By Mark Pruner

By Mark Pruner

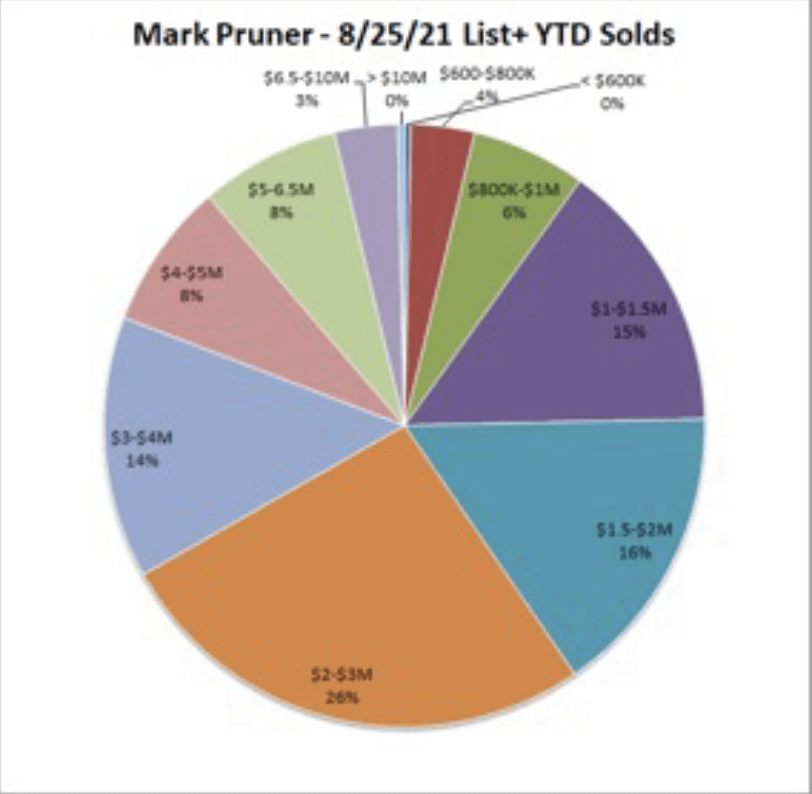

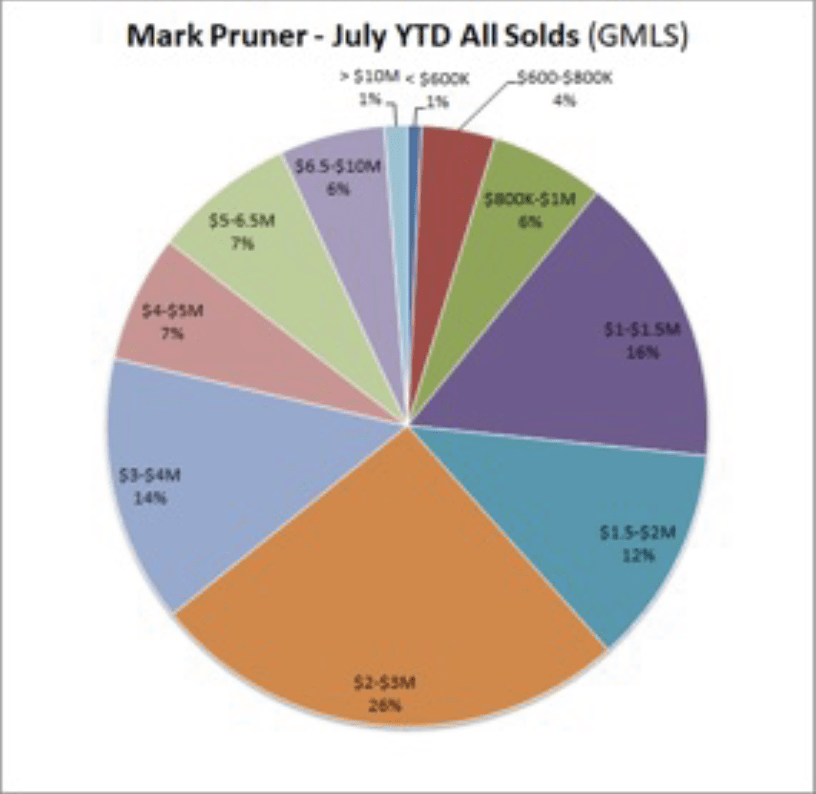

I was going to write this great article about what price segments were hot, but the numbers don’t support that kind of analysis. It doesn’t support it, because all the segments are hot, if you define hotness as the percent of listings in each price range that sell at or above their original list price. When you look at the pie charts of what price ranges have the most over list, it looks eerily similar to the pie chart of all sales by price ranges.

So far, we have had 733 sales for the year through this week. Of those sales, 131 went for full list price and a similar number, 161 houses, went for over original list price for a total of 292. That’s 40% of our sales going for full list price or over list. Let’s take a look at the very hot $1 – 1.5 million price range. That price range makes up 16% of all sales so far this year and that price range makes up 15% of the at or over list price sales.

That’s what we see all the way from $600,000 to $6.5 million with one exception. The only price range that has a more than average list and over list sales is from $1.5 – 2.0 million. That price range makes up only 12% of our 733 sales so far, but it makes up 16% of our list and over list sales.

On the less than very hot side you have to go all the way up $6.5 – 10 million before you see a drop off in hot sales. Above $6.5 million the hot sales are only 3.4% of all sales while that segment represents 5.7% of our sales.

If you compare the hot sales within a price category to all sales in that price category the $1.5 – 2.0 million price range stands out even more. Of the 77 total sales in that price category, 46 or 60% went for list or over list. For the entire market, as noted above, 40% of all of sales went for list or over list. Looked at this way the other very hot price range is $4 – 5 million where 51 of sales, 23 of 45 sales went for list or over list.

The over $6.5 million price ranges stand out on the lower end of over list bidders. There only 24% of the 45 sales are going for list or over list but think about that. You come to Greenwich wanting to buy a house for around $8 million. The odds are 1 in 4 that you are going to have pay full list price or over list for that $8 million house. This is in a market segment that only a few years ago was seeing the over $5 million market going for an average 76% of original list price.

BTW: When looking at other people’s stats be very careful as to whether they are using the sales price to original list price (SP/OLP) or the most recent list price (SP/LP). Markets can be made to look hotter if you use SP/LP. This means that if a listing started at $4 million and was grossly over-priced and then over 2 years , the list price was lowered to $2.5 million dollars and then sold for $2.6 million it would be counted as a hot property, when it was really just a badly price property that took 2 years to sell.

We have 18% of our sales going for full original list price, but we have 22% going for over list price, but how much over list price? Reporters like going for the records, the most extreme we have is 32 Wesskum Wood. It was listed on April Fool’s Day (my brother’s Russ’ birthday by the way) at $1.6 million and 8 days later it was under contract for $2,200,000 or an amazing 38% over list. A few years back, I sold a property for 22% over list, a record that stood for several years, but this year we have another listing that sold for 29% over list. We have a total of 4 houses that sold for 20% or more over list, but this is out of 161 sales that went for over list price.

When you look a little closer, these over list price bidding wars are not quite as intense as you might think. The median amount over list for those 161 sales was 5% over list. If you are looking at buying a house with multiple offers that is listed at $1,000,000, the numbers say you have a pretty good chance of getting the house at $1,050,000. At the other of over list sales 25% went for 3% or less over list.

It always amazes me that some buyers just refuse to get in a bidding war, it’s just not for them. The point is that you don’t have to go much over list even in 2021 to win the house in many situations. Five years ago, when bidding wars were much less common, my client’s house was in the sweet spot of the moment, and we had 7 bidders. We went to highest and best, one very distinguished gentleman who had initially bid over list refused to participate in the highest and best competition. He wouldn’t even put in his original bid. He should have; he would have gotten the house for no more money than he was willing to pay before the highest and best competition.

Multiple offer competitions are not to be feared. If you lose you are in the same situation you were before, you don’t have a house. This isn’t poker, where if you come in second best you lose everything in the pot.

Also, the best offer is not always about money. I’ve seen lower bidders get the house because the buyer was willing to wait 3 months while the owner found a place to move. This year, I’ve heard of multiple winning bidders who pulled out of the deal while contracts were being drafted. This is why, I always suggest my seller agree to notify not only the winning bidder, but a second and third back-up. There is a much better chance that those folks will have a good taste in their mouth when you go back to them asking if they will honor their original offer now that the winning bidder has withdrawn.

So bid away, you’ve nothing to lose, and you’ll have great stories for the future, win or lose.

Mark Pruner is a Realtor in Greenwich, CT. He can be reached mark@bhhsne.com or 203-969-7900.