By Mark Pruner

Plus, Sniping Prevention, Gridlock and LTCGs

The Greenwich real estate market is not like most of the rest of the U.S. The median price for a single-family home in the U.S. was $453K in August of this year. Connecticut as a state has a similar median sales number with SFH’s going on average for $508K. This is actually up rather dramatically in the latter part of this year. As recently as March of 2024, the national median and the CT median were essentially the same at $435K.

Since March 2024, the U.S. median house price is up 4.1%, while statewide Connecticut house prices are up 16.8% according to a Redfin report. Compare those medians to Greenwich where our median SFH sales price was $2,850,000 or 6.3 times the national median and 5.6 times the Connecticut median. With sales prices that dramatically higher, you’d be right if you suspected that Greenwich reacts a little differently to the Fed dropping the Fed Funds rate by 0.5% and lower mortgage rates.

Not many buyers actually use mortgages in Greenwich

Back in the 1970’s, about two-thirds of house purchases in Greenwich had mortgage contingencies. In 2024 YTD, 119 of our 347 sales on the Greenwich MLS have had contingencies, which is 34.3% of all home sales.

So, the number of mortgage contingencies is down by half, but is it really? When you look at the time between when the contingent contract is signed and the time that it goes “pending”, which what our FlexMLS software calls a non-contingent contract, 47 of those 119 contingent contracts went to pending in 10 days or less.

We have some really good mortgage brokers in town, but it’s rare to see a mortgage contingency lifted in less than 10 days. These short-term contingencies are usually non-mortgage contingencies, such a correcting a title issue, or waiting for radon or water test results to come back, or any of several other reasons. Some of these “contingent” contracts may even be inspection contingencies, at least one of which was my buyer.

This is way that we used to do contract back in 80s when I was a real estate attorney. Most contracts had a 10-day inspection contingency and a 45-day mortgage contingency. These contingencies transferred control of the deal from the seller to the buyer, since the seller was bound, but the buyer could exercise either contingency and call off the deal.

By the 90s, sellers had gotten smart and made the buyers do the inspection, before signing a contract. This way the seller could continue to entertain offers from other buyers until the contract was signed. In Greenwich, the rule is that there is no deal until the contract is signed. This means that a buyer wants to get to contract as soon as possible, lest the seller accept a better offer from another buyer.

Is another buyer looking to snipe your deal?

Buyers and their agents should monitor, just what the seller’s agent is disclosing about the contingency provision. Once a contingent contract is signed, the GMLS requires the seller’s agent to change the status of the listing from “Active” to “Contingent” within 24 hours or get fined. As a result, agents nowadays are good about keeping the status up to date.

Unfortunately, 13 of our agents put in the wrong contingency date this year. Instead of putting in the date the contingent contract was signed, they are putting in the date, the contingency expires. This is very helpful to some buyers that are looking to snipe a house from the first buyer. By knowing when the contingency is about to expire, the second buyer knows just when to present a better offer, to entice the seller not to extend the contingency date, leaving the seller free to contract with the second buyer and the first buyer out in the cold.

If you are a buyer or a buyer’s agent, you want to make sure that the seller’s agent put in the contract signing date, not contingency expiration date. Right now, four of our contingent contracts on the GMLS are showing the contingency expiration date, leaving buyers in that deal open to sniping.

Who takes out mortgages in Greenwich?

But what does all that have to do with mortgage rates in Greenwich? What we find after taking out the 47 short contingency date contracts, i.e. non-mortgage contingencies, you are left with only 21% of the sales contract with what are likely to be mortgage contingencies. Only about a fifth of our buyers are sensitive to rising or falling mortgage rates.

As you would expect, the median sales price for those 21% of buyers with a mortgage contingency is less than the median for the overall market price by $250,000. The folks who have a mortgage contingency tend to buy lower priced houses, which are not as competitive and need work. While overall 52% of our houses sold so far this year went for full list or over list price, that is true of only 39% of our deals with mortgage contingencies. You can also be sure that that those buyers that needed a mortgage contingency in a multiple offer situation had to offer more than the all-cash buyers that they were competing against.

But wait, I hear you say. Many buyers in the 80% of the market that don’t request a mortgage contingency in their contract, still get a mortgage; and that is very true. However, these people can afford to pay all cash and are much less interest rate sensitive.

If they can’t afford to pay all cash, they are running the risk that if the mortgage doesn’t come through in time for closing, they may lose their 10% downpayment. As you might expect, this very rarely happens, but I’ve had it happen twice in my career. Luckily, I represented the jilted seller in both cases, and in both cases, the seller got to keep the downpayment.

In one case, we had to file a lawsuit against the buyer, but once he was served, he quickly backed down. In the other case, the buyer was a lawyer and decided not to contest the forfeiture of his 10% down payment. Where the buyer defaults the 10% downpayment is considered liquidated damages, i.e. a damage amount that the buyer and seller agree on before the breach of contract. This means that the seller doesn’t have to prove their actual monetary damages, and the buyer isn’t liable if the seller’s damages exceed the amount of the 10% downpayment.

Are Greenwich sellers really locked in due to low-rate mortgages?

The general consensus on a national level is that higher mortgage rates have locked in sellers who bought in the 14 years with some of lowest interest rates ever. These lucky owners won’t move because they would have to pay a higher interest rate on their new house and would have to settle for less house. As a result, these sellers have golden handcuffs and can’t sign a listing agreement.

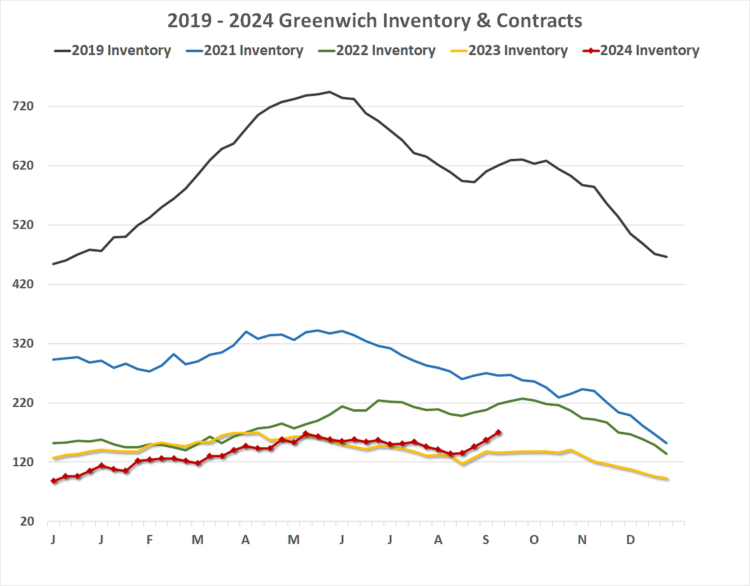

I would contend that these lower interest rates only play a small part in the 7% sales drop that we have seen in Greenwich this year. Here are 5 reasons that higher interest rates only have been a small factor in lower sales in Greenwich:

1. People who are paying all cash to buy don’t care that much about the interest rates. In fact, higher interest rates may mean that they are getting more money on their savings accounts and bonds and hence have more money to spend.

2. A corollary to this is that many of our sellers, particularly, older downsizers paid off their mortgages years ago. Other seniors may not have fully paid off all their mortgage, but they have seen the value of their house double and triple over the last couple of decades. As such, they have plenty of equity to buy a new and often smaller place, either here or down south with all cash from their large equity.

3. In Greenwich, a much bigger reason for owners to stay in their house is not higher interest rates, but a different type of lock-in; they have nothing to buy. Right now, I have three clients that would be glad to list their house if they had some place to move to.

4. The Greenwich real estate market is driven much more by stock prices than it is by interest rates. When the market reaches record highs, many of our residents, and residents-to-be, have more money to buy a house and the wealth effect kicks in.

5. We also have a tax lock-in effect. If you sell your house, you have to pay capital gains on it. The large majority of houses, that owners bought many years ago have unrealized capital gains well in excess of $400,000. This means that if they sell, the Obamacare tax kicks in, and they pay 23.4% of their gain to the IRS. Even if both the husband and wife are still alive, and get the $500,000 capital gains exemption, lots of our older residents can’t afford to sell.

I have two family friends who should be in senior care facilities, but won’t sell their houses, because then they lose the personal residence $500,000 exemption. For some seniors who took out reverse mortgages, they may not even have enough equity to pay these taxes were they to sell.

Even if they equity is there, the capital gains tax can take a large part of what they have to live out the rest of their lives and a large part of their children’s inheritance. What’s particularly pernicious, is that a majority of their “gain” is simply the effects of compound inflation over the decades.

Why we haven’t seen one of our candidates for the U.S. Congress propose solution to ameliorate the effect of these inflation driven gains on our seniors who have lived here the longest, I don’t know.

Will lower rates result in more sales and less gridlock in Greenwich, probably not, but the knock-on effects such as continued house appreciation, may entice more owners to take their gains now.

Stay tuned …

Mark Pruner is a principal and one of the founders of the GreenwichStreets Team at Compass Connecticut. He can be reached at mark.pruner@compass.com, 203-817-2871 or at the Compass office at 200 Greenwich Ave.