By Mark Pruner

Last week we looked at the superlative sales in the Greenwich real estate market, but is there a fly in the ointment, straws in the wind, or even an approaching storm, then again I may just be making a mountain out of mole hill? (The publisher is not fan of idioms, sorry Beth. They are in this article in spades 😉

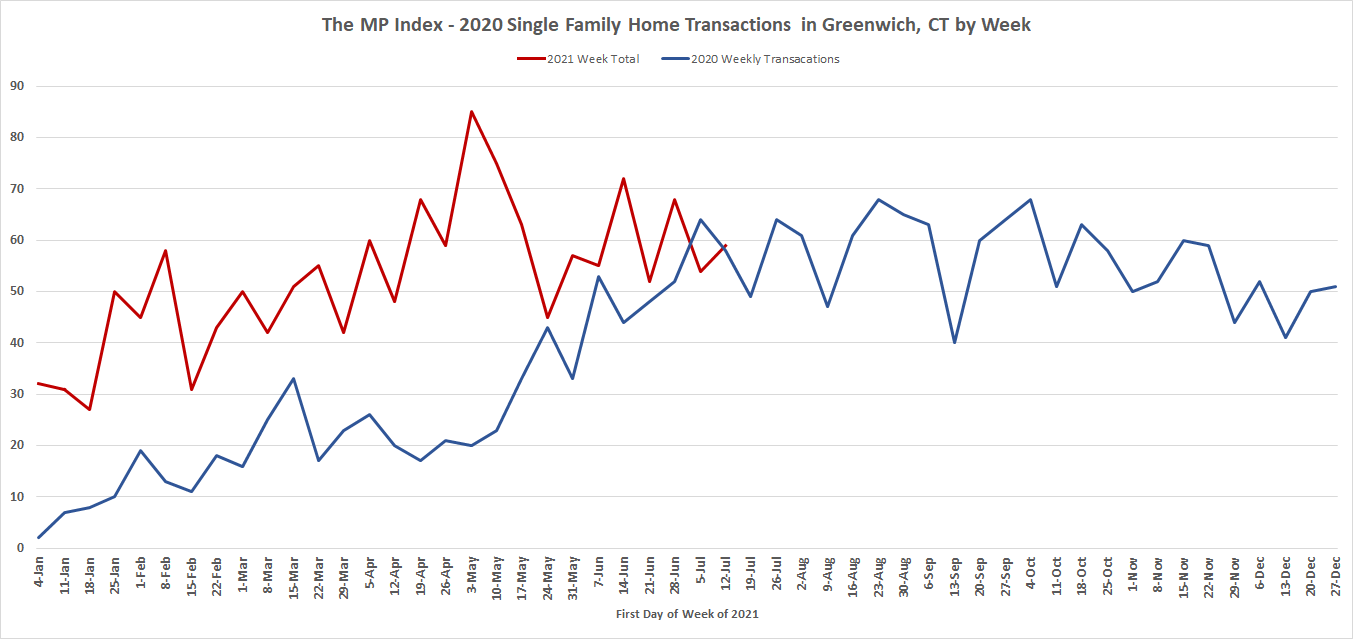

Our sales have been spectacular over the last 12 months and June was the biggest month for sales ever. But for Realtors, sales are like looking in the rear view mirror, because sales are deals that happened one to two months ago, not what the market is doing now.

A Busy July So Far

Looking at the first 20 days of July YTD, we have 604 sales for the year, which means we’ve already sold 15% more houses in 2021 than in all of 2019 when we only had 526 sales. Of those 604 sales, 93 of them happened in the first 20 days of July, which is already 20 sales above our 10-year average for all of July.

A Fly in the Ointment

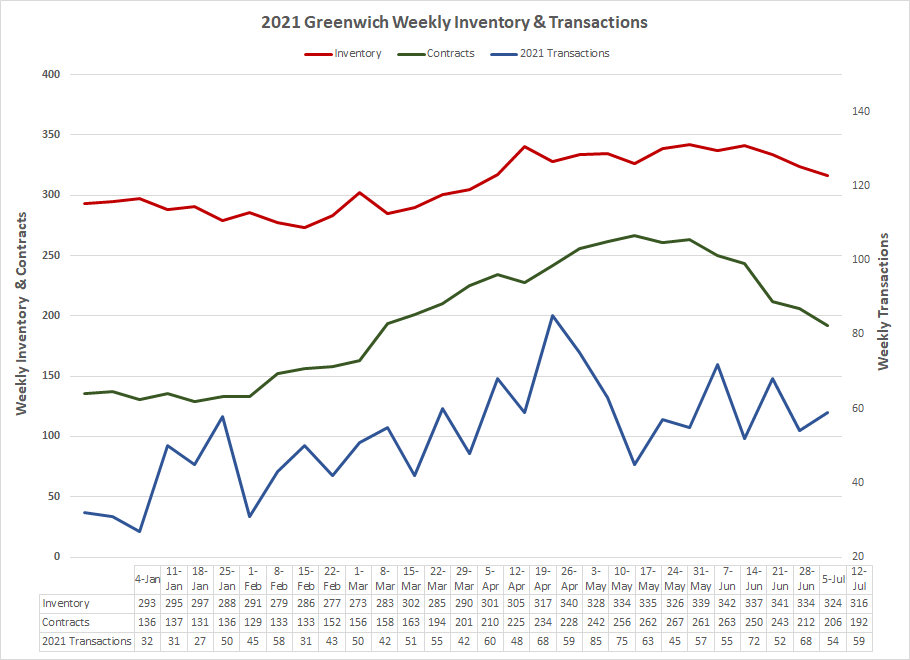

The fly in the ointment is contracts. We have 191 contracts waiting to close in mid-July compared to 208 contracts at the end of July last year. Now 17 contracts is not a lot and sales from week to week are a roller coaster ride. We may still see contracts exceed last year’s numbers, but the trend is not in that direction. Our weekly contract signings peaked in the first week of May at 57 contracts and has been mostly down since then. Last week we were down to only 26 contract signings. The chicken littles may actually think the sky is falling, but this drop in contracts probably just shows a return to some level of normalcy – though at a higher level than normal.

Our sales nearly always peak in June, or occasionally in July. This means that contract signings are seeds that are planted in April or May, so that closings can bloom in June and July. This drop in contracts then may not be a fly in the ointment, but only a stray flake of pepper.

Since, we are looking for straws in the wind, another shiver down your back can be seen in our inventory numbers. If you look at the inventory numbers they look like a fraternity tug of war between the Betas and the Deltas. The Betas (contract signings) moved the numbers slightly down for the first two month of the year to a low of only 273 listing at the end of February. For the first two months, we had more buyers than we had inventory, but only by a smidgen.

Then the Super Bowl came along, the official start of the spring market, and the brothers from Delta (new listings) started moving the numbers back as more listings came on than went to contract. Our inventory was like Lindbergh trying to gain altitude on his take-off from Roosevelt Field. We were climbing, but not real fast. By May we were still climbing but we were still flying nape of the earth. Our altitude should have been in the 600’s and even the 700’s listing number, but the best we could do was to peak at 342 listings in the first week of June. Since then we have been on a gentle decline to 310 listings this week. At this rate, Lindberg never would have made it off of Long Island.

For the Greenwich market, this drop in inventory when our contracts are also dropping, means that a bunch of the Betas and Deltas have headed for the bar and of the ones that are left, it is the Betas (contract signings) are winning. (Beth also dislikes mixed metaphors. 😉 This drop in inventory happens nearly every year, but not from such a low altitudes.

Over a Thousand This Year?

Where are sales headed for the rest of this year? If you use a pencil and a ruler to make predictions, then you can take our first half sales of 511 and double them and expect to see our first calendar year with more than 1,000 sales. July sales would say that we are well on the way to hitting that number, but our contracts, and more importantly, our sliding inventory make it look like we won’t break a millenary.

Another sign of a slowing market from frenzied to more normal is the number of expired listings. In the first half of the year with sales up 93% and inventory down 45% – making for an incredibly pro-seller market – we still had 78 listings expire unsold. These expired listings were across the board in pricing from $749K to $32M. We have some very well informed buyers and pushing the envelope on pricing too far just pops the bubble.

Our Neighborhoods

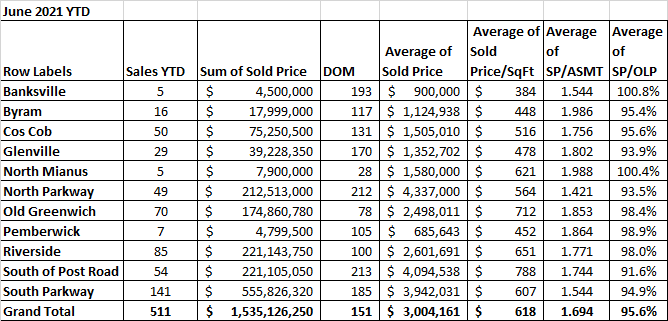

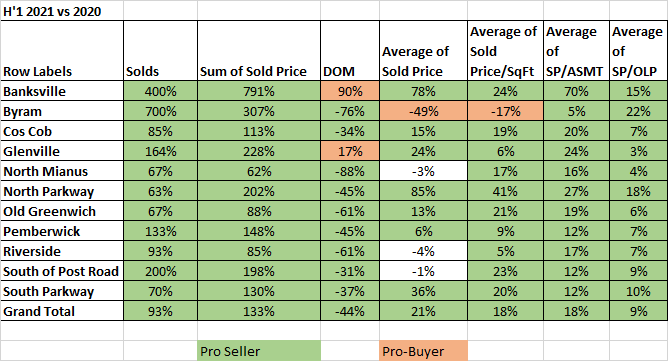

That’s the story townwide, but how are our neighborhoods doing? The short answer is mostly they are doing very well to great and the areas that look like they aren’t doing doing well are mostly victims of the law of the small numbers. For example, the days on market in Banksville is up 90%, but that’s because one of the five sales this year in Banksville had been on the market for 650 days.

Sales in Banksville, Byram, Glenville and South of the Post Road were all up more than 150%. The average price north of the Parkway was up 85%, but that was due to more high-end houses selling. When you look at the average of the sold price/sf that was up 41% and the sales price to assessment ratio was up 27%. Backcountry is definitely back.

Every neighborhood, but Byram, saw the average sales price to the assessment ratio go up by double digits from 12% south of the Parkway to 27% north of the Parkway. Days on market dropped by 44% and the average sales price to original list price was up 9% to 95.6% with several neighborhoods being above 98%. Buyers are not getting much of discount off of list price.

In the first half of the 2021 we sold $1.54 billion of single family homes up 133% from last year’s first half. This number all of the numbers should be taken with a grain of salt as the record breaking months didn’t start until August of 2020. So we are comparing the best half year sales ever in Greenwich to what was actually a slow first half as the Covid lock down slowed everything.

Stay tuned, this rest of the year won’t all be smooth sailing, but it looks like another America’s cup win for the town.

Mark Pruner is a Realtor in Greenwich, CT. He can be reached mark@bhhsne.com or 203-969-7900.