By Mark Pruner

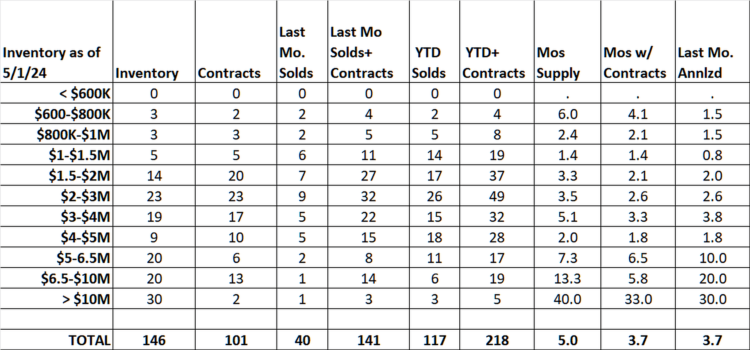

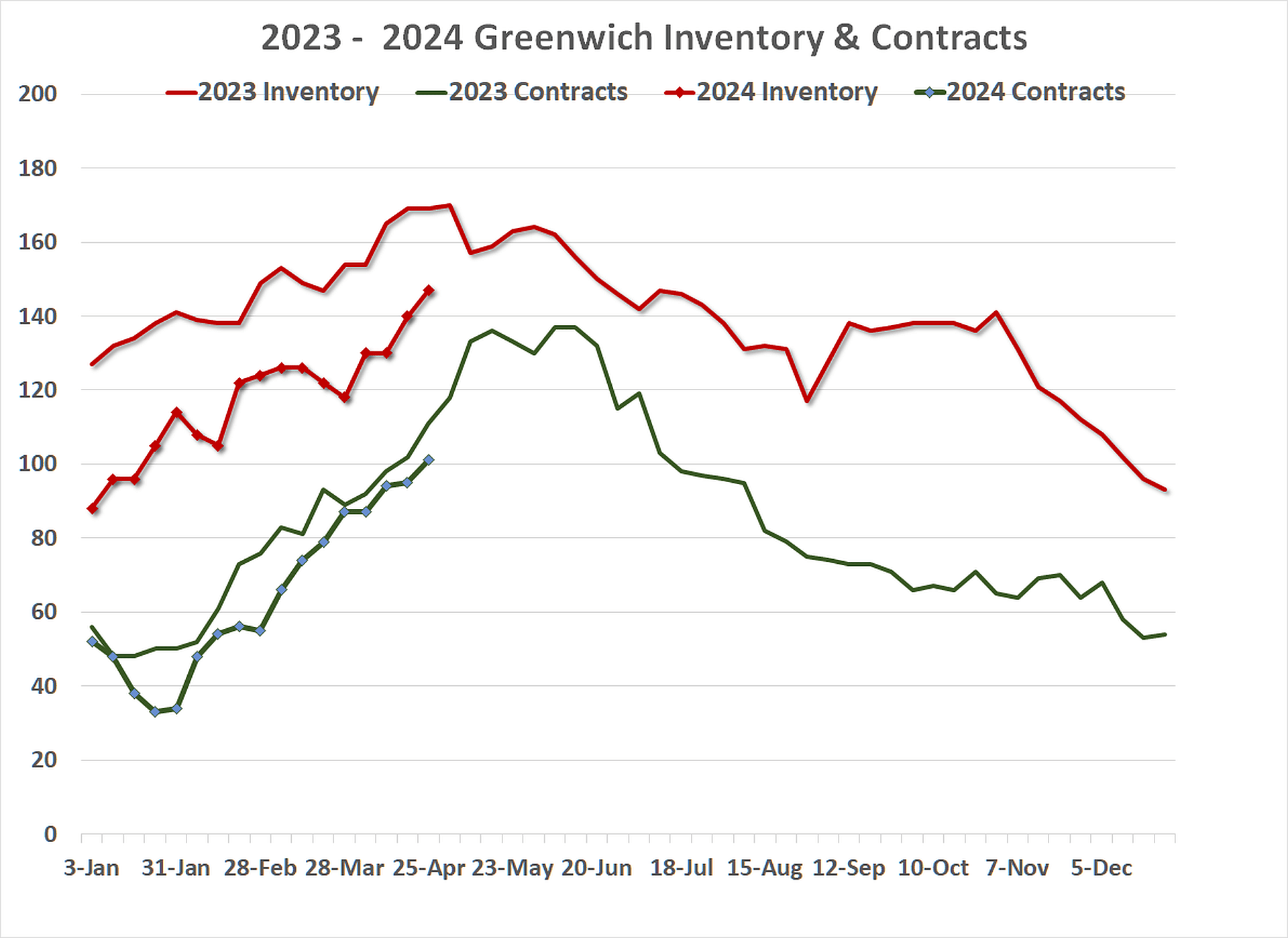

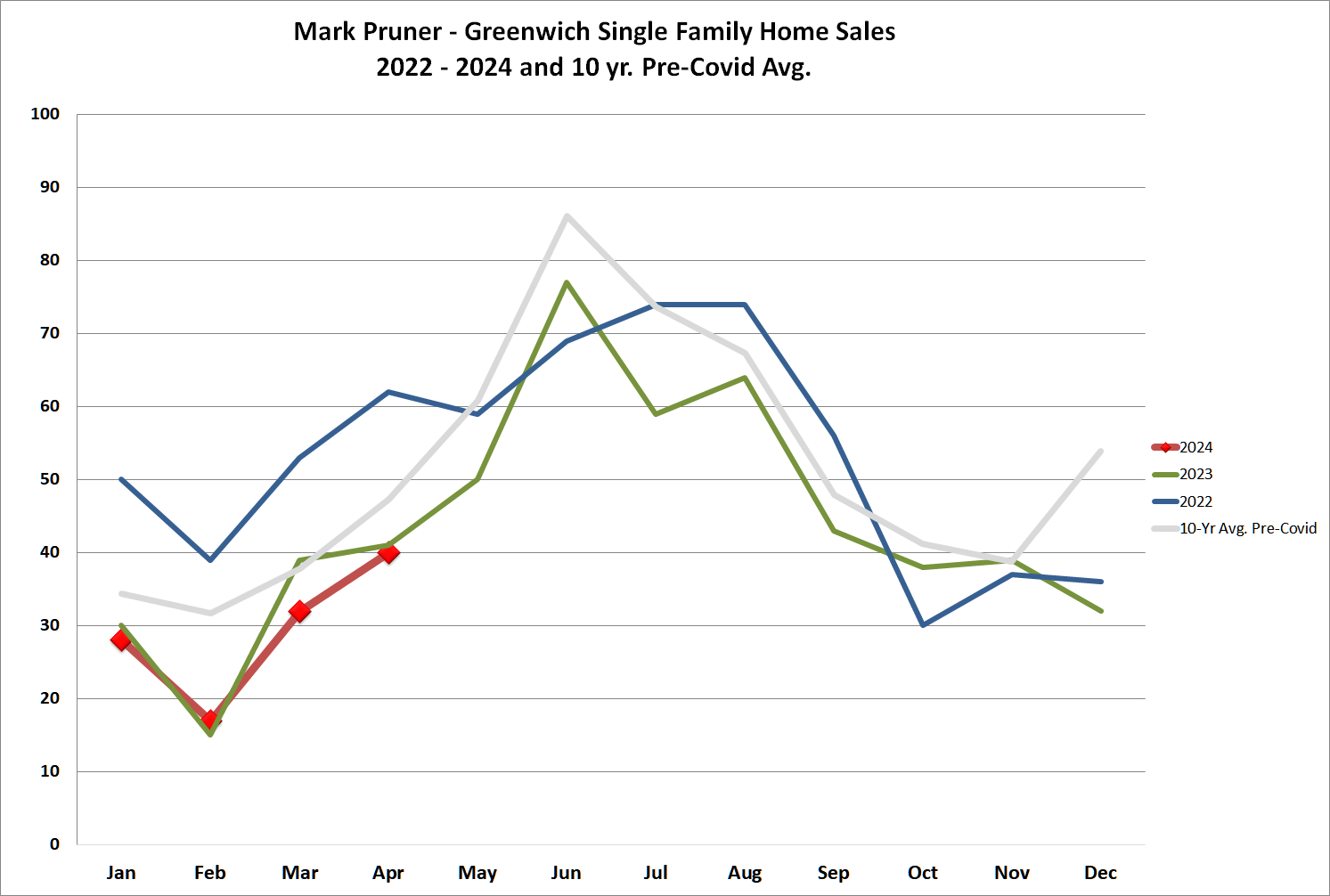

Our April sales are just about the same as last year, which is remarkable given that our inventory is down 13% from last year to a new record weekly low. We had 40 sales in this April, which is almost the same as last year. At the same time, our inventory shrank from 167 in last years spring market to only 146 single family home listings this year.

This year our median days on market is down to only 29 DOM, which means that half of inventory is going to a non-contingent contract in less than a month. This compares a month and a half last year (48 days) and 5 months on the market in 2019. If you want to buy in Greenwich and in much of the area, you need to be prepared to move quickly.

Our sales price to original list price was at 98% last year and is now up to 100% of the list price this year. Prices are also up. Out median sales price is $2.90 million for sales so far this year. This is up 55% from the April 2019 median price of $1.87 million and up 16% from last April’s median price of $2.5 million. As I explained, a couple of weeks ago this doesn’t mean that your house is up 55% from 2019 in most cases. Much of this “price increase” has to do with what’s selling.

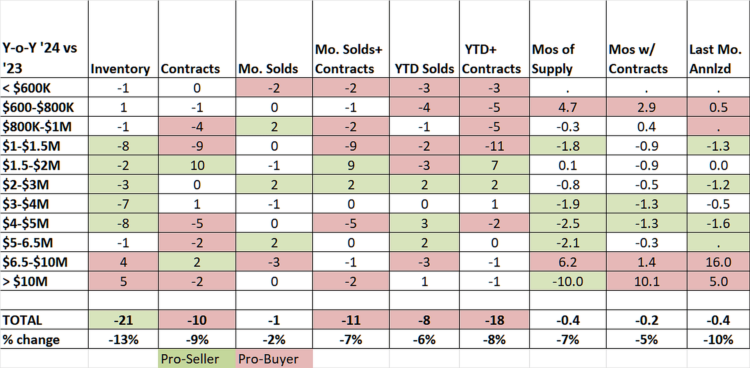

Our median price is up, because our sales year to date are down under $2 million, while our sales from $2 million to $6.5 million are up from last year. The result is both the average sales price, now at $3.5 million, and our median sales price are up. The number least affected by the change in the mix of what is selling is the sales price to the Tax Assessor’s assessment. When you compare the April 2024 ratio to the April 2023 ratio you get an increase of 11.7%, still quite a jump in one year.

As I said, sales from $2 million to $6.5 million are up this year, which is remarkable, because our inventory from $2 million to $5 million is down. Our Greenwich Streets team has a bunch of buyers actively looking in this price range and other agents have a lot more buyers, so if you are thinking about selling this an excellent time to put your house on the market.

Below $5 million we have a super-seller’s market with less than 3 months of supply. It’s only above $5 million that you see a more balanced market and only above $10 million that you could argue that there is a buyer’s market. Our highest priced sale this month was 22 Dairy Road, which sold for $16.25 million after 189 days on market. It was only our third sale over $10 million this year. The future in the ultra-high-end is also looking uncertain with inventory up from last year and contracts down.

Between $5 million and $10 million we’ve had 20 sales so far this year, but the fly in the ointment is that we only had 3 sales in April this year. The good news, at least from my viewpoint, is that all 3 of those transactions which were at $8.9, $6.3 and $5.8 million done were done by me, Russ and Dena Zarra on our Greenwich Streets Team. Dena’s sale at 4 Ford Lane was listed at $5.3 million and went to contract in 9 days for 110% over list. It was like new and close to the Sound. New, and like new houses, at just about any price point go quickly, if properly priced.

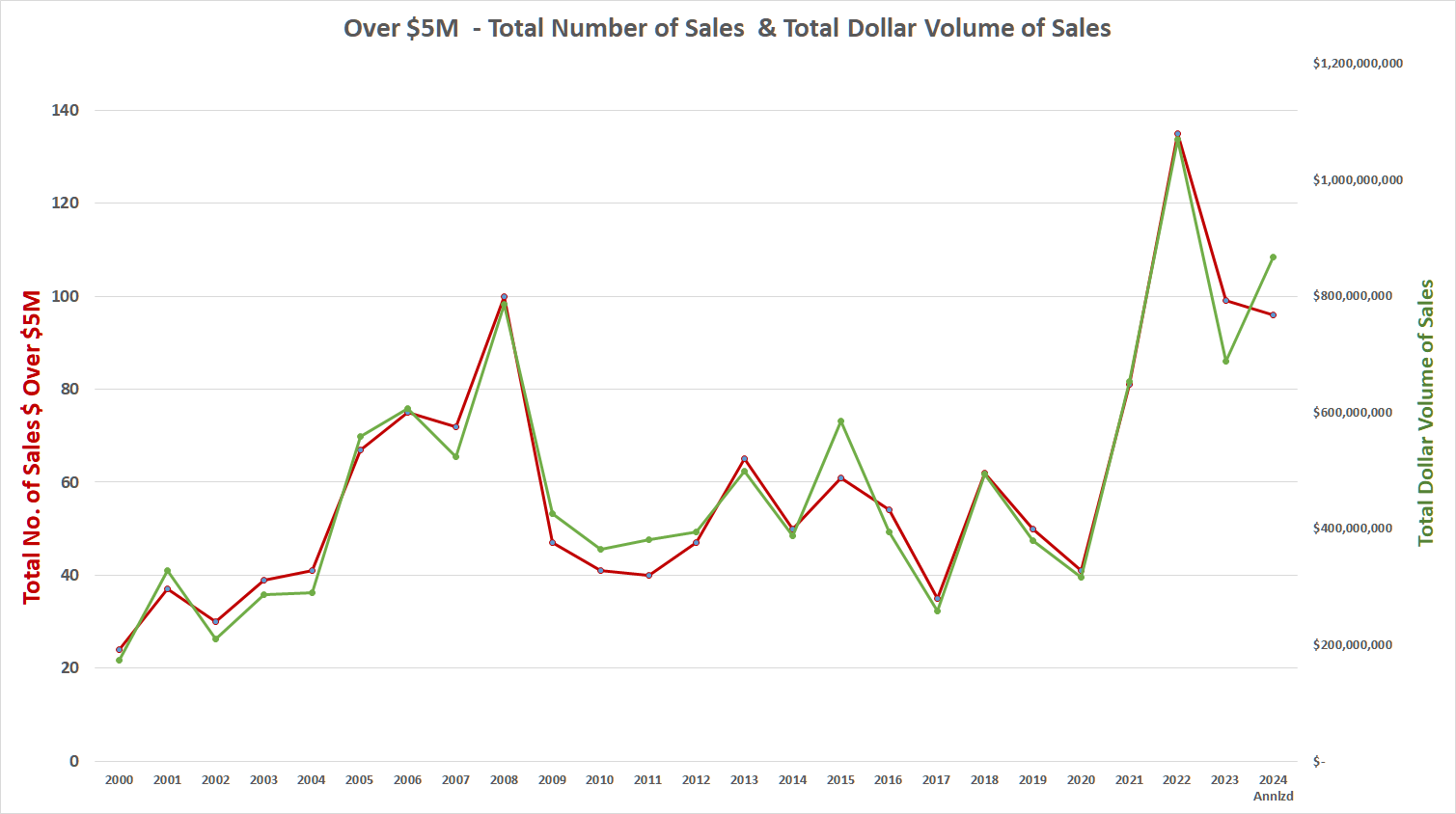

So, what’s the high-end market going to do; up, down or sideways. Starting in 2021 our high-end sales took a big jump up, along with the rest of the market. The same year, 2021, that we had an all time record for single family home sales, we also saw an all-time record for sales over $5 million with a 135 sales. Only once before had we had triple digit high-end sales and that was way back in 2007 at the height of the bubble.

In 2022, we fell one short of 100 sales with 99 sales over $5 million. Last year, in 2023, we still did very well with 96 total high-end sales. This was our fourth highest sales year ever going back to 1999. Before that we had very few sales over $5 million as house prices in general were just much lower.

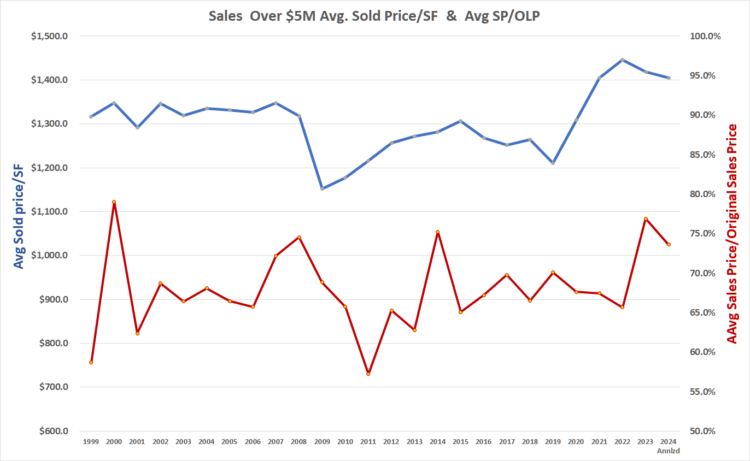

So far in 2024, our average price per square foot for high-end house has been hanging in there at $1,025/sf compared to last year’s all time high of $1,084/sf. Our sales price to original list price also is looking good at 94.7% down less than 1% from last year’s 95.5%. Our days on market for high-end houses is 176 days, but back in 2019 it was 405 days.

Still with sales down, and inventory up, there are some dark clouds on the horizon. Then again, most of our high-end sales have moved to the third and fourth quarters as most people aren’t getting their big bonuses in one lump sum at the beginning of the year. If contracts stay down in July to September, then we’ve got something to worry about.

Our main worry is our very low inventory. The nice thing is while inventory is still down from last year, it up significantly from March, when we closed the month with only 118 listings. We are now up to 146 listings. More listings have resulted in more contracts. Our inventory is down 13% from last year, while our contracts are only down 9% from last year. If our inventory continues it’s rapid rise then we just might finally see more contracts than we saw in the same week in prior years. That would be good signal, that we are headed back to normal, but while close, we haven’t seen it yet.

Stay tuned the market just might be changing for the better in most price ranges …

Mark Pruner is a principal in the Greenwich Streets Team, along with Russ Pruner, Dena Zara, Tim Agro and our newest member, Felipe Dutra. He can be reached at Compass Connecticut at mark.pruner@compass.com or 203-817-2871.