By Mark Pruner

Well the numbers are in and the superlatives are spread out among many of the sections of the town.

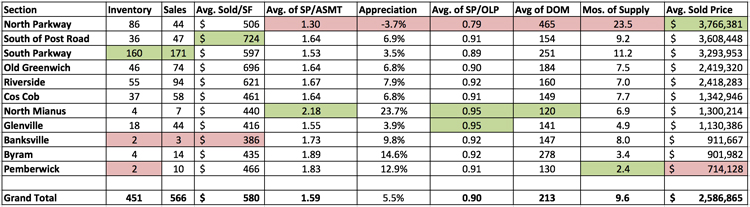

Highest Average Sales Price

Backcountry (aka North Parkway to the Greenwich MLS) still has the highest average sales price in Greenwich at $3,766,381 based on 44 sales last year. Now this is both good news, and not so surprising news, when you figure that north of the Parkway is a 4-acre zone; twice as big as the next zone. The large acreage also allows for a bigger house. So, the maximum square footage in the 4-acre zone under present regs is 10,890 s.f., which is 3,049 s.f. larger than in the next larger, 2-acre zone.

One way to get to a high average is to have a few really good sales and we did in the backcountry with 8 sales over $5.5 million including 25 Lower Cross Road which sold for $21,000,000. At the same time, we had 17 sales for less than $2 million, which shows just how diverse the housing choices are in backcountry.

Highest Average Sales Price Per Square Foot

While backcountry has the highest average price, South of Post Road wins the prize for the highest sold price per square foot. In this case South of the Post Road means everything between Cos Cob and Byram (though there seems to be a dispute whether the area around Byram Shore Road is in Byram or South of the Post Road with listings going both ways). South of Post Road blows away the rest of the town for sold price/s.f. at $724/s.f.

This is primarily for two reasons. First, in this section we have some of our highest priced water front properties in Belle Haven, Mead Point and the sectionally in dispute Byram Shore Road area. The second reason is that this area also has the central Greenwich properties with all of the recently built, expensive duplexes and condos on roads on each side of Greenwich Avenue.

Lowest Months of Supply

If you want to buy a house in Pemberwick you need to move fast, and you can’t be too particular. Right now, you have two houses to pick from. Now much of Pemberwick is a R-6 zone which allows duplexes, and used to allow even more than two units in a single structure, so the situation is not quite that tight for Pemberwick, as this report only looks at single family homes. However, going condo in Pemberwick won’t help that much as right now you only have four condo choices in Pemberwick. As a result, for houses in Pemberwick with 10 sales last year and 2 houses in inventory you are looking at only 2.4 months of supply.

Best Sales Price to Assessment Ratio

Now I was originally going to entitle this section, “Best Appreciation”, but that’s not correct even though some people use it that way. Regardless, the easy winner here is North Mianus with an SP/Assmt ratio of 2.18. This equates to a non-compounded rate of appreciation of 24% a year since our last reassessment date of October 1, 2015. Now 24% appreciation looks pretty awesome when the average appreciation for the town is 5.5% per year for the same time period.

Part of what makes North Mianus appreciation look so good is the new construction in this area. For listings that are under construction, the assessment is what the value of the teardown was, while the sales price is for the new and much larger house. This gives you a great SP/Assmt ratio. But, make no mistake North Mianus is a busy neighborhood, just as it was last year. Further evidences of this is that the North Mianus sales last year had the smallest days on market.

Best Sales Price to Original List Price Ratio

The winners here are Glenville and North Mianus, but we just talked about North Mianus, and Glenville beats North Mianus on a couple of the other stats. For the 44 sales in Glenville last year buyers got 95% of what they originally asked for. Glenville had only 4.9 months of supply at the end of 2017, while North Mianus had 6.9 months.

Glenville’s numbers are even more impressive when you compare the size of the two areas. Glenville had the aforesaid 44 sales, while the smaller North Mianus neighborhood had 7 sales in 2017 so it’s a larger hot neighborhood. Our most recently completed elementary, Glenville E.S. has been a nice plus for this area. Also, Glenville’s an average sales price of $1,130,386 looks like a relative bargain among Greenwich houses who overall averaged $2,586,865 in 2017.

The Other Side

When you look at the other end of the stats Banksville and Pemberwick have a tiny inventory and Banksville had only 3 sales last years, but it’s a very small area and at $386/s.f. a good value in the backcountry. It’s the rest of the backcountry that unfortunately gets the awards you don’t want to get including; lowest appreciation (actually a depreciation of 3.7% since the last assessment date of 10/1/15), longest days on market and highest months of supply.

Now some may think of this as just a backcountry problem. Some, particularly outside Greenwich, and even a few national reporters, take a little schadenfreude from the slow sale of these expensive backcountry houses. The problem is that the slow demand in the backcountry is a problem for all of Greenwich.

The value of the expensive houses in backcountry, and to a lesser extent mid-country, represent a large portion of our grand list. To the extent that these houses become a smaller portion of the grand list, property taxes will shift from these houses to Old Greenwich, Riverside, central Greenwich, North Mianus, Glenville, Cos Cob, Byram and Pemberwick, i.e. everyone’s property taxes are going to be going up; it just math.

It seems ironic, but helping some of our wealthiest neighbors get a higher sales price will help keep all of our property taxes down. The backcountry of Greenwich, and mid-country, have been a premium place to live for over a century. It has lots of good things going for it and people buy high-end houses there all the time.

Now there’s a chance that the problem may solve itself as many successful residents are looking for more space, a quarter-acre in Old Greenwich is seeming more cramped than cozy for some folks. Also, there is a lot of money sitting in stock portfolios and we saw a fair amount move into Greenwich last year with sales over $3 million up 30% in 2017.

At the same time lots of money is being spent marketing the 246 houses in mid-country and backcountry. A little coordinated marketing and flexibility by town agencies could go a long way to help keep the rest of the town’s taxes from a double digit jump at the next reassessment date of 10/1/2020.

Mark Pruner is an award-winning real estate agent with Berkshire Hathaway. He can be reached at 203-969-7900 and mark@bhhsne.com