By Mark Pruner

Sentinel Contributor

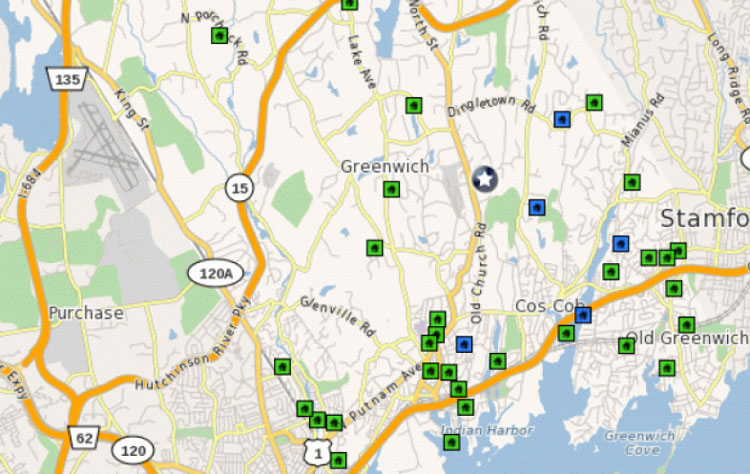

You might think the beginning of the year would be quiet for the real estate market but that hasn’t been the case. In the past week we had five sales, slightly lower than we would expect, but we have also had 35 new listings. That’s the kind of new listing volume we would normally see in March.

You might think the beginning of the year would be quiet for the real estate market but that hasn’t been the case. In the past week we had five sales, slightly lower than we would expect, but we have also had 35 new listings. That’s the kind of new listing volume we would normally see in March.

If the pace of new listings were to continue, we would have 140 new listings this month. This in a year when we started with 425 single-family homes and less than 80 condos. Generally it takes 10 days to a month or even more to get a listing on the market so it is likely that these new listings were planned in December when the weather was warmer.

What a difference a few days make. We’re finally getting some real winter weather but as tends to happen in an El Niño winter, it doesn’t look like it will last long.

So far we’ve seen no major snow, one of the factors that does significantly affect the real estate market. It’s hard to sell houses over $4 million in the snow as buyers really want to see what they’re going to be getting. Under $1.5M it can be easier because often buyers are event driven; new jobs, marriages, and births.

The black swan we will need to watch carefully is the thousand point plus drop in the Dow Jones Industrial Average. The majority of our buyers are employed in the financial industry one way or another; investment banks, hedge funds, banks and ancillary businesses. And, at all price levels the buyers stock portfolio is an important consideration so a significant drop in the Dow may cause many to pause.

Surprisingly, it also seems to delay closing’s where the property is already under contract as buyers and bankers proceed with more caution. The main change is buyers hesitate on finalizing in order to wait and see whether if there will be a stock market recovery or not. In better times, this kind of stock market correction might be less of a factor, but we still don’t have an economic recovery where people are confident that, regardless of short term downturns, we are moving in the right direction and so they may hesitate to make a major investment.

The other major news of this week, GE is moving its headquarters to Boston. This may ultimately turn out to be neutral news for Greenwich. Since GE is located in Fairfield, few of their 800 headquarter employees that are relocating to Boston live in Greenwich. At the high-end we certainly have the ability to absorb a few more houses and at the lower end we have plenty of demand.

The other major news of this week, GE is moving its headquarters to Boston. This may ultimately turn out to be neutral news for Greenwich. Since GE is located in Fairfield, few of their 800 headquarter employees that are relocating to Boston live in Greenwich. At the high-end we certainly have the ability to absorb a few more houses and at the lower end we have plenty of demand.

The good news is that this may be the shock that causes Hartford to examine some of the policies that have hindered high-end sales. The implementation of a slightly higher top rate and the defunding of the probate court system have been factors for ultra-high-end buyers.

Also some of the corporate tax policies haven’t incentivized large corporations to move into Fairfield County. If the legislature and the governor re-examine some of these policies, this black cloud might turn out to have a silver lining.

Bottom line, under $2 million neither the Dow drop or GE’s moving is likely to have much effect on the market. Above that price these changes give smart buyers a chance to make a better deal. Come next week with warmer weather and higher Dow all this may be forgotten.

Mark Pruner is with Douglas Elliman in Greenwich, CT. Mark Pruner, Realtor

203-969-7900

mark@greenwichstreets.com

www.greenwichstreets.com