By Rob Longsworth

Sentinel Business Columnist

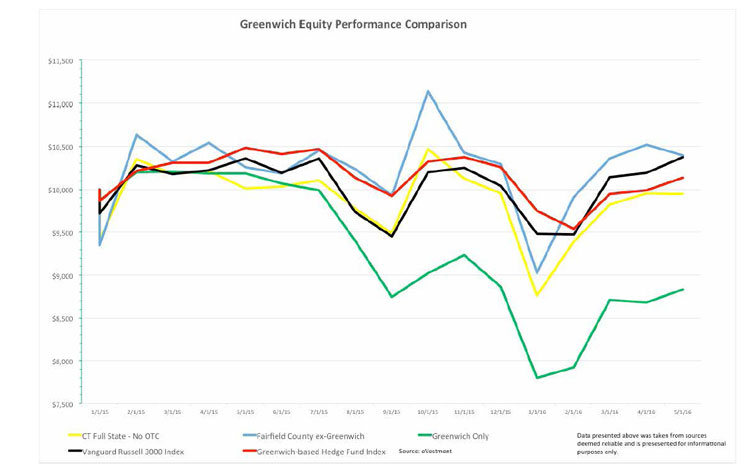

The chart above was inspired by the Sentinel’s own Greenwich-focused stock table. Based on both the town’s and Connecticut’s disproportionately large influences on the economy, I thought it would be interesting to expand on the stock table and create several trackable indices as measures of Connecticut-based economic performance.

According to the U.S. Department of Commerce’s Bureau of Economic Activity in 2015 Connecticut’s $259.66 billion Gross State Product (GSP; which is a state level equivalent of GDP) ranked 23rd in the union. To put this into context, California was first with $2.45 trillion, while Vermont ranked 50th with $29.75 billion. By themselves, these numbers are not that telling. But dividing each of the top 23 state’s GSP by its respective square mileage results in a second place ranking for Connecticut behind only New Jersey ($46.84 million versus $65.8 million).

It’s a far tighter race when examining GSP relative to estimated populations. Here, New York State barely edges out Connecticut for first place in GSP/resident ($72,965 versus $72,311). This is a particularly impressive metric when taking into consideration New York’s third-ranking GSP of $1.455 trillion; the diversity of its upstate and downstate economies; and the inclusion of New York City, a global hub of finance and commerce.

Connecticut’s inordinately large influence on the economy sparked some additional thoughts. I began to research all of the publicly traded companies headquartered in Connecticut and came up with approximately 275. I culled this list by removing the over-the-counter (OTC) stocks, which tend to have very small market capitalizations, trade infrequently, and often experience wide price swings when they do. This state portfolio was whittled down to 88 companies, with market capitalizations ranging from approximately $15.4 million to $280 billion.

I then broke this portfolio down into two others: a Fairfield County-based portfolio excluding companies headquartered in Greenwich, which contains 44 companies ranging in market capitalizations from approximately $28.8 million to $280 billion; and a Greenwich-only portfolio, with 13 companies ranging in market capitalizations from approximately $60.4 million to $7.0 billion.

Because Greenwich is home to a large number of alternative investment managers, I decided to include a custom Hedge Fund Index comprised of equity long bias Greenwich-based hedge funds. It was constructed for me by eVestment, a global provider of intelligence on the alternative and traditional asset management industries. As the three equity portfolios are effectively long only (meaning they buy and hold equities, with no hedging overlays), it was determined that without becoming too technical, a hedge fund portfolio consisting of only equity long bias funds would provide the closest comparison to the three stock indices. For a benchmark against which to compare the four portfolios, I chose the Vanguard Russell 3000 Index. It roughly approximates the wide range of market capitalizations and industry sectors included in these indices.

The chart shows performance through May 31, 2016 of a $10,000 investment made on January 1, 2015 in each of the portfolios and the benchmark. Although there are countless ways to look at these numbers, presenting the ongoing performance of a $10,000 investment is an easily understood industry standard. The time frame itself was chosen for several reasons. It allows for inclusion of a handful of recent initial public offerings, while removing some of the distortions of the 2008 financial crisis and subsequent bull market. It is also relatively close to the last domestic equity market tops (the Dow peaked in May 2015, the S&P 500 in July 2015) preceding the current market volatility dating to the middle of last summer.

It bears mentioning that these indices do not explicitly or implicitly indicate that Greenwich Wealth Management manages these portfolios, or offers them to current or prospective clients. Rather, their purpose is to provide some insight into the magnitude and diversity of Connecticut’s economy, both locally and throughout the state.

They also serve as a reminder of how much economic dynamism Connecticut has to lose. As corporate behemoth and longtime resident General Electric begins migrating its headquarters to Boston this summer, it begs the question: Who’s next?

Questions, comments, and insights are not only welcome, but are encouraged.

Rob Longsworth is a Wealth Advisor at Greenwich Wealth Management LLC in Greenwich. Email Rob with questions at Rob@greenwichwealth.com or write to him c/o the Greenwich Sentinel, 28 Bruce Park Ave., Greenwich, CT 06830 (203) 883-1430. Advisory services offered through Greenwich Wealth Management, LLC, an SEC Registered Investment Advisor. Securities offered through Private Client Services, Member FINRA, SIPC. Greenwich Wealth Management and PCS are unaffiliated entities.