By Mark Pruner

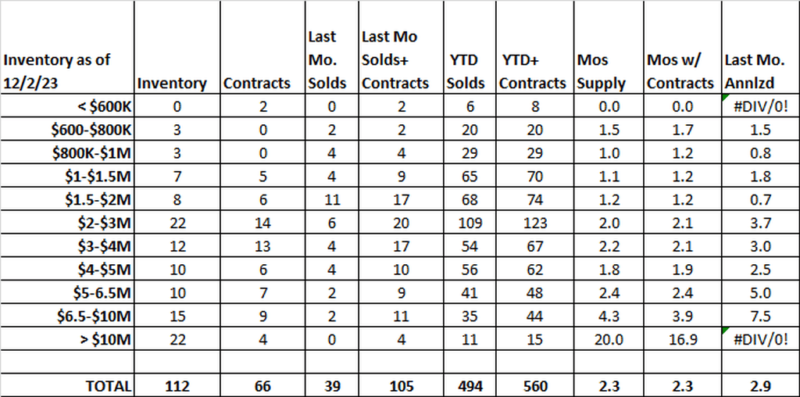

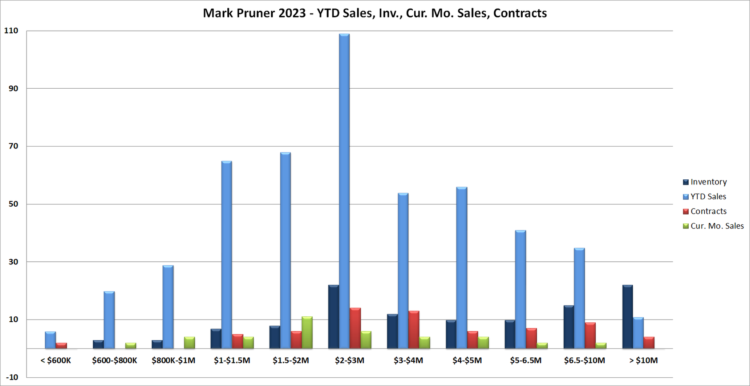

If present trends continue, there will be no single-family homes on the market by the end of March 2024. At the end of last month, there were only 112 single-family home listings on the Greenwich MLS. In the first six days of March, we have dropped another four listings.

For the last five weeks, we have witnessed our inventory drop every week, which is perfectly normal for this time of year. However, what is not normal is that every week starting in May has been the lowest inventory that we have ever recorded for that week, going back to 1856. (OK that’s a little exaggeration, but my brother and team member at Compass, Russ Pruner, has number going back to 1986 and the lowest pre-Covid inventory number was 217 house listings.)

We had the possibility of breaking this seven months of declining inventory in September and October as we entered our fall market, and inventory stayed flat for seven weeks. It even increased at the end of October, but that was just a Halloween trick. Every week in November and into the first week of December has seen inventory slide, going from 141 listings at the end of November to only 108 listings now, a drop of 23.4% in only five weeks.

Given how fast inventory is dropping, we will have no houses to sell at all by the end of March 2024. Luckily, March is when the spring market kicks in, and new listings come on. Let’s hope it’s a lot better than our 2023 fall market. Labor Day is when the fall market starts, and it netted only 20 more listings this. Still, that doesn’t tell the whole story, as can be seen when you look at sales.

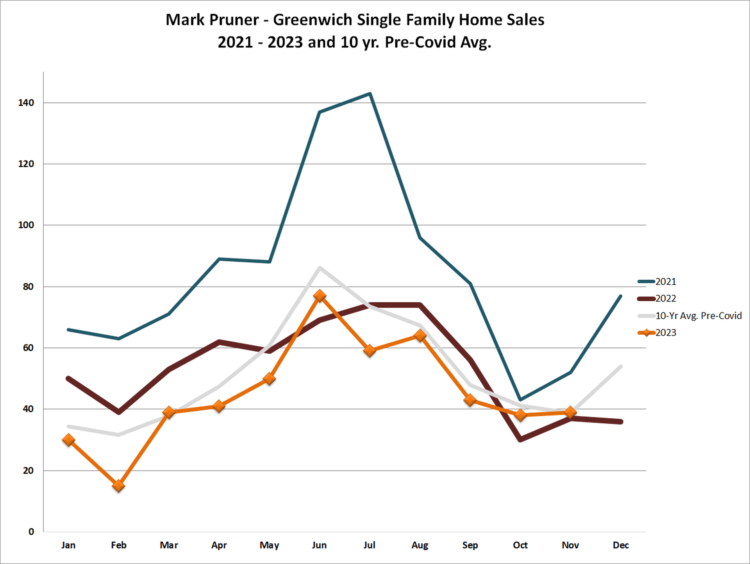

Our sales should be dropping, and they are, but they actually went up in November compared to the last November and compared to our 10-year pre-COVID average. We had 39 single-family home sales in November 2023 compared to only 35 sales last November, and 39 sales is slightly above our 10-year average. But mathematically, that can’t happen. How can you have the same number of sales in November 2023 as we had in November 2019, when we had 566 listings and 40 sales. In 2019, we had 405% more inventory and only 2% more sales than this November. You can’t sell houses when you don’t have listings.

This mathematical conundrum is solved by blue moons and super blue moons. A blue moon is a house that came on in one month and didn’t make it to the beginning of next month, and hence never showed up in the month ending inventory numbers. In November, we had 23 listings go to contract in less than 30 days. A super blue moon is a listing that came on the market, went to contract, and was sold before the end of the month. In November, we had the aforesaid 39 sales, and 22 or 56% of the sales in November closed within 30 days of listings.

This is a total of 43 listings that went from active to under contract in less than 30 days in November 2023. (In the interest of full transparency, we did not have that many blue moons, as any listing that came on after October 16th and sold before November 15th would have less than 30 days on the market and would actually be counted in the end-of-October inventory numbers. Instead of 43 blue moons, it’s probably more like 30 blue moons that were listed in November and were under contract or sold by the end of the month.) Regardless of the exact number, a large percentage of our new listings are never counted in month-end inventory numbers, so inventory doesn’t accurately reflect new listings.

The national media is focused on high-interest rates and says that’s what is causing the drop in sales. That may be true in some western cities that got way overheated during COVID. It is not the case in Greenwich. Most houses over $3 million don’t have mortgages, so higher interest rates aren’t slowing their sales. Our median sales price year to date is $2,500,250, and few of the houses above that price are using mortgages.

But what about those houses under $2.5M? Most of them aren’t using mortgages either, or at least they are not putting in mortgage contingencies in their purchase contracts. If you look the contracts with contingencies it’s not clear how few houses are actually purchased with a mortgage. In November we had 25 sales under $2.5M. Of those 25 sale contracts, 12 of them first went to contingent contract status, but not all of those contingencies were mortgage contingencies.

In a market this hot, it is in the buyer’s interest to get control of the deal as quickly as possible. One way to do that is to get the seller to sign a contract with a contingency that the buyer controls. That is exactly what a mortgage contingency is. Once the sellers sign the contract, they are bound; the buyer can decide to exercise the contingency and get out or not, but not all contingencies are mortgage contingencies.

This was not the case when I was a real estate attorney back in the ’80s. Contracts had both a mortgage contingency and an inspection contingency. After the contract was signed and the seller bound to sell, the buyer could decide the house didn’t pass inspection and walk away or, more likely, go back to the seller and tell the sellers they wanted a better deal.

Today, very few buyers are able to do this, and usually, if they try, the seller’s attorney won’t let them put in two contingencies. Today, the buyer has to do the inspection first before the contract is signed. If the inspection turns up an issue, they can ask for additional concessions from the seller, but meanwhile, the seller is continuing to market the house. Nothing good ever happens to the buyer’s deal between the time the offer is accepted and contract signing. As a result buyers are trying to keep these periods as short as possible.

Of the 12 deals under $2.5M with contingencies, at least 3 and probably 5 of those contingencies were probably not mortgage contingencies as they were too short for a bank to approve a mortgage. One contract was only contingent for one day, but the buyer knew that none of the other bidders could get the house on that day. Of the 25 sales under $2.5M, only 7 likely had mortgage contingencies and hence were influenced by higher interest rates. When the government injects $2.7 trillion dollars into the economy, a lot of people can do all-cash purchases at all price levels.

So, when are we going to return to normal inventory levels? It’s not likely to happen in 2024; we are just too far down in listings, and we have lots of unsatisfied demand. Of our 39 sales in November, 22 of them went for list or over list price. Nearly all of those were multiple offer situations, so there were probably 30 – 40 disappointed buyers, who are actively in the market bidding on houses.

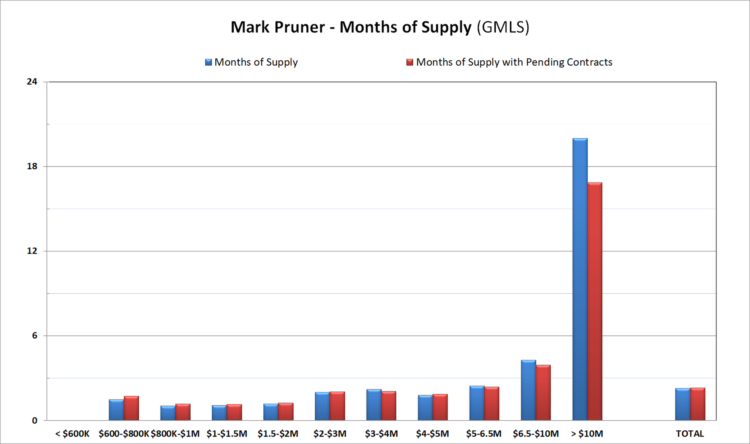

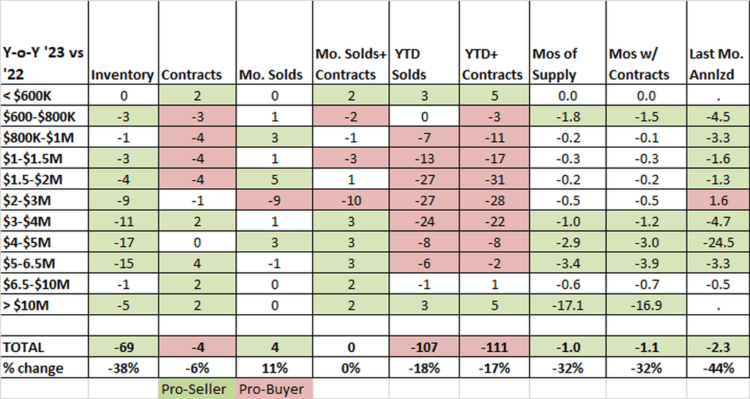

When you look at months of supply, you see that they are at combat buying levels with only 2.3 months of supply. Yes, demand has shrunk a little as the economy has slowed, but the stock market, bond market, and crypto markets are all up.

On the supply side, our shadow inventory of sellers waiting for a better market disappeared in the hyper-market of 2020 and 2021 all the way up to $5 million. The shadow inventory from $5 – 10 got eaten up this year, as we are around 3 months of supply with contracts, which is super-seller’s market territory. Only over $10 million do we have more supply than demand, and there we are seeing months of supply shrinking rapidly.

If you are thinking about listing your house, now is not bad, but 1/2/24 is looking like a good date. Our spring market has been getting earlier and earlier. Less snow is part of it, but unrequited demand is a big factor too. Happy Chanukah, Merry Christmas, and Happy New Year, and get underwritten pre-approved if you are looking under $1 million or bring cash.

Mark Pruner is a realtor with Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com.