By Mark Pruner

A bill has been introduced in the Connecticut legislature which, if it is passed, will do great damage to the Greenwich housing market in a wide variety of price ranges. HB No. 7313 proposes to put a 19% surcharge on “income derived from investment management services”. This bill proposes to raise the Connecticut income tax to make up for the so-called carried interest revenue. Many investment management funds are set up so that the managers’ payments are taxed as capital gains. The capital gains tax rate is 20% at the federal level and the maximum federal income tax rate is 39.6%. The idea behind the Connecticut tax is to tax investment managers for nearly the full difference between these two federal tax rates and have all the taxes go to Connecticut.

The authors of this bill realize that such a tax could encourage Connecticut investment managers to relocate to New York. So, the tax bill has a curious provision which provides that the 19% surcharge shall only be applicable in tax years where New Jersey, New York and Massachusetts have enacted substantially similar laws. The thinking seems to be that if the whole region is taxing investment managers at this rate then there won’t be an incentive to move between the states within the region. It’s not clear how this will prevent a move to Florida.

Now given this curious multi-state provision, some may see the proposed bill as a tempest in teapot. The problem with this bill is that it is only the worst of many efforts that have been made in the last few years to tax our wealthiest residents to make up for significant budget shortfalls.

The idea of many legislators is that the wealthy residents can afford it and that ratcheting up the high-end tax rate percentage will result in the same percentage increase in tax revenues. While that is true up to a point it appears that point was passed sometime around 2014 when high net worth taxpayers starting to vote with their feet.

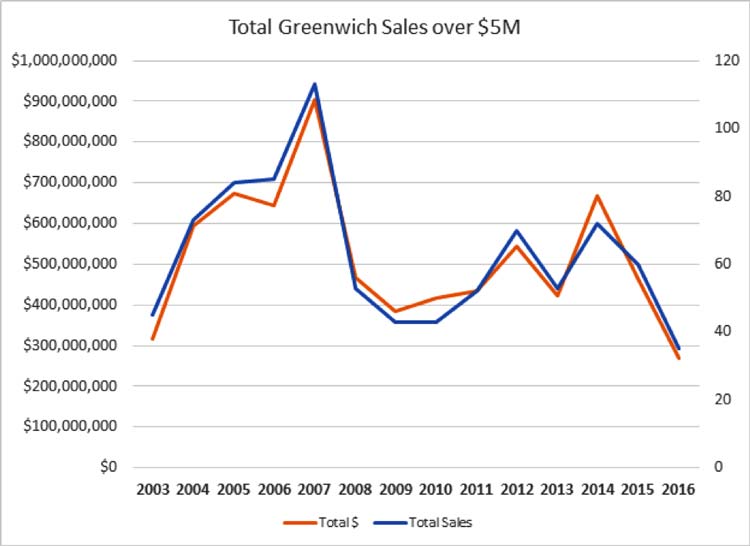

In 2014, we had 72 sales over $5 million, which was the largest number of sales since the pre-recession boom year of 2007. In that year, those 72 home sales generated $666,770,298 in sales revenue. The following year, however, sales dropped to 60 houses and $465,171,045. In 2016, we had only 35 sales over $5 million which totaled $267,660,990. The total revenue drop in those two years was just shy of $400,000,000.

The direct consequence of the reduced sales is a significant loss of property conveyance tax for both the Town of Greenwich and the State of Connecticut. However, these are minor taxes compared to the huge amount of lost personal income tax that the reduced sales to high income individuals represents. You also have lost sales tax and fewer local charitable contributions.

Several of our wealthiest homeowners are no longer Connecticut citizens. Most of the people in these income levels who can afford high-end homes in Connecticut have more than one home and often two or three. For these folks who spend more than six months in another state, Florida is popular given that it has no income tax, to eliminate their Connecticut tax burden.

It’s not quite that simple as it is a multi-factor test as to what state gets to tax you as a resident. At one point the DRS was looking at whether investment managers were still making contributions to local charities as a factor to determine if the manager was still a Connecticut resident. As a result, people were encouraged by their accountants to stop giving to local Connecticut charities. Luckily, the Connecticut legislature got the DRS to reverse their position (see DRS PS 2106-3).

And, while the focus is on the very highest earners, there are hundreds of mid-level managers and traders who make good salaries who are not headline worthy. If firms continue to move out of state, we lose many of these folks. All of the suppliers of these companies, the people doing renovations and even the local grocer get a lot of business from these companies and their employees.

You would think that the state would be trying to grow the pie rather than taking a bigger piece of a shrinking pie. It’s an industry of highly educated, high earning people who don’t overly tax the state’s infrastructure and don’t cause pollution problems. The problem is that Connecticut is two very different states. In Greenwich, our median home price is around $1.6 million, while for the state as a whole, the median home price is around $240,000 or 15% of prices here and that is the median price, meaning half of the homes sell for less than that amount.

Connecticut has a lot of citizens with real needs, but raising taxes has become a negative sum game. If you’d like to do something, write to Greenwich’s Senator Frantz or Representatives Floren, Camillo and Bocchino. They understand these issues well, but they need real life experiences and clear opposition to this method of solving the state’s budget problems.

We need to turn Connecticut back into a state that attracts the top investment managers and companies as it has done for the last three decades. It is a good solution for everyone. .

Mark Pruner was the #1 Connecticut agent for Douglas Elliman in 2015; mark.pruner@elliman.com, 203-969-7900.