years tend to be good for sales in Greenwich as no congressman wants to be seen as doing something that would hurt the economy. We certainly saw that in the record budget giveaways by both parties in the great compromise budget.

$1 – 2 Million

Strong sales between 1 million and $2 million are likely to continue and if we have a more positive election year economy expect months of supply over $4 million to come down significantly. We have already seen a few hints of that at the end of the year.

Riverside

Riverside south appears to be the new hot area taking away Old Greenwich’s south of the village’s title but if you’re buying in that area you still want to come prepared to take quick action and be able to finance your purchase quickly.

New Construction

The other thing last year has shown and I expect to see gather more steam in 2016 is the construction of new spec homes and buyers building their dream houses. New houses sell at a 15 to 20% premium over the average here in Greenwich so builders are motivated to build and banks are starting to provide appropriate financing too many of the construction firms that were previously considered undercapitalized.

Black Swans

You can never count out black swan events but we should see a steady improvement and the first quarter should be better given the warm weather, so Happy New Year to the Greenwich real estate market.