By Mark Pruner

By Mark Pruner

Sentinel Dashboard Editor

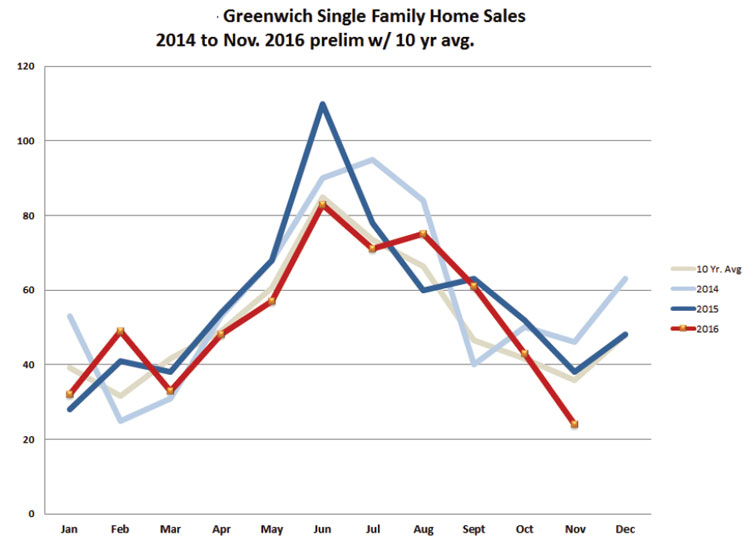

If you only look at sales as some pundits do, you’d swear that the Greenwich real estate market is in deep trouble. Since August our sales have been in a steep decline dropping from 75 sales to only 24 sales this month.

Now, 75 sales in August is pretty good. It’s above our ten-year average of 66 sales and in fact the 61 sales in September and 43 sales in October are both above average, however the 24 sales for November is well below our average of 36 sales. It is below our ten-year average and below the 38 sales that we had in November 2015.

The election clearly did a job on people’s willingness to close a sale in Greenwich. The good news, however, is that our contracts are up eight compared to November 2015. We have 93 properties that are waiting to close, which compares to 85 properties under contract in November 2015. The recent run up in interest rates post-election has put a new urgency in the buying process for many folks that had been sitting on the fence considering buying, but not feeling rushed.

The market from $1 to $2 million continues to be the major driver in Greenwich. As of today, 210 of our 521 sales reported by the Greenwich MLS have been between $1 and 2 million and 45 of our 93 contracts are between $1 and 2 million. The good news for buyers is that 104 of our 572 listings are in that price range. Buyers have a choice but they’re looking at significant competition. The market above $5 million continues to be slow. We have 161 listings with only one contract and one sale last month at that price.

Contracts are where the action is. We are up 11 contracts from $1 – 1.5 million and 10 contracts from $3 – 5 million compared to last year. This seems to be the new sweet spot at the high-end as people who can afford more expensive houses are being cost conscious and buying nice houses, but not as expensive as they could actually afford.

A clear positive for the Greenwich market is the post-election surge in the stock market to new record highs on the Dow Jones Index. Historically, as people feel wealthier with the increase in their stock portfolio they have moved some of that wealth into real estate. We have a lot of real estate available above $4 million dollars and a bunch of good deals.

The drop in these high-end sales is not just a Greenwich issue, but is actually a world-wide phenomenon as high-end sales have slowed down pretty much everywhere. I got an email this Monday from a well-known broker in NYC who had a listing for $11 million that they had reduced to $7 million provided that you put your offer in by Friday of this week. For owners in this price range that really need to sell you need creative brokers and a willingness to bite the bullet on pricing.

If the sellers at the high-end can continue to hold on as many have done since the end of the Great Recession there may be light at the end of the tunnel. With a more positive economic outlook and stock portfolios increasing, the market may actually turn around in 2017. I’m also working on reviving our weekend market, particularly in the backcountry, which has been slow. Many New Yorkers are getting sick of the Hamptons hassle and are looking for a closer and more convenient alternative. Greenwich has a lot to offer and we just need to get our story out as to how easy it is to get here and the great lifestyle for weekenders once you do.

MARK PRUNER

DOUGLAS ELLIMAN REAL ESTATE

DIRECT: 203.969.7900 OFFICE: 203.622.4900 MOBILE: 203.969.7900 mark.pruner@elliman.com